Question: Please help All four questions Question Three weeks ago, you purchased a 1-year futures contract on an index. You are given: Time (in week) Futures

Please help All four questions

Please help All four questions

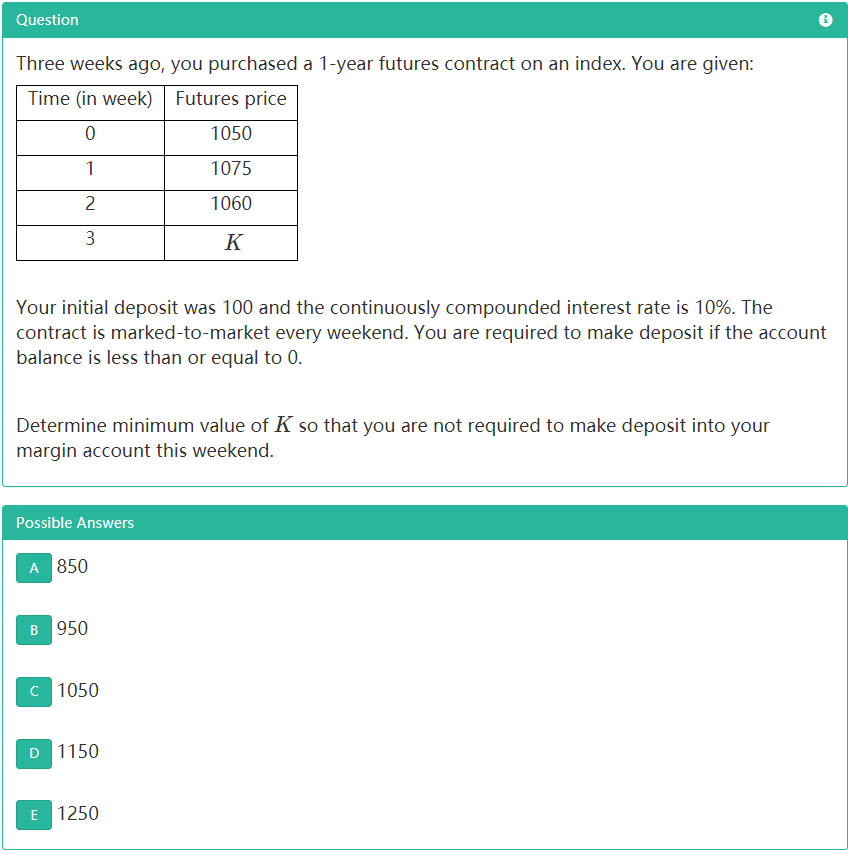

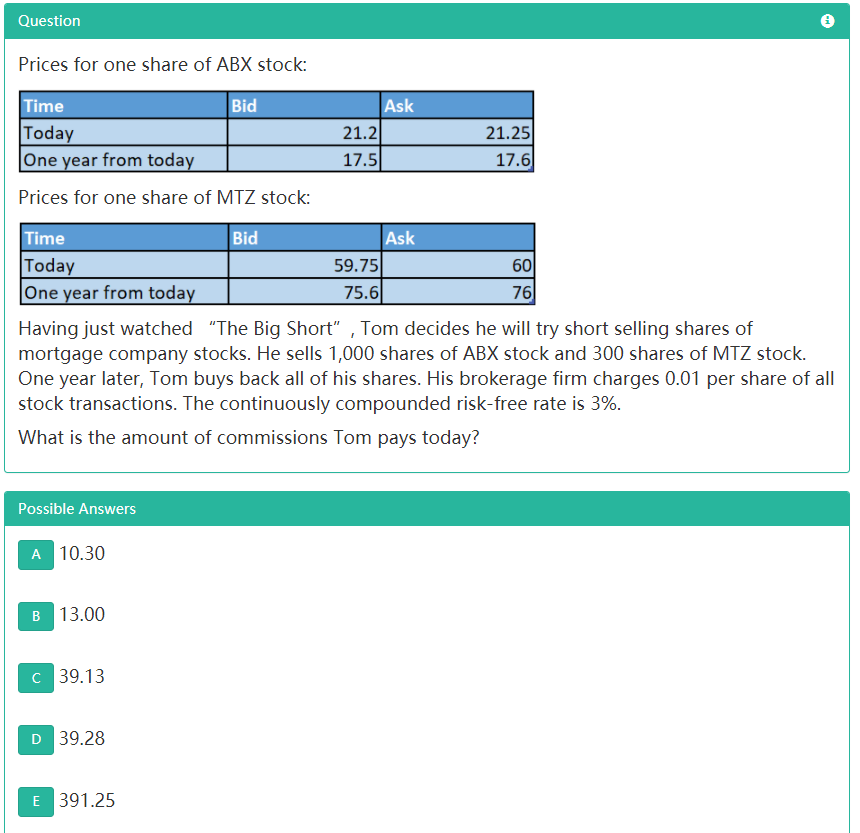

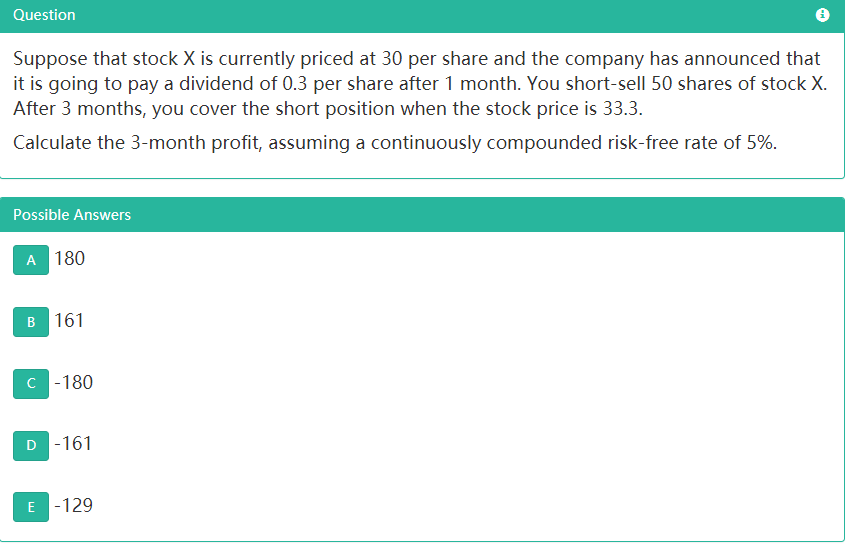

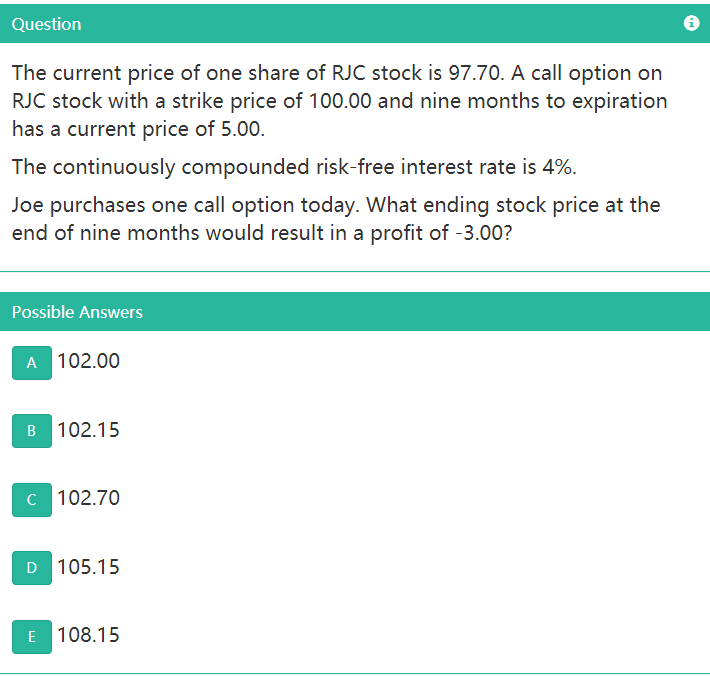

Question Three weeks ago, you purchased a 1-year futures contract on an index. You are given: Time (in week) Futures price 0 1050 1 1075 2 1060 3 K Your initial deposit was 100 and the continuously compounded interest rate is 10%. The contract is marked-to-market every weekend. You are required to make deposit if the account balance is less than or equal to 0. Determine minimum value of K so that you are not required to make deposit into your margin account this weekend. Possible Answers A 850 B 950 C 1050 D 1150 E 1250 Question Prices for one share of ABX stock: Time Bid Today One year from today Prices for one share of MTZ stock: Ask 21.21 17.5 21.251 17.6 Time Bid Ask Today 59.75 60 One year from today 75.6 76 Having just watched The Big Short" , Tom decides he will try short selling shares of mortgage company stocks. He sells 1,000 shares of ABX stock and 300 shares of MTZ stock. One year later, Tom buys back all of his shares. His brokerage firm charges 0.01 per share of all stock transactions. The continuously compounded risk-free rate is 3%. What is the amount of commissions Tom pays today? Possible Answers A 10.30 B 13.00 C 39.13 D 39.28 E 391.25 Question Suppose that stock X is currently priced at 30 per share and the company has announced that it is going to pay a dividend of 0.3 per share after 1 month. You short-sell 50 shares of stock X. After 3 months, you cover the short position when the stock price is 33.3. Calculate the 3-month profit, assuming a continuously compounded risk-free rate of 5%. Possible Answers A 180 B 161 C -180 D-161 E-129 Question The current price of one share of RJC stock is 97.70. A call option on RJC stock with a strike price of 100.00 and nine months to expiration has a current price of 5.00. The continuously compounded risk-free interest rate is 4%. Joe purchases one call option today. What ending stock price at the end of nine months would result in a profit of -3.00? Possible Answers A 102.00 B 102.15 C 102.70 D 105.15 E 108.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts