Question: Please help all given information Chic Events by Jada INSTRUCTIONS FOR USING BUSINESS FORMS This booklet of the practice set contains the busi Date of

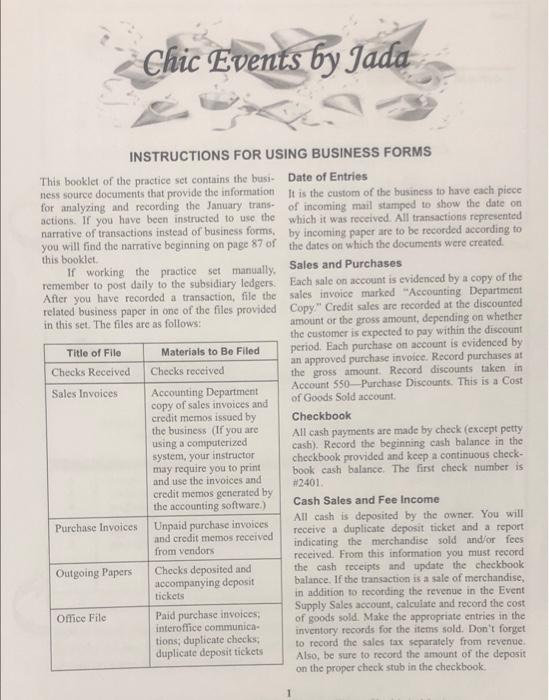

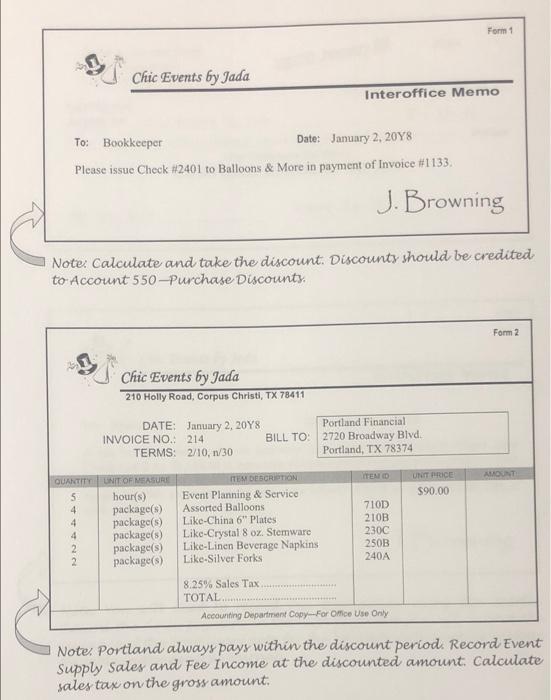

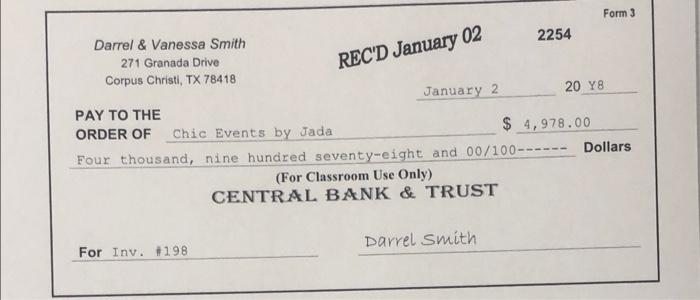

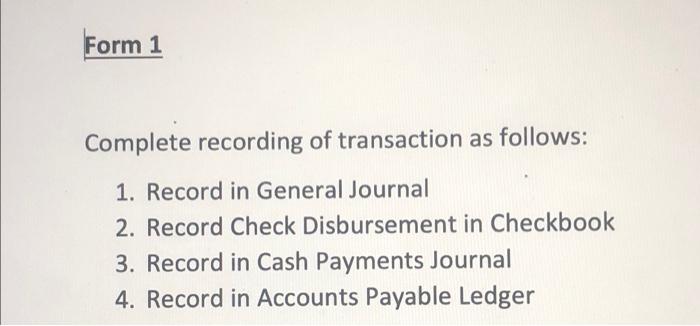

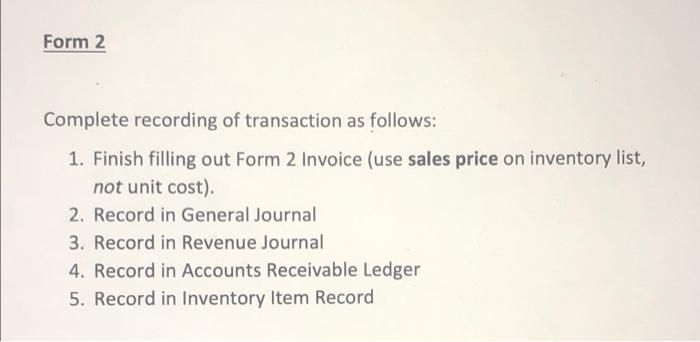

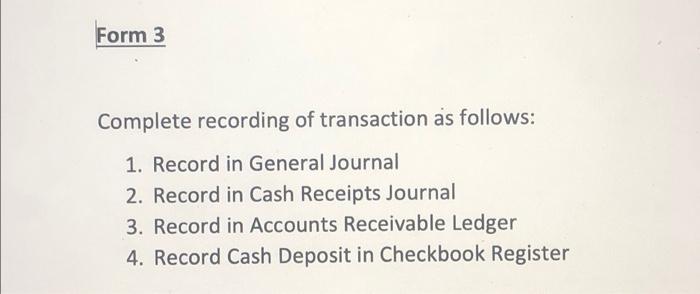

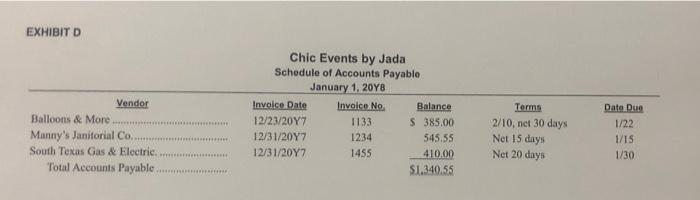

Chic Events by Jada INSTRUCTIONS FOR USING BUSINESS FORMS This booklet of the practice set contains the busi Date of Entries ness source documents that provide the information It is the custom of the business to have cach piece for analyzing and recording the January trans- of incoming mail stamped to show the date on actions. If you have been instructed to use the which it was received. All transactions represented narrative of transactions instead of business form, by incoming paper are to be recorded according to you will find the narrative beginning on page 87 of the dates on which the documents were created this booklet If working the practice set manually. Sales and Purchases remember to post daily to the subsidiary ledgers. Each sale on account is evidenced by a copy of the After you have recorded a transaction file the sales invoice marked "Accounting Department related business paper in one of the files provided Copy" Credit sales are recorded at the discounted in this set. The files are as follows: amount of the gross amount, depending on whether the customer is expected to pay within the discount Title of File Materials to Be Filed period. Each purchase on account is evidenced by Checks Received Checks roccived an approved purchase invoice Record purchases at the gross amount. Record discounts taken in Sales Invoices Accounting Department Account 550-Purchase Discounts. This is a Cost of Goods Sold account copy of sales invoices and credit memos issued by Checkbook the business (If you are All cash payments are made by check (except petty using a computerized cash). Record the beginning cash balance in the system, your instructor checkbook provided and keep a continuous check- may require you to print book cash balance. The first check number is and use the invoices and #2401 credit memos generated by the accounting software.) Cash Sales and Fee Income Purchase Invoices Unpaid purchase invoices All cash is deposited by the owner. You will and credit memos received receive a duplicate deposit ticket and a report from vendors indicating the merchandise sold and/or fees received. From this information you must record Outgoing Papers Checks deposited and the cash receipts and update the checkbook accompanying deposit balance. If the transaction is a sale of merchandise, tickets in addition to recording the revenue in the Event Supply Sales account, calculate and record the cost Omice File Paid purchase invoices of goods sold. Make the appropriate entries in the interoffice communica inventory records for the items sold. Don't forget tions; duplicate checks, to record the sales tax separately from revenue duplicate deposit tickets Also, be sure to record the amount of the deposit on the proper check stub in the checkbook Form 1 Chic Events by Jada Interoffice Memo To: Bookkeeper Date: January 2, 2018 Please issue Check #2401 to Balloons & More in payment of Invoice #1133 J. Browning Note: Calculate and take the discount: Discounty should be credited to Account 550-Purchase Discounts. Form 2 Chic Events by Jada 210 Holly Road, Corpus Christi, TX 78411 DATE: January 2, 20Y8 Portland Financial INVOICE NO.: 214 BILL TO: 2720 Broadway Blvd TERMS: 2/10, 1/30 Portland, TX 78374 ITEMID AMOUNT UNT CE $90.00 QUANTITY UNIT OF MEASURE 5 hour(s) 4 package(s) 4 package(s) 4 package(s) 2 package(s) 2 package(s) ITEM DESCRIPTION Event Planning & Service Assorted Balloons Like-China 6" Plates Like-Crystal 8 oz. Stemware Like-Linen Beverage Napkins Like-Silver Forks 710D 210B 230C 250B 240A 8.25% Sales Tax TOTAL Accounting Department Copy--For Once Use Only Note: Portland always pays within the discount period. Record Event Supply Sales and Fee Income at the discounted amount: Calculate sales tax on the grow amount REC'D January 02 Form 3 Darrel & Vanessa Smith 2254 271 Granada Drive Corpus Christi, TX 78418 January 2 20 Y8 PAY TO THE ORDER OF Chic Events by Jada $ 4,978.00 Four thousand, nine hundred seventy-eight and 00/100--- Dollars (For Classroom Use Only) CENTRAL BANK & TRUST Darrel Smith For Inv. 198 Form 1 Complete recording of transaction as follows: 1. Record in General Journal 2. Record Check Disbursement in Checkbook 3. Record in Cash Payments Journal 4. Record in Accounts Payable Ledger Form 2 Complete recording of transaction as follows: 1. Finish filling out Form 2 Invoice (use sales price on inventory list, not unit cost). 2. Record in General Journal 3. Record in Revenue Journal 4. Record in Accounts Receivable Ledger 5. Record in Inventory Item Record Form 3 Complete recording of transaction as follows: 1. Record in General Journal 2. Record in Cash Receipts Journal 3. Record in Accounts Receivable Ledger 4. Record Cash Deposit in Checkbook Register EXHIBIT D Date Due Chic Events by Jada Schedule of Accounts Payable January 1, 2048 Invoice Date Invoice No Balance 12/23/2017 1133 $385.00 12/31/2017 1234 545.55 12/31/2017 1455 410.00 $1.340.55 Vendor Balloons & More Manny's Janitorial Co. South Texas Gas & Electric Total Accounts Payable 1/22 Terms 2/10, net 30 days Net 15 days Net 20 days 1/15 1/30 Chic Events by Jada INSTRUCTIONS FOR USING BUSINESS FORMS This booklet of the practice set contains the busi Date of Entries ness source documents that provide the information It is the custom of the business to have cach piece for analyzing and recording the January trans- of incoming mail stamped to show the date on actions. If you have been instructed to use the which it was received. All transactions represented narrative of transactions instead of business form, by incoming paper are to be recorded according to you will find the narrative beginning on page 87 of the dates on which the documents were created this booklet If working the practice set manually. Sales and Purchases remember to post daily to the subsidiary ledgers. Each sale on account is evidenced by a copy of the After you have recorded a transaction file the sales invoice marked "Accounting Department related business paper in one of the files provided Copy" Credit sales are recorded at the discounted in this set. The files are as follows: amount of the gross amount, depending on whether the customer is expected to pay within the discount Title of File Materials to Be Filed period. Each purchase on account is evidenced by Checks Received Checks roccived an approved purchase invoice Record purchases at the gross amount. Record discounts taken in Sales Invoices Accounting Department Account 550-Purchase Discounts. This is a Cost of Goods Sold account copy of sales invoices and credit memos issued by Checkbook the business (If you are All cash payments are made by check (except petty using a computerized cash). Record the beginning cash balance in the system, your instructor checkbook provided and keep a continuous check- may require you to print book cash balance. The first check number is and use the invoices and #2401 credit memos generated by the accounting software.) Cash Sales and Fee Income Purchase Invoices Unpaid purchase invoices All cash is deposited by the owner. You will and credit memos received receive a duplicate deposit ticket and a report from vendors indicating the merchandise sold and/or fees received. From this information you must record Outgoing Papers Checks deposited and the cash receipts and update the checkbook accompanying deposit balance. If the transaction is a sale of merchandise, tickets in addition to recording the revenue in the Event Supply Sales account, calculate and record the cost Omice File Paid purchase invoices of goods sold. Make the appropriate entries in the interoffice communica inventory records for the items sold. Don't forget tions; duplicate checks, to record the sales tax separately from revenue duplicate deposit tickets Also, be sure to record the amount of the deposit on the proper check stub in the checkbook Form 1 Chic Events by Jada Interoffice Memo To: Bookkeeper Date: January 2, 2018 Please issue Check #2401 to Balloons & More in payment of Invoice #1133 J. Browning Note: Calculate and take the discount: Discounty should be credited to Account 550-Purchase Discounts. Form 2 Chic Events by Jada 210 Holly Road, Corpus Christi, TX 78411 DATE: January 2, 20Y8 Portland Financial INVOICE NO.: 214 BILL TO: 2720 Broadway Blvd TERMS: 2/10, 1/30 Portland, TX 78374 ITEMID AMOUNT UNT CE $90.00 QUANTITY UNIT OF MEASURE 5 hour(s) 4 package(s) 4 package(s) 4 package(s) 2 package(s) 2 package(s) ITEM DESCRIPTION Event Planning & Service Assorted Balloons Like-China 6" Plates Like-Crystal 8 oz. Stemware Like-Linen Beverage Napkins Like-Silver Forks 710D 210B 230C 250B 240A 8.25% Sales Tax TOTAL Accounting Department Copy--For Once Use Only Note: Portland always pays within the discount period. Record Event Supply Sales and Fee Income at the discounted amount: Calculate sales tax on the grow amount REC'D January 02 Form 3 Darrel & Vanessa Smith 2254 271 Granada Drive Corpus Christi, TX 78418 January 2 20 Y8 PAY TO THE ORDER OF Chic Events by Jada $ 4,978.00 Four thousand, nine hundred seventy-eight and 00/100--- Dollars (For Classroom Use Only) CENTRAL BANK & TRUST Darrel Smith For Inv. 198 Form 1 Complete recording of transaction as follows: 1. Record in General Journal 2. Record Check Disbursement in Checkbook 3. Record in Cash Payments Journal 4. Record in Accounts Payable Ledger Form 2 Complete recording of transaction as follows: 1. Finish filling out Form 2 Invoice (use sales price on inventory list, not unit cost). 2. Record in General Journal 3. Record in Revenue Journal 4. Record in Accounts Receivable Ledger 5. Record in Inventory Item Record Form 3 Complete recording of transaction as follows: 1. Record in General Journal 2. Record in Cash Receipts Journal 3. Record in Accounts Receivable Ledger 4. Record Cash Deposit in Checkbook Register EXHIBIT D Date Due Chic Events by Jada Schedule of Accounts Payable January 1, 2048 Invoice Date Invoice No Balance 12/23/2017 1133 $385.00 12/31/2017 1234 545.55 12/31/2017 1455 410.00 $1.340.55 Vendor Balloons & More Manny's Janitorial Co. South Texas Gas & Electric Total Accounts Payable 1/22 Terms 2/10, net 30 days Net 15 days Net 20 days 1/15 1/30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts