Question: Please help and explain to me on the INCORRECT DATE that is in color RED BLANK I filled in FEB 28. but it was incorrect.

Please help and explain to me on the INCORRECT DATE that is in color RED BLANK I filled in FEB 28. but it was incorrect.

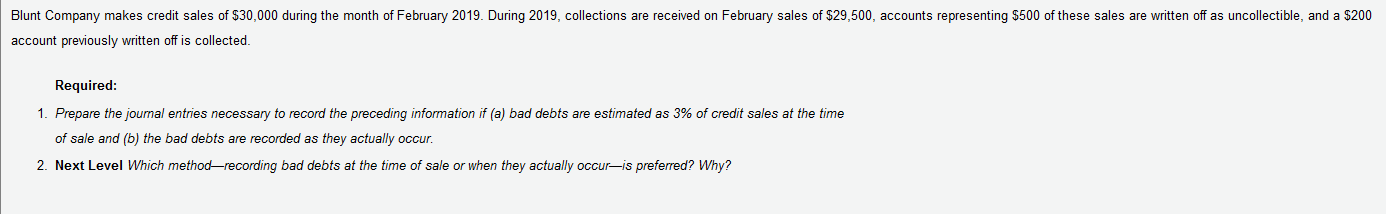

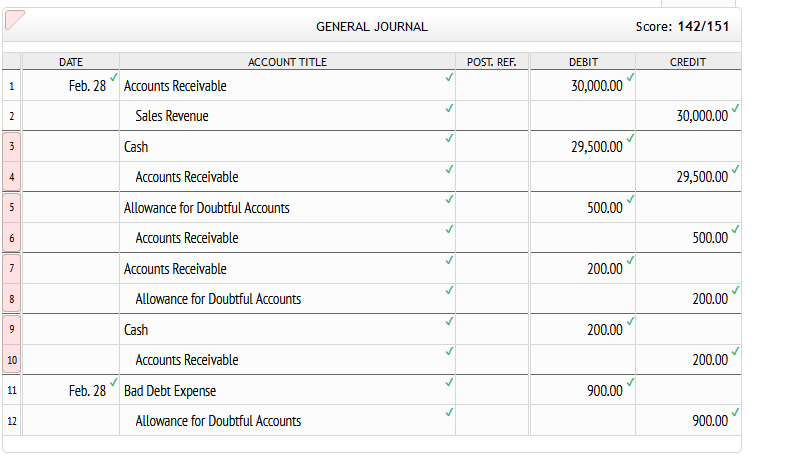

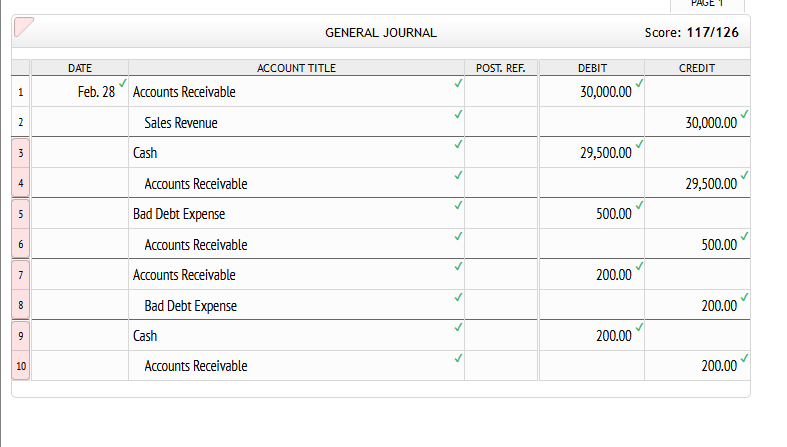

Blunt Company makes credit sales of $30,000 during the month of February 2019. During 2019, collections are received on February sales of $29,500, accounts representing $500 of these sales are written off as uncollectible, and a $200 account previously written off is collected. Required: 1. Prepare the journal entries necessary to record the preceding information if (a) bad debts are estimated as 3% of credit sales at the time of sale and (b) the bad debts are recorded as they actually occur. 2. Next Level Which method-recording bad debts at the time of sale or when they actually occuris preferred? Why? GENERAL JOURNAL Score: 142/151 DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 Feb. 28 Accounts Receivable 30,000.00 2 Sales Revenue 30,000.00 3 Cash 29,500.00 29,500.00 5 500.00 6 Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable Accounts Receivable Allowance for Doubtful Accounts 500.00 7 200.00 00 200.00 9 Cash 200.00 10 200.00 Accounts Receivable Feb. 28 Bad Debt Expense 11 900.00 12 Allowance for Doubtful Accounts 900.00 PAGE 1 GENERAL JOURNAL Score: 117/126 DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 Feb. 28 Accounts Receivable 30,000.00 2 Sales Revenue 30,000.00 3 Cash 29,500.00 4 29,500.00 5 500.00 6 500.00 7 Accounts Receivable Bad Debt Expense Accounts Receivable Accounts Receivable Bad Debt Expense Cash Accounts Receivable 200.00 8 200.00 9 200.00 10 200.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts