Question: please help and i will rate (CHAPTER 10) A large wine maker would like to buy new stainless steel containers for aging its wine. It

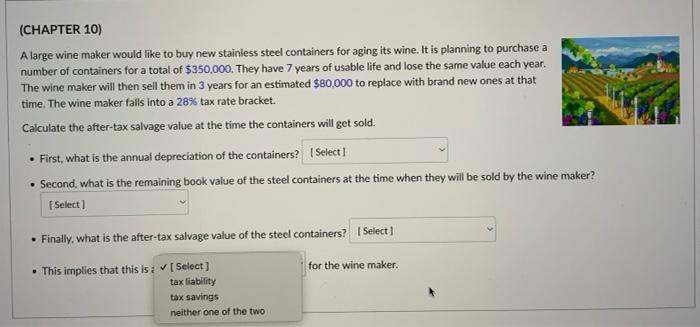

(CHAPTER 10) A large wine maker would like to buy new stainless steel containers for aging its wine. It is planning to purchase a number of containers for a total of $350,000. They have 7 years of usable life and lose the same value each year. The wine maker will then sell them in 3 years for an estimated $80,000 to replace with brand new ones at that time. The wine maker falls into a 28% tax rate bracket. Calculate the after-tax salvage value at the time the containers will get sold. . First, what is the annual depreciation of the containers? Select] Second, what is the remaining book value of the steel containers at the time when they will be sold by the wine maker? Select . Finally, what is the after-tax salvage value of the steel containers? Select) . This implies that this is a Select] for the wine maker. tax liability tax savings neither one of the two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts