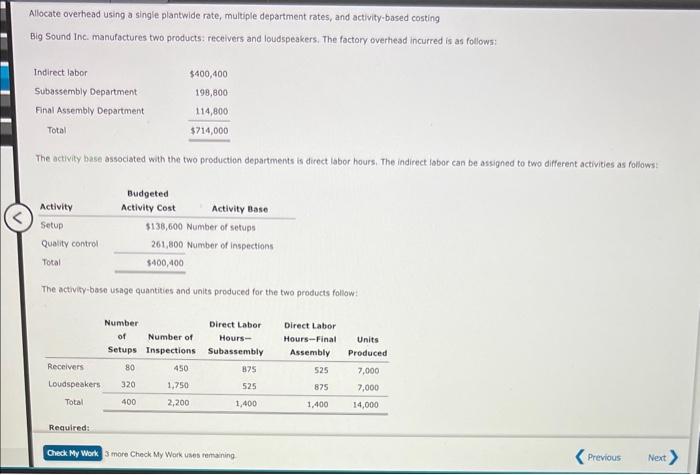

Question: please help Allocate overhead using a single plantwide rate, multiple department rates, and activity-based costing Big Sound Inc. manufactures two products: recelvers and loudspeakers. The

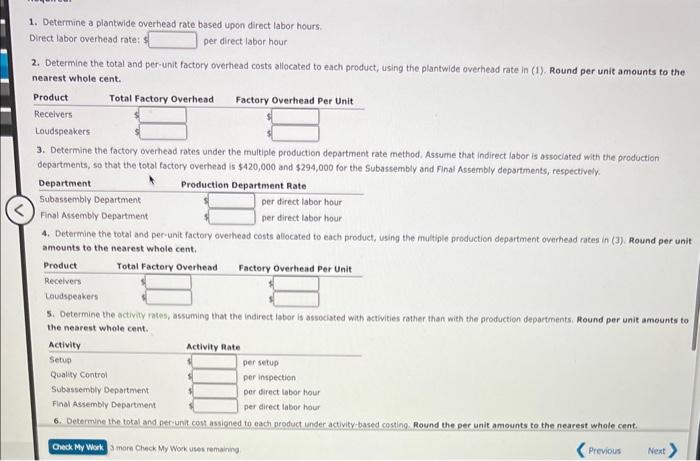

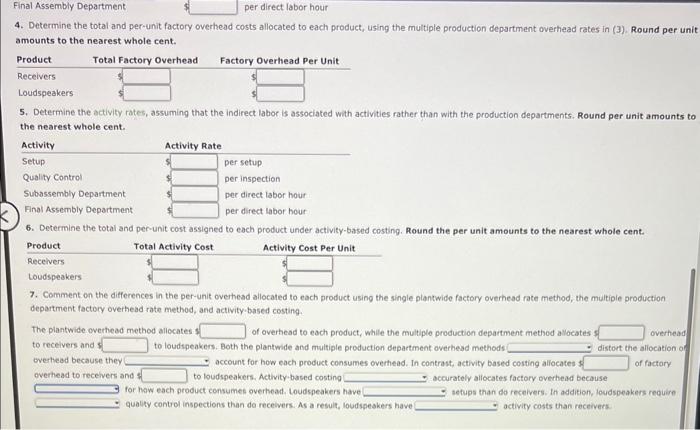

Allocate overhead using a single plantwide rate, multiple department rates, and activity-based costing Big Sound Inc. manufactures two products: recelvers and loudspeakers. The factory overhead incurred is as follows: The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as foliows: The activity-baso usage quantities and units produced for the two products follow: Required: 3 more Check My Work uses rentaning 1. Determine a plantwide overhead rate based upon direct labor hours: Direct labor overhead rate: $ per direct labor hour 2. Determine the total and per-unit factory overhead costs allocated to each product, using the plantwide overhead rate in (1). Round per unit amounts to the nearest whole cent. 3. Determine the factory overhead rates under the multiple production department rate methodi. Assume that indirect labor is associared with the production departments, so that the total factory oyerhead is $420,000 and $294,000 for the Subassembly and Final Assembly departments, respectively. 4. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (3), Round per unit amounts to the nearest whole cent. 5. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Round per unit amounts to the nearest whole cent. 6. Determine the total and per-unit cov assigned to each product inder activity-based costing: Round the per unit amounts to the nearest whole cent. 3 morn Check My Wok uses remaining Final Assembly Department $ per direct labor hour 4. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (3). Round per unit amounts to the nearest whole cent. 5. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Round per unit amounts to the nearest whole cent. 6. Determine the total and per-unit cost assigned to each product under activity-based costing. Round the per unit amounts to the nearest whole cent. 7. Comment on the differences in the per-unit overhead allocated to each product using the single plantwide factory overhead rate method, the multipie production department factory overhead rate method, and activity based costing. The plantwide overheed method allocates s of overhead to eoch product, whille the multiple production department method allocates 5 . of to recelvers and 5 to loudspeakers. Both the plantwide and multiple production department overhead methods distort the allocation of overhead because they account for how each product consumes overhead. In contrast, activity based costing allocates s of factory overhead to receivers and 5 to loudspeakers. Activity-based costing accurately aliocates factory overhead becouse for haw each product consumes overhead. Loudspeakers have setups than do recelivers. In addition, loudspeakers reduire quality control inspections than do receivers. As a resuit, loudspeskers have activity costs than receivers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts