Question: please help. and if possible solve without excel. A firm has projected the following financials for a possible project: The firm has a capital structure

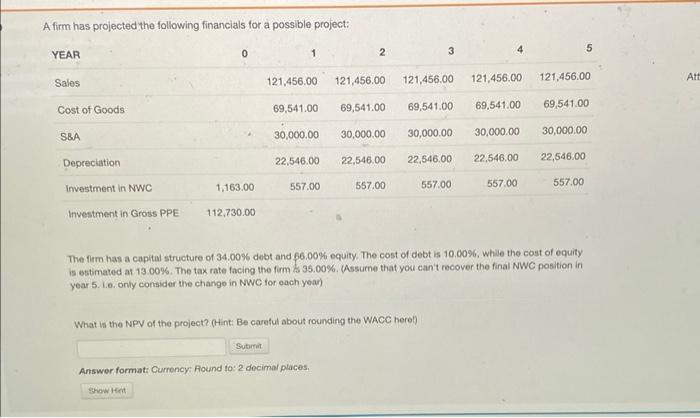

A firm has projected the following financials for a possible project: The firm has a capital structure of 34.00% debt and 66.00% equity. The cost of debt is 10.00%, while the cost of equity is estimated at 13.00%. The tax rate facing the firm 35.00\%. (Assume that you can't recover the final NWC position in year 5. Le. only consider the change in NWC for each yeap) What is the NPV of the project? (Hint: Be careful about rounding the WACC herel)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts