Question: Please help and correct the mistake.Thanks a lot. Please answer both questions. 2 The following are selected ledger accounts of Waterway Corporation at December 31,

Please help and correct the mistake.Thanks a lot.Please answer both questions.

2

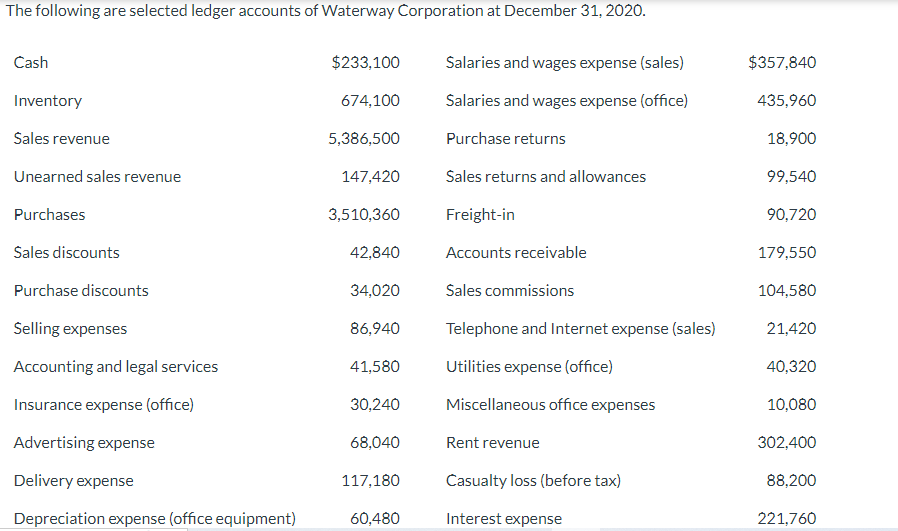

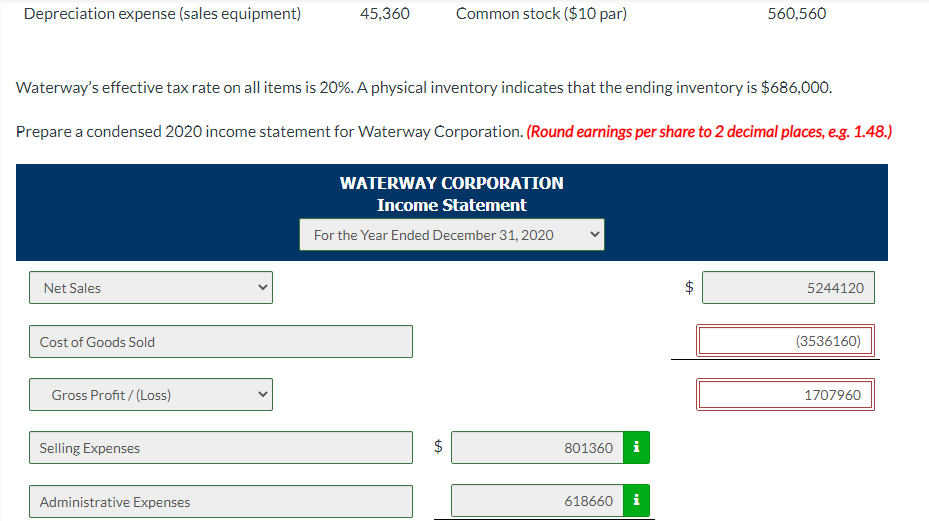

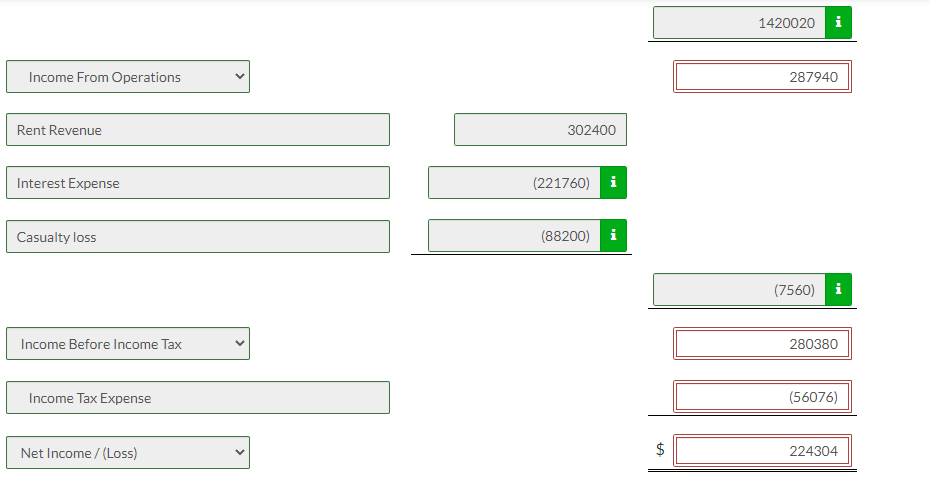

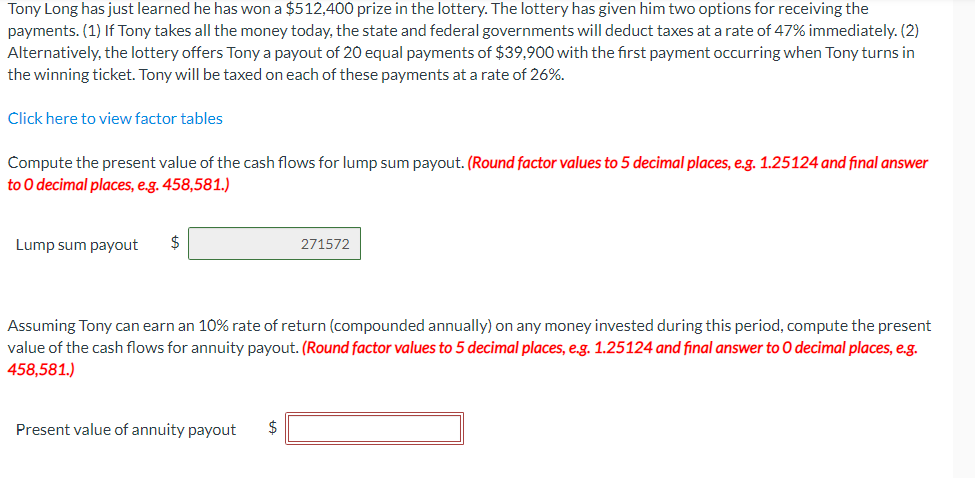

The following are selected ledger accounts of Waterway Corporation at December 31, 2020. Cash $233,100 Salaries and wages expense (sales) $357,840 Inventory 674,100 Salaries and wages expense (office) 435,960 Sales revenue 5,386,500 Purchase returns 18,900 Unearned sales revenue 147,420Salesreturnsandallowances99,540 Purchases 3,510,360 Freight-in 90,720 Sales discounts 42,840 Accounts receivable 179,550 Purchase discounts 34,020 Sales commissions 104,580 Selling expenses 86,940 Telephone and Internet expense (sales) 21,420 Accounting and legal services 41,580 Utilities expense (office) 40,320 Insurance expense (office) 30,240 Miscellaneous office expenses 10,080 Advertising expense 68,040 Rent revenue 302,400 Delivery expense 117,180 Casualty loss (before tax) 88,200 Depreciation expense (office equipment) 60,480 Interest expense 221,760 Waterway's effective tax rate on all items is 20%. A physical inventory indicates that the ending inventory is $686,000. Prepare a condensed 2020 income statement for Waterway Corporation. (Round earnings per share to 2 decimal places, e.g. 1.48.) Income From Operations \begin{tabular}{||c||} \hline 287940 \\ \hline \hline \end{tabular} Rent Revenue 302400 Interest Expense \begin{tabular}{|l|l|} \hline(221760) & i \\ \hline \end{tabular} Casualty loss Income Before Income Tax Income Tax Expense \begin{tabular}{|l|} \hline \hline \multicolumn{1}{|c|}{(56076)} \\ \hline \hline \end{tabular} Net Income /(Loss) Tony Long has just learned he has won a $512,400 prize in the lottery. The lottery has given him two options for receiving the payments. (1) If Tony takes all the money today, the state and federal governments will deduct taxes at a rate of 47% immediately. (2) Alternatively, the lottery offers Tony a payout of 20 equal payments of $39,900 with the first payment occurring when Tony turns in the winning ticket. Tony will be taxed on each of these payments at a rate of 26%. Click here to view factor tables Compute the present value of the cash flows for lump sum payout. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Lump sum payout $ Assuming Tony can earn an 10% rate of return (compounded annually) on any money invested during this period, compute the present value of the cash flows for annuity payout. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Present value of annuity payout $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts