Question: Please help and explain. I am not understanding the duplicate payroll periods. A The first quarter tax return needs to be filed for Prevosti Farms

Please help and explain. I am not understanding the duplicate payroll periods.

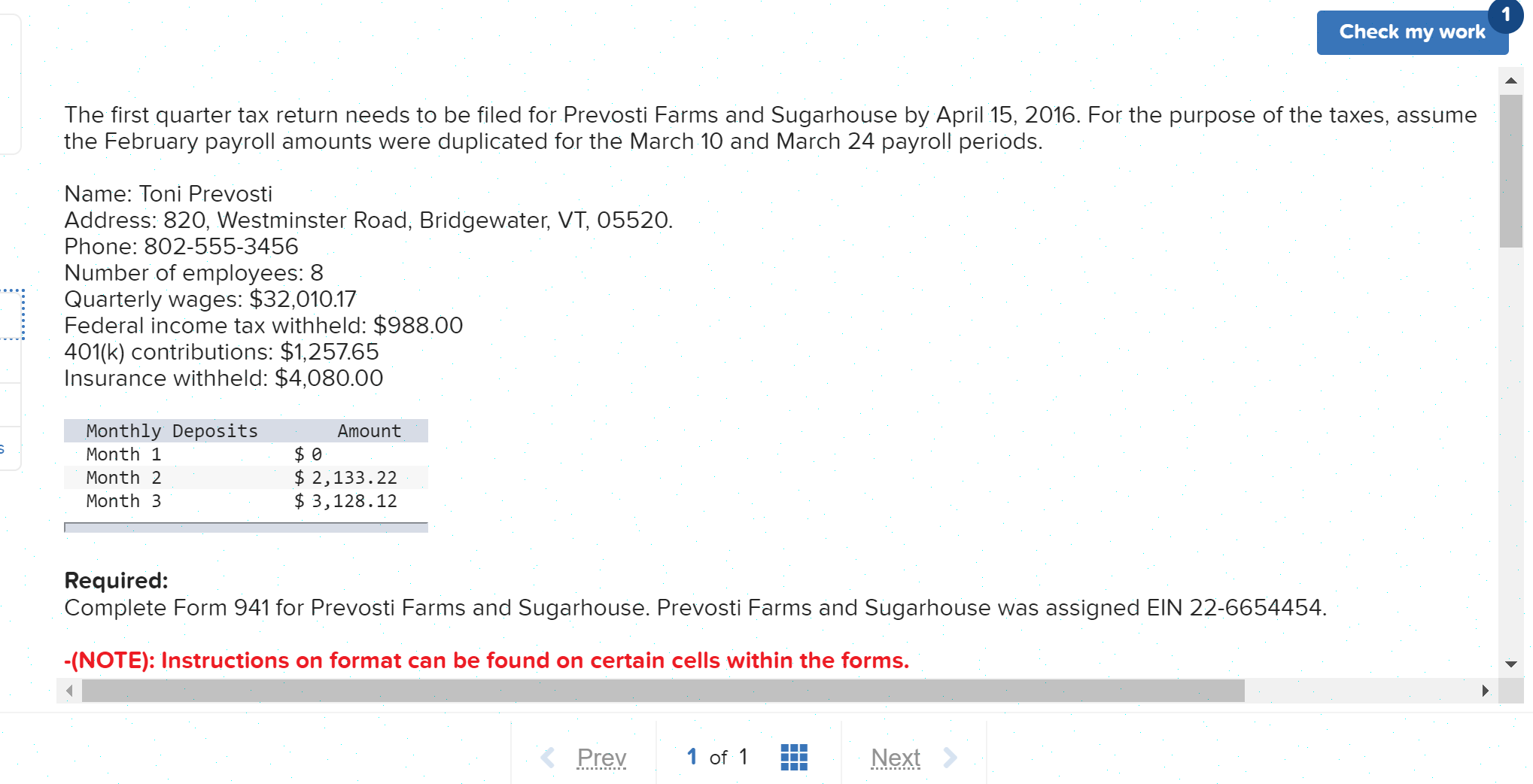

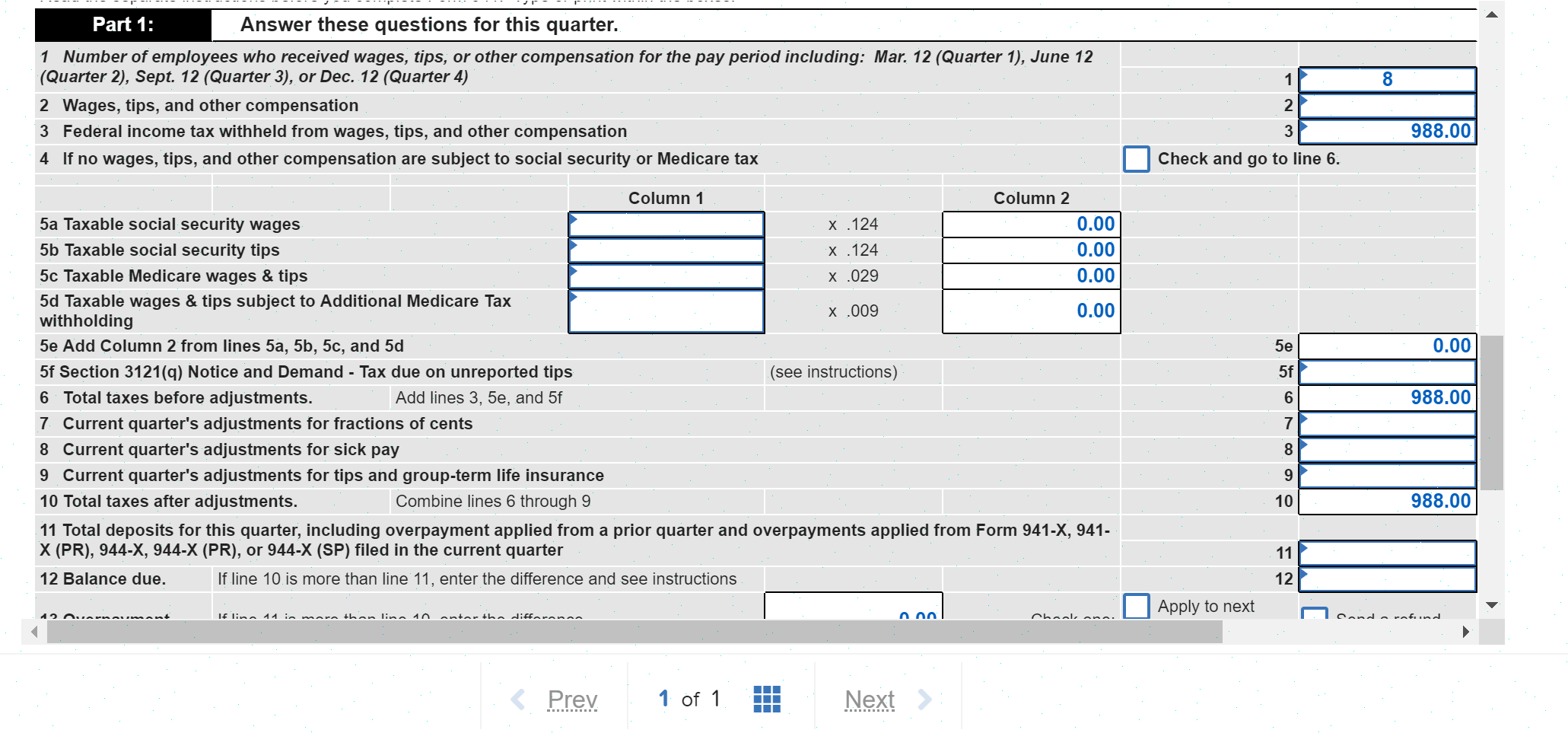

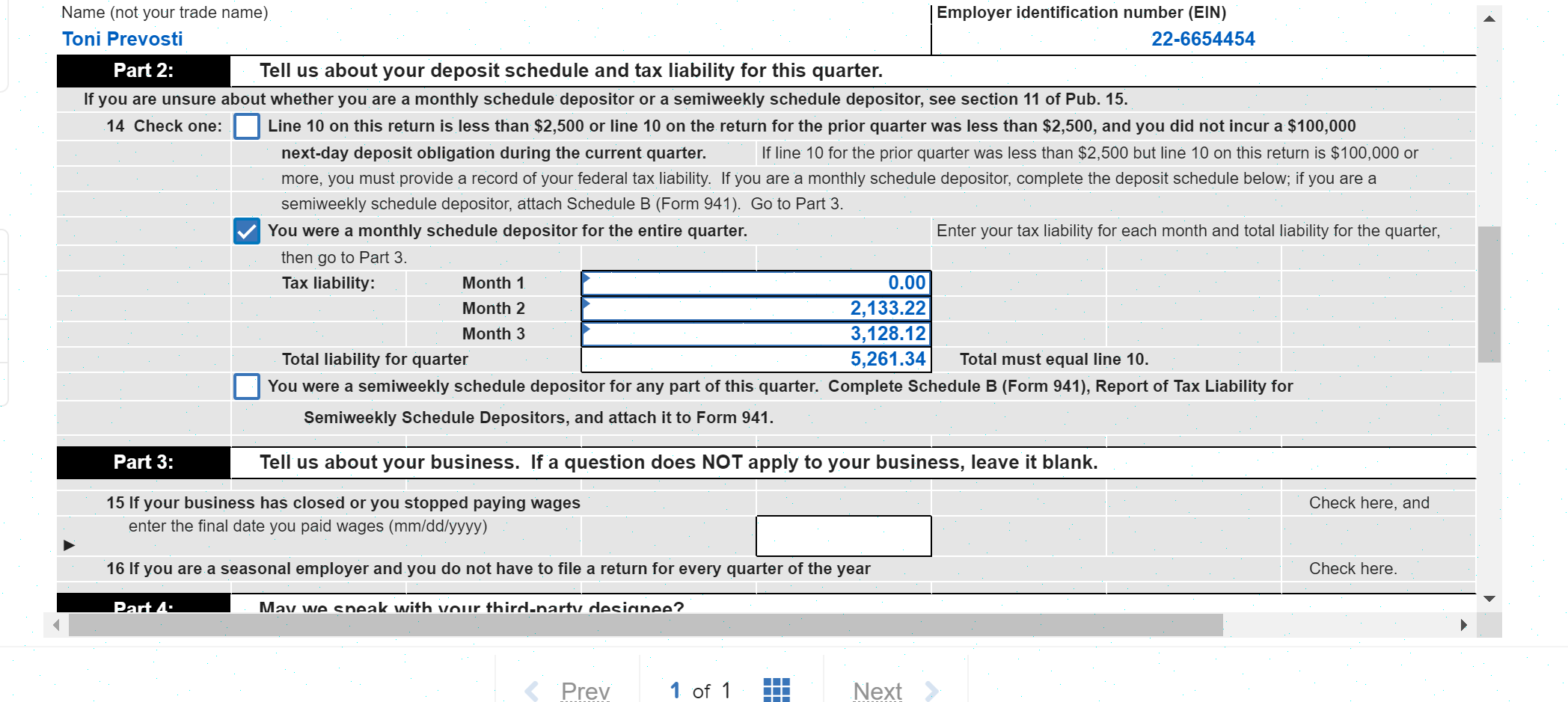

A The first quarter tax return needs to be filed for Prevosti Farms and Sugarhouse by April 15, 2016. For the purpose of the taxes, assume the February payroll amounts were duplicated for the March 10 and March 24 payroll periods. Name: Toni Prevosti Address: 820, Westminster Road, Bridgewater, VT, 05520. Phone: 8025553456 Number of employees: 8 Quarterly wages: $32,010.17 Federal income tax withheld: $988.00 401(k) contributions: $1,257.65 Insurance withheld: $4,080.00 Monthly Deposits Amount 5 Month 1 s a Month 2 $ 2,133.22 Month 3 $ 3,128.12 | Required: Complete Form 941 for Prevosti Farms and Sugarhouse. Prevosti Farms and Sugarhouse was assigned EIN 22-6654454. -(NOTE): Instructions on format can be found on certain cells within the forms. v Emil. 1 of 1 EEE Next Answer these questions for this quarter. A 1 Number of employees who received wages, tips, or other compensation for the pay period including: Mar: 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 1 2 Wages, tips, and other compensation 2 3 3 Federal income tax withheld from wages, tips, and other compensation 988.00 4 If no wages, tips, and other compensation are subject to social security or Medicare tax D Check and go to line 6. Column 1 Column 2 5a Taxable social security wages x .124 0.00 5h Taxable social security tips x .124 0.00 5c Taxable Medicare wages 8. tips x .029 0.00 tlgilwage &tlps subject to Addltlonal Medlcare Tax x 009 0.00 5e Add Column 2 from lines 5a, 5b, 5c, and 5d Sf Section 3121 (q) Notice and Demand - Tax due on unreported tips _ (see instmctions) 6 Total taxes before adjustments. Add lines 3, Se, and 5f 7 Current quarter's adjustments for fractions of cents 8 Current quarter's-adjustments for sick pay 9 Current quarter's adjustments for tips and group-term life insurance 10 Total taxes after adjustments. Combine lines 6 through 9 11 Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form 941-X, 941- X (PR), 944-X, 944-X (PR), or 944-X (SP) led in the current quarter 11 12 Balance due. If line 10 is more than line 11, enter the difference and see instructions 12 A'- n..----..---. u .:-- 44 : _____ LL_-. .:-- 4n ---_u.- -:u------ A An n---. ----- D Apply to nex' I_I o--.. - .-'.-- v 4 > Name (not your trade name) Employer identification number (EIN) Toni Prevosti 22-6654454 Tell us about your deposit schedule and tax liability for this quarter. If you are unsure about whether you are a monthly schedule depositor or a semiweekly schedule depositor, see section 11 of Pub. 15. 14 Check one: D Line 10 on this retum is less than $2,500 or line 10 on the return for the prior quarter was less than $2,500, and you did not incur a $100,000 next-day deposit obligation during the current quarter. It line 10 forthe prior quarter was less than $2,500 but line 10 on this return is $100,000 or more, you must provide a record of your federal tax liability. If you are a monthly schedule depositor, complete the deposit schedule below; if you are a semiweekly schedule depositor, attach Schedule B (Form 941). Go to Part 3. You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the quarter, then go to Part 3. Taxnabimw Monm m Month 2 _mm Month 3 m Total liability for quarter 5,261.34 Total must equal line 10. D You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Tell us about your business. If a question does NOT apply to your business, leave it blank. . 15 If your business has closed or you stopped paying wages Check here, and enter the nal date you paid wages (mm/dd/yyyy) I: V 16 If you are a seasonal employer and you do not have to le a return for every quarter of the year Check here. '-M'- Mau we anall with um" minimarm rlneinnnn\

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts