Question: Please help and do this on excel if possible please. Thanks! A small Queensland farming company is contemplating whether to invest in a new irrigation

Please help and do this on excel if possible please. Thanks!

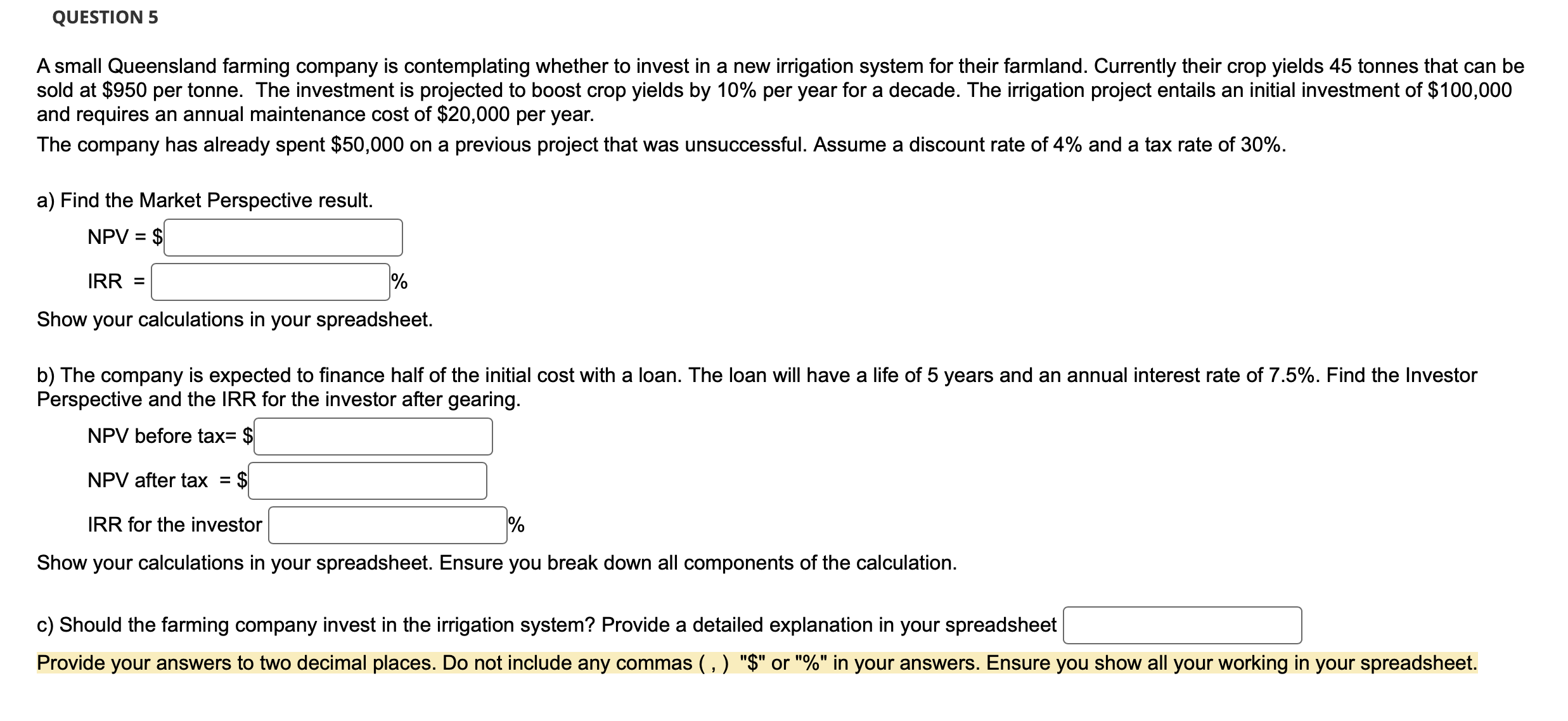

A small Queensland farming company is contemplating whether to invest in a new irrigation system for their farmland. Currently their crop yields 45 tonnes that can be sold at $950 per tonne. The investment is projected to boost crop yields by 10% per year for a decade. The irrigation project entails an initial investment of $100,000 and requires an annual maintenance cost of $20,000 per year. The company has already spent $50,000 on a previous project that was unsuccessful. Assume a discount rate of 4% and a tax rate of 30%. a) Find the Market Perspective result. NPV=$IRR= \% Show your calculations in your spreadsheet. b) The company is expected to finance half of the initial cost with a loan. The loan will have a life of 5 years and an annual interest rate of 7.5%. Find the Investor Perspective and the IRR for the investor after gearing. NPVbeforetax=$ NPV after tax =$ IRR for the investor % Show your calculations in your spreadsheet. Ensure you break down all components of the calculation. c) Should the farming company invest in the irrigation system? Provide a detailed explanation in your spreadsheet Provide your answers to two decimal places. Do not include any commas ( , ) "\$" or "\%" in your answers. Ensure you show all your working in your spreadsheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts