Question: Please Help Advise the CEO. Choose the correct answer below. A. Since the comedy has the higher NPV, it should be selected. B. Since one

Please Help Advise the CEO. Choose the correct answer below.

Advise the CEO. Choose the correct answer below.

A. Since the comedy has the higher NPV, it should be selected.

B. Since one project has a negative NPV, the other project should be selected even though it has a payback greater than four years. If that project's longer payback period is unacceptable, then neither project should be accepted.

C. Since only one of the projects has a payback period of less than fouryears, it should be selected. Projects that pay the company back quicker are always preferable to projects that do not pay the company back as quickly.

D. Since the thriller has the higher NPV, it should be selected.

*HOW TO DO QUESTION* EXAMPLE

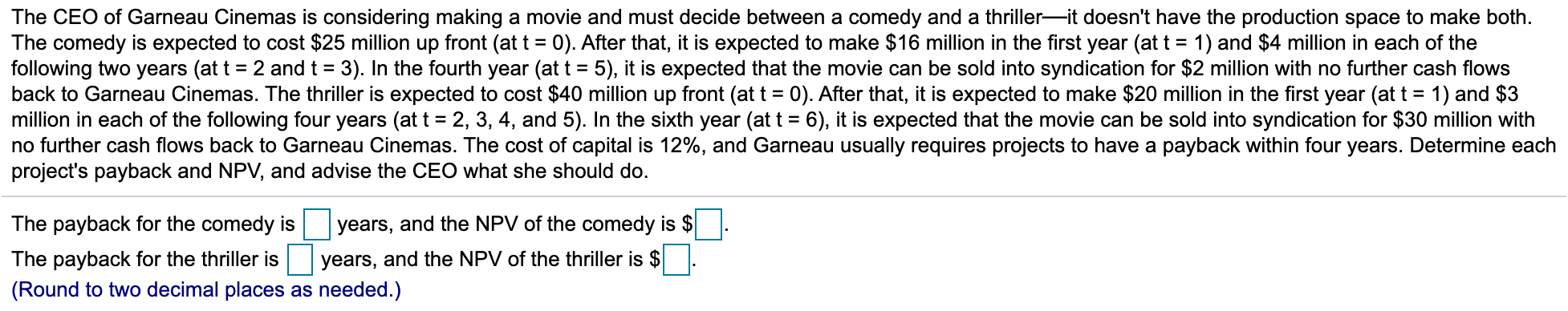

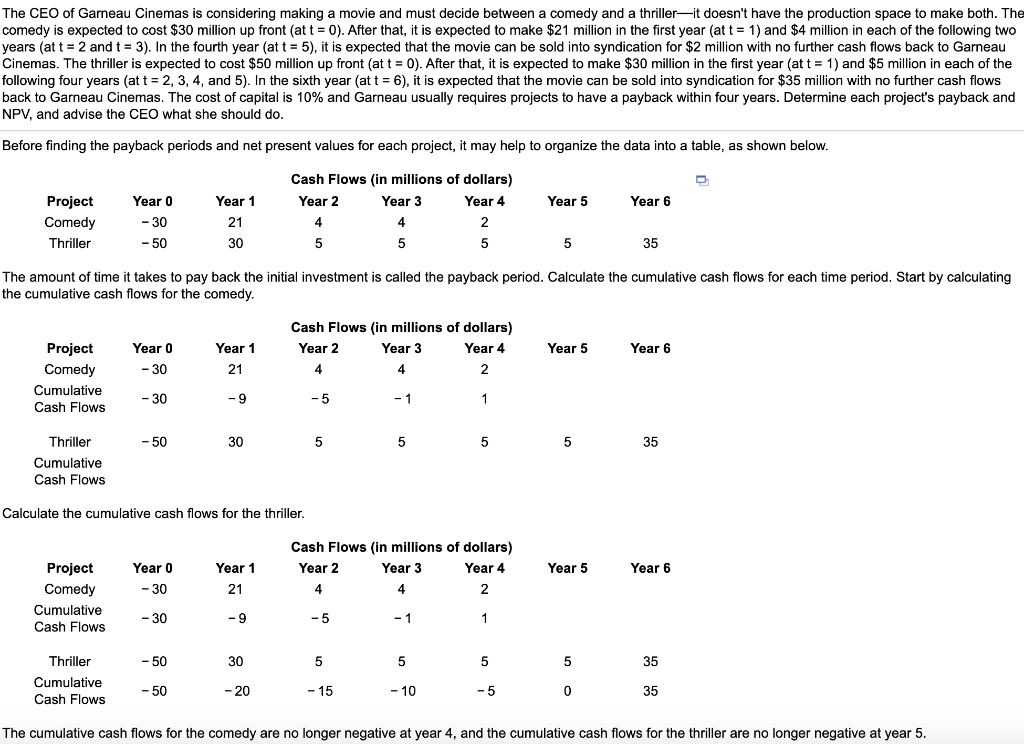

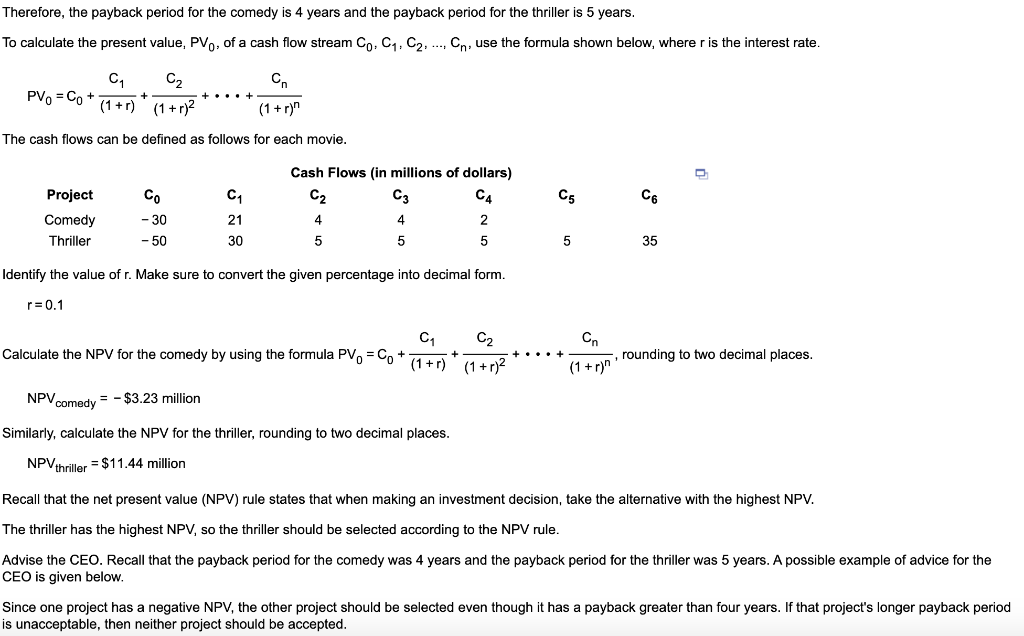

The CEO of Garneau Cinemas is considering making a movie and must decide between a comedy and a thriller-it doesn't have the production space to make both. The comedy is expected to cost $25 million up front (at t = 0). After that, it is expected to make $16 million in the first year (at t = 1) and $4 million in each of the following two years (at t = 2 and t = 3). In the fourth year (at t = 5), it is expected that the movie can be sold into syndication for $2 million with no further cash flows back to Garneau Cinemas. The thriller is expected to cost $40 million up front (at t = 0). After that, it is expected to make $20 million in the first year (at t = 1) and $3 million in each of the following four years (at t = 2, 3, 4, and 5). In the sixth year (at t = 6), it is expected that the movie can be sold into syndication for $30 million with no further cash flows back to Garneau Cinemas. The cost of capital is 12%, and Garneau usually requires projects to have a payback within four years. Determine each project's payback and NPV, and advise the CEO what she should do. The payback for the comedy is years, and the NPV of the comedy is $ The payback for the thriller is years, and the NPV of the thriller is $ (Round to two decimal places as needed.) The CEO of Garneau Cinemas is considering making a movie and must decide between a comedy and a thrillerit doesn't have the production space to make both. The comedy is expected to cost $30 million up front (at t = 0). After that, it is expected to make $21 million in the first year (at t = 1) and $4 million in each of the following two years (at t = 2 and t = 3). In the fourth year (at t = 5), it is expected that the movie can be sold into syndication for $2 million with no further cash flows back to Garneau Cinemas. The thriller is expected to cost $50 million up front (at t = 0). After that, it is expected to make $30 million in the first year (at t = 1) and $5 million in each of the following four years at t = 2, 3, 4, and 5). In the sixth year (at t = 6), it is expected that the movie can be sold into syndication for $35 million with no further cash flows back to Garneau Cinemas. The cost of capital is 10% and Garneau usually requires projects to have a payback within four years. Determine each project's payback and NPV, and advise the CEO what she should do. Before finding the payback periods and net present values for each project, it may help to organize the data into a table, as shown below. Year 5 Year 6 Project Comedy Thriller Year o -30 - 50 Year 1 21 Cash Flows (in millions of dollars) Year 2 Year 3 Year 4 4 4 2 5 5 5 30 5 35 The amount of time it takes to pay back the initial investment is called the payback period. Calculate the cumulative cash flows for each time period. Start by calculating the cumulative cash flows for the comedy. Year 5 Cash Flows (in millions of dollars) Year 2 Year 3 Year 4 4 4 2 Year 0 - 30 Year 6 Year 1 21 Project Comedy Cumulative Cash Flows -30 -9 -5 -1 1 -50 30 5 5 5 5 35 Thriller Cumulative Cash Flows Calculate the cumulative cash flows for the thriller. Year 5 Year 0 - 30 Year 6 Cash Flows (in millions of dollars) Year 2 Year 3 Year 4 4 4 2 Year 1 21 Project Comedy Cumulative Cash Flows -30 -9 -5 -1 1 - 50 30 5 5 5 5 35 Thriller Cumulative Cash Flows -50 - 20 -15 - 10 -5 0 35 The cumulative cash flows for the comedy are no longer negative at year 4, and the cumulative cash flows for the thriller are no longer negative at year 5. Therefore, the payback period for the comedy is 4 years and the payback period for the thriller is 5 years. To calculate the present value, PV, of a cash flow stream Co, C1, C2, ..., Cn, use the formula shown below, where r is the interest rate. C1 PVo = Co + (1 + r) + C2 (1 + r)2 C (1 + r)" The cash flows can be defined as follows for each movie. C1 C5 C6 Project Comedy Thriller -30 - 50 Cash Flows (in millions of dollars) C2 C3 C4 4 4 2 5 21 30 5 35 Identify the value of r. Make sure to convert the given percentage into decimal form. r=0.1 C1 Cz Calculate the NPV for the comedy by using the formula PV. = Co + (1+r) (1 + r)2 CA rounding to two decimal places. (1 + r)"' NPVA comedy = - $3.23 million Similarly, calculate the NPV for the thriller, rounding to two decimal places. NPV thriller = $11.44 million Recall that the net present value (NPV) rule states that when making an investment decision, take the alternative with the highest NPV. The thriller has the highest NPV, so the thriller should be selected according to the NPV rule. Advise the CEO. Recall that the payback period for the comedy was 4 years and the payback period for the thriller was 5 years. A possible example of advice for the CEO is given below. Since one project has a negative NPV, the other project should be selected even though it has a payback greater than four years. If that project's longer payback period is unacceptable, then neither project should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts