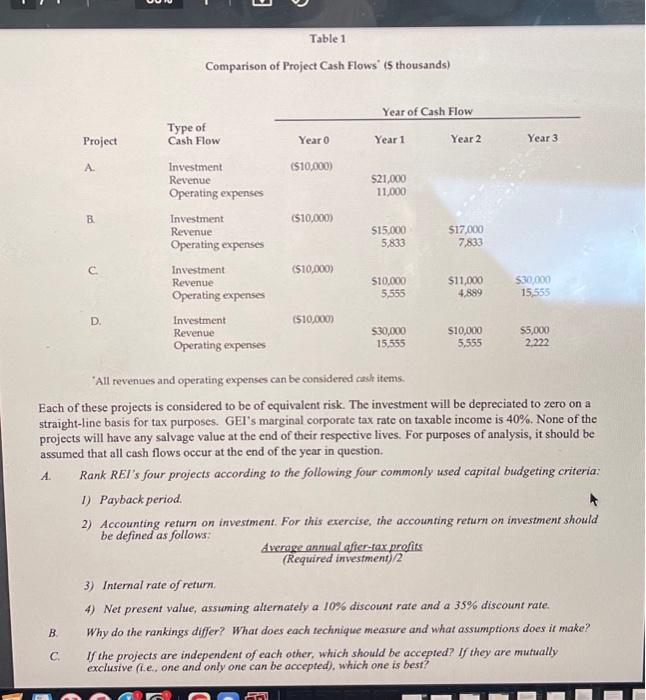

Question: please help and include formulas! Table 1 Comparison of Project Cash Flows ( 5 thousands) All revenues and operating expenses can be considered cash items.

Table 1 Comparison of Project Cash Flows" ( 5 thousands) "All revenues and operating expenses can be considered cash items. Each of these projects is considered to be of equivalent risk. The investment will be depreciated to zero on a straight-line basis for tax purposes. GEl's marginal corporate tax rate on taxable income is 40%. None of the projects will have any salvage value at the end of their respective lives. For purposes of analysis, it should be assumed that all cash flows occur at the end of the year in question. A. Rank REI's four projects according to the following four commonly used capital budgeting criteria: 1) Payback period. 2) Accounting return on investment. For this exercise, the accounting return on investment should be defined as follows: Average annual afier-tax profits (Required investment)/2 3) Intemal rate of return. 4) Net present value, assuming altemately a 10%6 discount rate and a 35% discount rate- B. Why do the rankings differ? What does each technique measure and what assumptions does it make? C. If the projects are independent of each other, which should be accepted? If they are mutually exclusive (t.e, one and only one can be accepted), which one is best

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts