Question: please help and explain how you get EVERYTHING LOL thanks 10000 S Apr 19 Sale 2,500 units June 30 Purchase 4,500 units at $44 Sept.

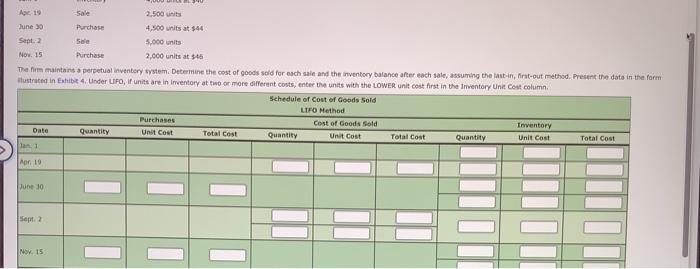

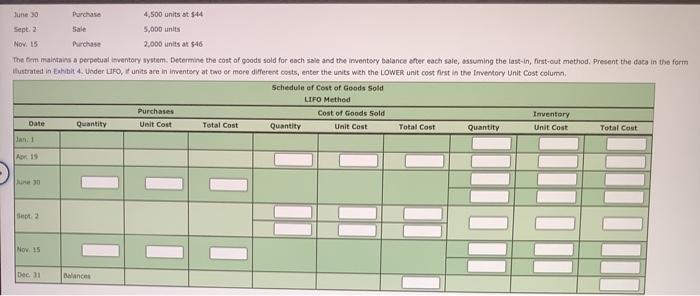

10000 S Apr 19 Sale 2,500 units June 30 Purchase 4,500 units at $44 Sept. 2 Sale 5,000 units Nov. 15 Purchase 2,000 units at $46 The firm maintains a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the data in the form lustrated in Exhibit 4. Under LIFO, If units are in Inventory at two or more different costs, enter the units with the LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Goods Sold LIFO Method. Cost of Goods Sold Inventory Purchases Unit Cost Date Quantity Total Cost Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost Jan. 1 Apr. 19 June 30, Sept. 2 Nov. 15 June 30 Purchase 4,500 units at $44 Sept. 2 Sale 5,000 units Nov. 15 Purchase 2,000 units at $46 The firm maintains a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two or more different costs, enter the units with the LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Goods Sold LIFO Method Cost of Goods Sold Purchases Unit Cost Inventory Unit Cost Date Quantity Total Cost Quantity Unit Cost Total Cost Quantity Total Cost Jan. 1 Apr 19 June 30 Sept. 2 Nov 15 Dec 31 Balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts