Question: please help, and explain thank you Show Attempt History Current Attempt in Progress - Your answer is partially correct. The net earnings of the factory

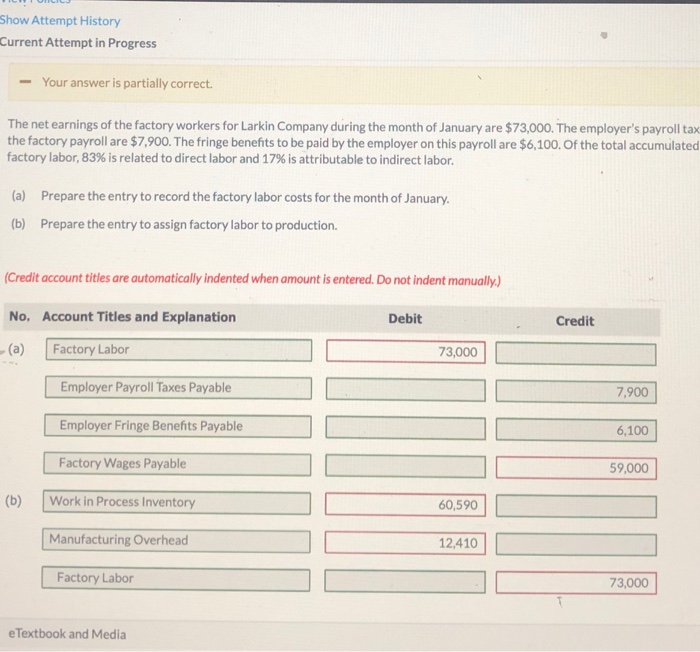

Show Attempt History Current Attempt in Progress - Your answer is partially correct. The net earnings of the factory workers for Larkin Company during the month of January are $73,000. The employer's payroll tax the factory payroll are $7,900. The fringe benefits to be paid by the employer on this payroll are $6,100. Of the total accumulated factory labor, 83% is related to direct labor and 17% is attributable to indirect labor. (a) Prepare the entry to record the factory labor costs for the month of January (b) Prepare the entry to assign factory labor to production. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (a) Factory Labor 73,000 Employer Payroll Taxes Payable 7,900 Employer Fringe Benefits Payable 6,100 Factory Wages Payable 59,000 (b) Work in Process Inventory 60,590 Manufacturing Overhead 12,410 Factory Labor 73,000 e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts