Question: please help and i need it with excel work thanks You are the investment manager for a bond fund. You have a one-year investment horizon

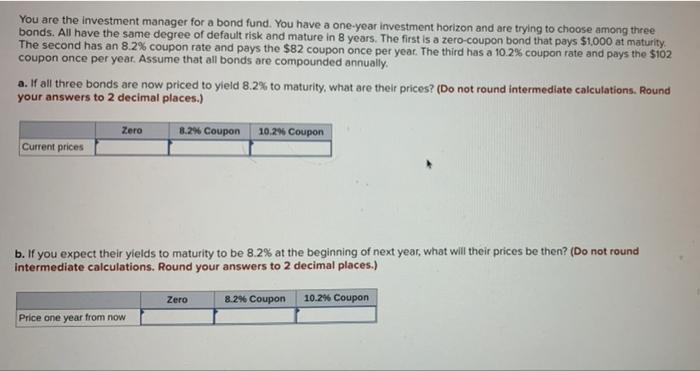

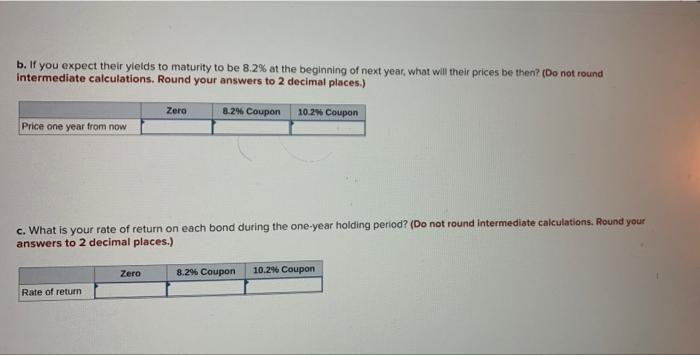

You are the investment manager for a bond fund. You have a one-year investment horizon and are trying to choose among three bonds. All have the same degree of default risk and mature in 8 years. The first is a zero-coupon bond that pays $1,000 at maturity The second has an 8.2% coupon rate and pays the $82 coupon once per year. The third has a 10.2% coupon rate and pays the $102 coupon once per year. Assume that all bonds are compounded annually. a. If all three bonds are now priced to yield 8.2% to maturity, what are their prices? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Zero 8.2 % Coupon 10.2 % Coupon Current prices b. If you expect their yields to maturity to be 8.2% at the beginning of next year, what will their prices be then? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Zero 8.2 % Coupon 10.2 % Coupon Price one year from now b. If you expect their yields to maturity to be 8.2% at the beginning of next year, what will their prices be then? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Zero 8.2% Coupon 10.2 % Coupon Price one year from now c. What is your rate of return on each bond during the one-year holding period? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Zero 8.2% Coupon 10.2% Coupon Rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts