Question: Please help. All given solutions were incorrect. Required information [The following information applies to the questions displayed below.] Roland had a taxable estate of $16.2

Please help. All given solutions were incorrect.

Required information

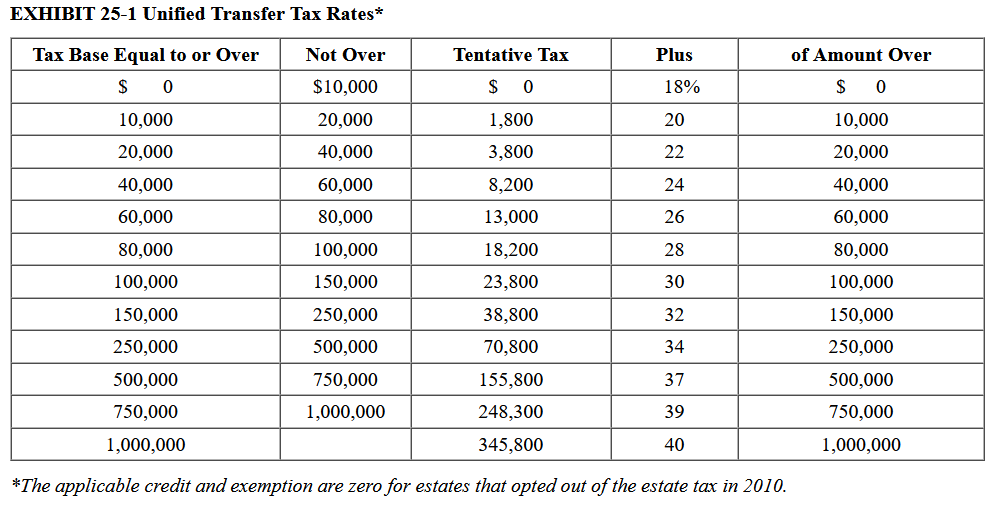

[The following information applies to the questions displayed below.] Roland had a taxable estate of $16.2 million when he died this year. Required: Calculate the amount of estate tax due (if any) under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars and not in millions of dollars.)

![applies to the questions displayed below.] Roland had a taxable estate of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ec83c9442cf_26466ec83c8bc26a.jpg)

a. Rolands prior taxable gifts consist of a taxable gift of $1 million in 2005.

b. Rolands prior taxable gifts consist of a taxable gift of $1.5 million in 2005.

c. Roland made a $1 million taxable gift in the year prior to his death.

EXHIBIT 25-1 Unified Transfer Tax Rates* *The applicable credit and exemption are zero for estates that opted out of the estate tax in 2010. EXHIBIT 25-2 The Exemption Equivalent EXHIBIT 25-1 Unified Transfer Tax Rates* *The applicable credit and exemption are zero for estates that opted out of the estate tax in 2010. EXHIBIT 25-2 The Exemption Equivalent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts