Question: PLEASE HELP AND BE IN DEPTH 1. Explain why having debt on the balance sheet can create value for the firm. Be specific. a. Does

PLEASE HELP AND BE IN DEPTH

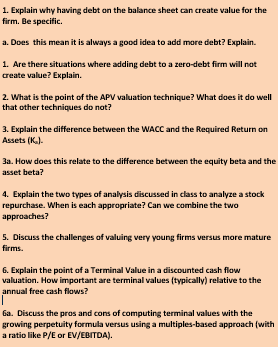

1. Explain why having debt on the balance sheet can create value for the firm. Be specific. a. Does this mean it is always a good idea to add more debt? Explain. 1. Are there situations where adding debt to a zero-debt firm will not create value? Explain. 2. What is the point of the APV valuation technique? What does it do well that other techniques do not? 3. Explain the difference between the WACC and the Required Return on Assets (K.). 3a. How does this relate to the difference between the equity beta and the asset beta? 4. Explain the two types of analysis discussed in class to analyze a stock repurchase. When is each appropriate? Can we combine the two approaches? 5. Discuss the challenges of valuing very young firms versus more mature firms. 6. Explain the point of a Terminal value in a discounted cash flow valuation. How important are terminal values (typically) relative to the annual free cash flows? ? | 6a. Discuss the pros and cons of computing terminal values with the growing perpetuity formula versus using a multiples-based approach (with a ratio like P/E or EV/EBITDA). 1. Explain why having debt on the balance sheet can create value for the firm. Be specific. a. Does this mean it is always a good idea to add more debt? Explain. 1. Are there situations where adding debt to a zero-debt firm will not create value? Explain. 2. What is the point of the APV valuation technique? What does it do well that other techniques do not? 3. Explain the difference between the WACC and the Required Return on Assets (K.). 3a. How does this relate to the difference between the equity beta and the asset beta? 4. Explain the two types of analysis discussed in class to analyze a stock repurchase. When is each appropriate? Can we combine the two approaches? 5. Discuss the challenges of valuing very young firms versus more mature firms. 6. Explain the point of a Terminal value in a discounted cash flow valuation. How important are terminal values (typically) relative to the annual free cash flows? ? | 6a. Discuss the pros and cons of computing terminal values with the growing perpetuity formula versus using a multiples-based approach (with a ratio like P/E or EV/EBITDA)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts