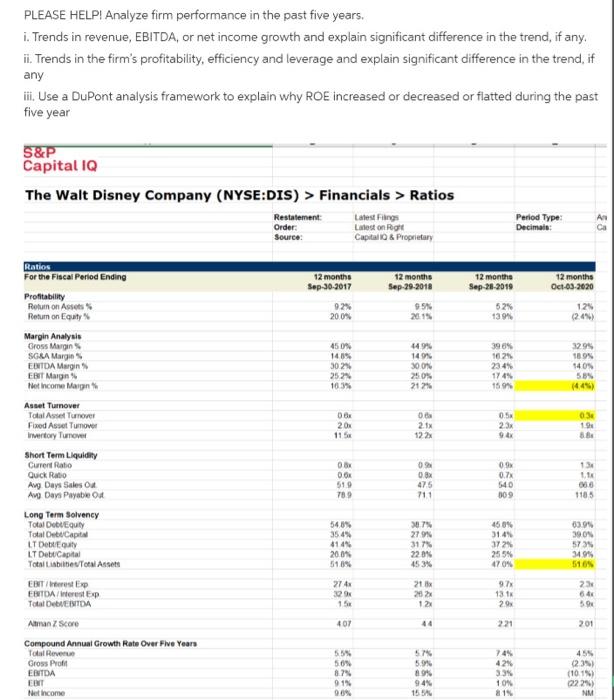

Question: PLEASE HELP! Analyze firm performance in the past five years. i. Trends in revenue, EBITDA, or net income growth and explain significant difference in the

PLEASE HELP! Analyze firm performance in the past five years. i. Trends in revenue, EBITDA, or net income growth and explain significant difference in the trend, if any. ii. Trends in the firm's profitability, efficiency and leverage and explain significant difference in the trend, if any iii. Use a DuPont analysis framework to explain why ROE increased or decreased or flatted during the past five year S&P Capital IQ The Walt Disney Company (NYSE:DIS) > Financials > Ratios Latest Filings Latest on Capital & Proprietary Restatement Order: Source: Period Type: Decimais: Ratios For the Fiscal Perlod Ending 12 months Sep-30-2017 12 months Sep-29-2018 12 months Sep-28-2019 12 months Oct-03-2020 Profitability Rolumn on Assets Return on Equity 954 92% 20.0% 52% 1394 124 (2.4%) 450% 140 3021 25 24 16.3% 44.99 149% 300% 250% Margin Analysis Gross Margins SGLA Margins ENTDA Margin FBT Margin het Income Margin Asset Turnover Total Assel Turner Fixed Asset Tumower Invertory Tumove 3985 162 2345 174 15.9% 1295 18.99 540 589 2125 08 20 115 06 2.1 122 0.5 23 94 03 19 OB 519 789 09 OBX 475 711 OS 0.7% 540 009 L. 06 1185 548% 35.4 414% 20.09 51.8% 307 2799 317% 2209 4505 31.4% 37 2 25 % 470% 03.09 39 ON 573 34.9% 510 Short Term Liquidity Current Ratio Quick Ratio Avg Days Sales Avg Days Payable on Long Term Solvency Total Dolly Total Debt Capital LT DEN LT DebCapital Total abilities/Total Assets EBIT/rest EBITDA Interest Exp Total DVERTDA Atman Z Sore Compound Annual Growth Rate Over Five Years Total Rever Gross Profit EBITDA ET Net Income 2741 329 21.1 26 9 131 29 23 64 594 407 221 201 55% 50% 87% 91% 00% 57 5.99 8.9 94 1556 74% 42% 3.3% 10% & 15 455 (23) (1019) 222) NM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts