Question: please HELP ALL :) K. Decker, S. Rosen, and E. Toso are forming a partnership. Decker is transferring $50,600 of personal cash to the partnership.

please HELP ALL :)

please HELP ALL :)

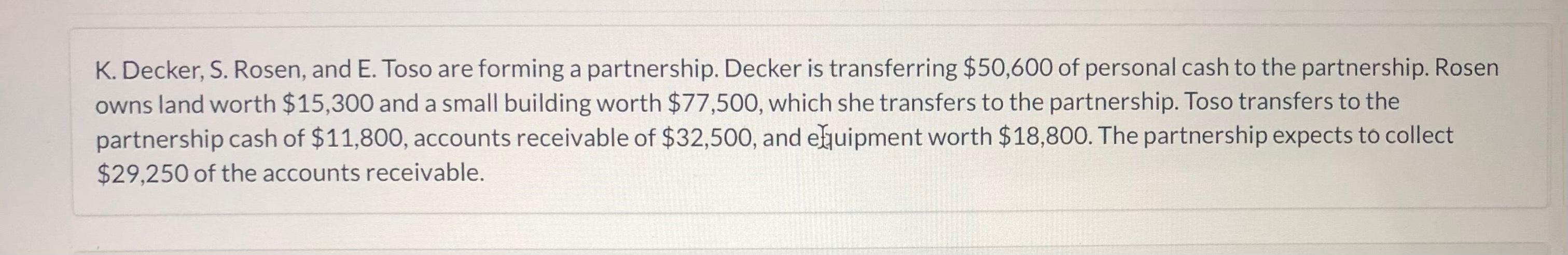

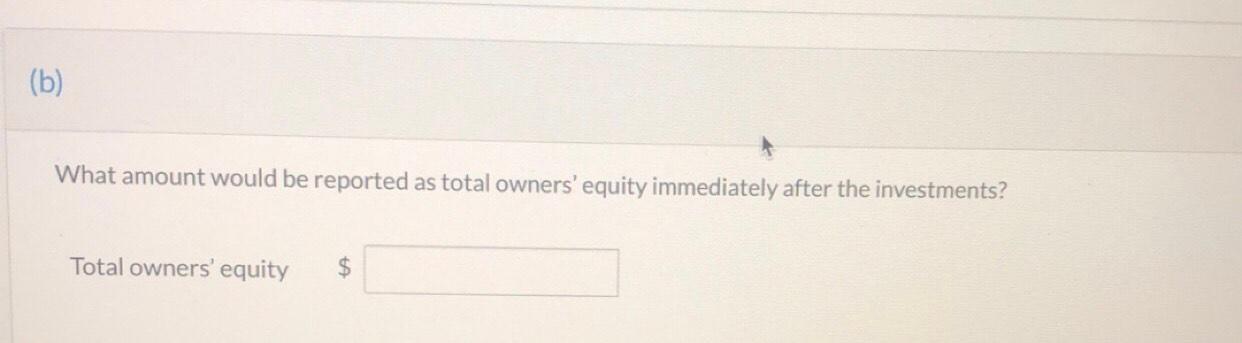

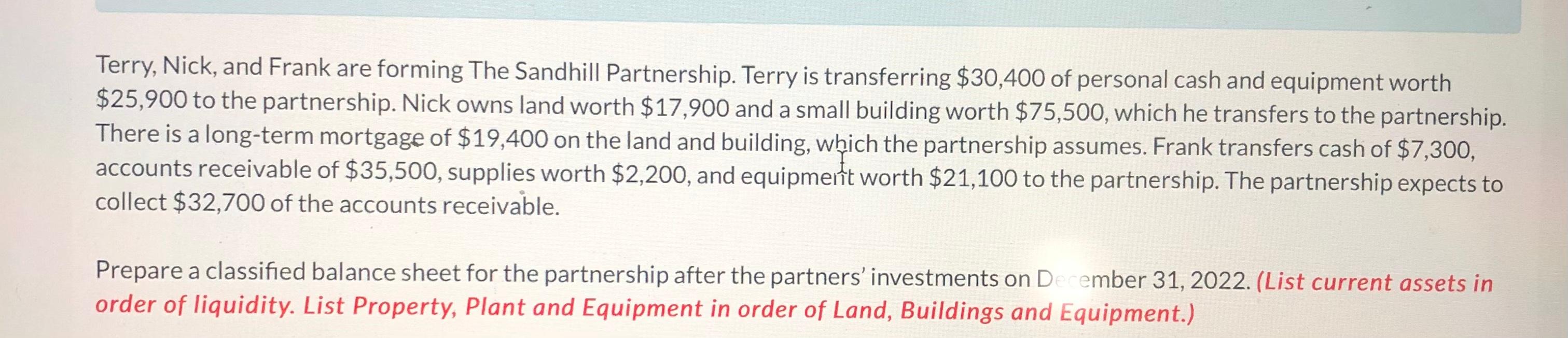

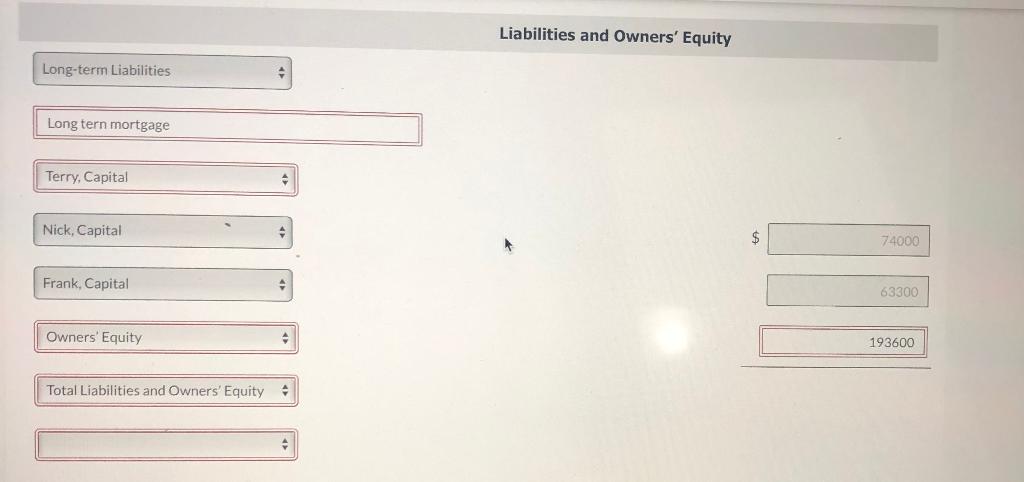

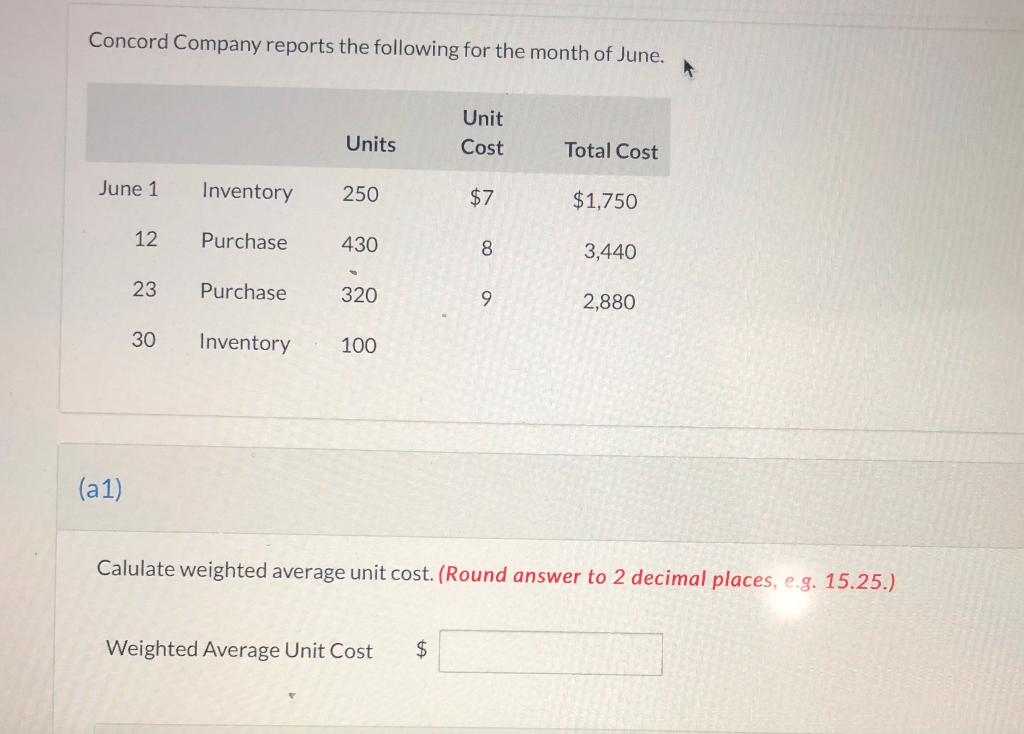

K. Decker, S. Rosen, and E. Toso are forming a partnership. Decker is transferring $50,600 of personal cash to the partnership. Rosen owns land worth $15,300 and a small building worth $77,500, which she transfers to the partnership. Toso transfers to the partnership cash of $11,800, accounts receivable of $32,500, and equipment worth $18,800. The partnership expects to collect $29,250 of the accounts receivable. (b) What amount would be reported as total owners' equity immediately after the investments? Total owners' equity Terry, Nick, and Frank are forming The Sandhill Partnership. Terry is transferring $30,400 of personal cash and equipment worth $25,900 to the partnership. Nick owns land worth $17,900 and a small building worth $75,500, which he transfers to the partnership. There is a long-term mortgage of $19,400 on the land and building, which the partnership assumes. Frank transfers cash of $7,300, accounts receivable of $35,500, supplies worth $2,200, and equipment worth $21,100 to the partnership. The partnership expects to collect $32,700 of the accounts receivable. Prepare a classified balance sheet for the partnership after the partners' investments on December 31, 2022. (List current assets in order of liquidity. List Property, Plant and Equipment in order of Land, Buildings and Equipment.) Long-term Liabilities Long tern mortgage Terry, Capital Nick, Capital Frank, Capital Owners' Equity Total Liabilities and Owners' Equity + + + Liabilities and Owners' Equity JON $ 74000 63300 193600 Concord Company reports the following for the month of June. K Unit Units Cost Total Cost June 1 Inventory 250 $7 $1,750 12 Purchase 430 8 3,440 23 Purchase 320 9 2,880 30 Inventory 100 (a1) Calulate weighted average unit cost. (Round answer to 2 decimal places, e.g. 15.25.) Weighted Average Unit Cost $ Calulate weighted average unit cost. (Round answer to 2 decimal places, e.g. 15.25.) Weighted Average Unit Cost $ eTextbook and Media Save for Later Attempts: 0 of 5 used (a2) The parts of this question must be completed in order. This part will be available when you complete the part above. (b) The parts of this question must be completed in order. This part will be available when you complete the part above. Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts