Question: Please Help and answer all, => Installation costs are normally treated as part of the outlay for the project (cash outflow at t = 0),

Please Help and answer all,

=> Installation costs are normally treated as part of the outlay for the project (cash outflow at t = 0), but are capitalized for tax purposes (added to the value of the asset) and charged as depreciation over the life of the project.

True

False

=> When evaluating a project on an after tax basis using NPV any tax losses are ignored.

True

False

=> Using discounted payback. A conventional project that has a discount payback period less than its useful life cannot have a negative NPV.

True

False

=> Interest paid on debt (borrowing) is tax deductible. This creates a tax shield. For this reason the interest tax shield should be added when determing Net Cash Flows After Tax [NCFAT].

True

False

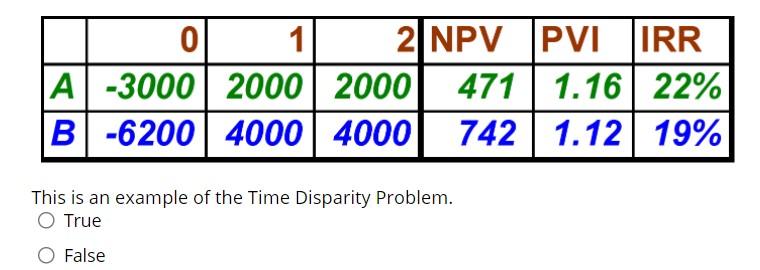

ol 1 2 NPV PVI IRR A-3000 2000 2000 471 1.16 22% B-6200 4000 4000 742 1.12 19% This is an example of the Time Disparity Problem. O True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts