Question: Please help! And please explain how to get answers so I can learn how to do it on future problems. Thanks in advance! I'll be

Please help! And please explain how to get answers so I can learn how to do it on future problems. Thanks in advance! I'll be sure to give a thumbs up.

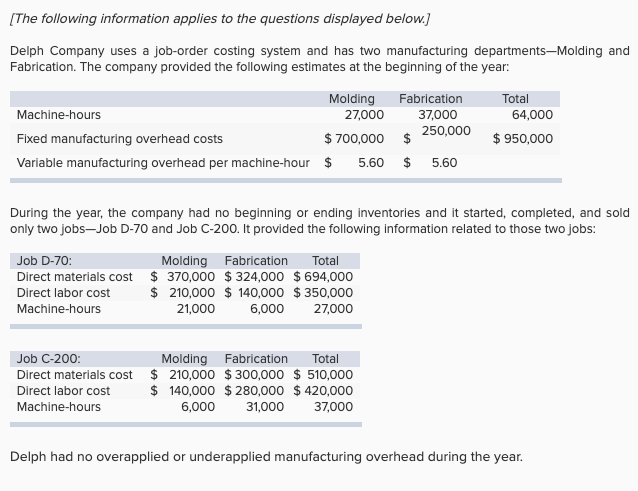

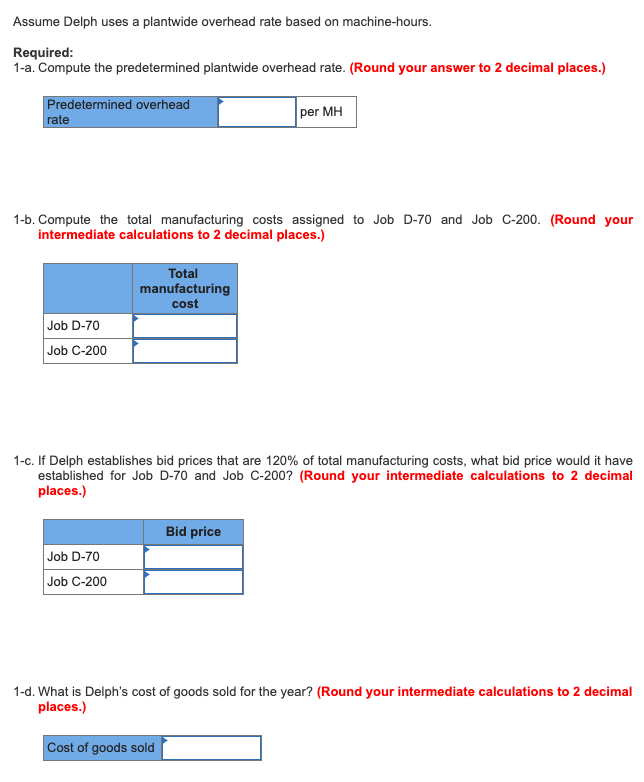

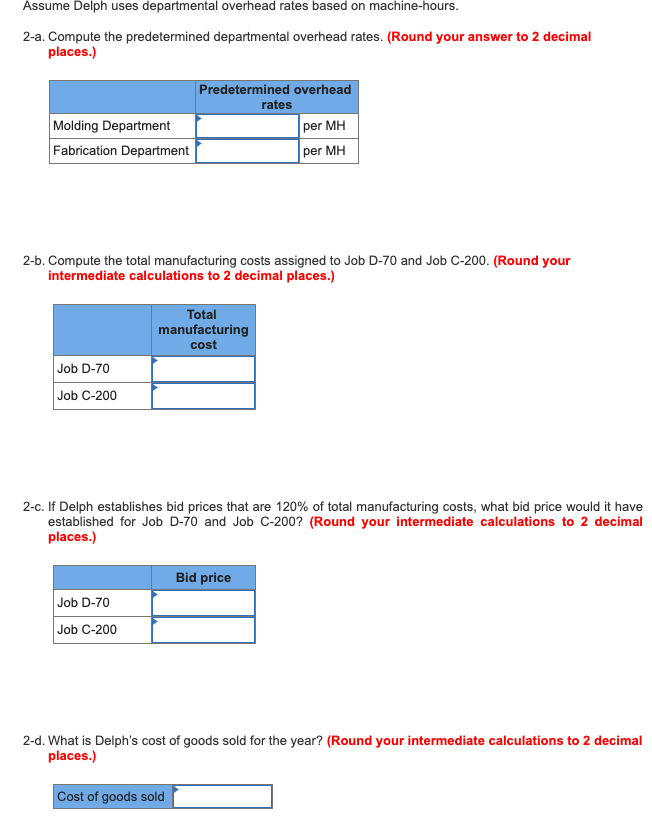

The following information applies to the questions displayed below.) Delph Company uses a job-order costing system and has two manufacturing departments-Molding and Fabrication. The company provided the following estimates at the beginning of the year: Molding Machine-hours 27,000 Fixed manufacturing overhead costs $ 700,000 Variable manufacturing overhead per machine-hour $ 5.60 Fabrication 37,000 $ 250,000 $ 5.60 Total 64,000 $950,000 During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobsJob D-70 and Job C-200. It provided the following information related to those two jobs: Job D-70 Direct materials cost Direct labor cost Machine-hours Molding Fabrication Total $ 370,000 $ 324,000 $ 694,000 $ 210,000 $ 140,000 $ 350,000 21,000 6,000 27,000 Job C-200: Direct materials cost Direct labor cost Machine-hours Molding Fabrication Total $ 210,000 $ 300,000 $ 510,000 $ 140,000 $ 280,000 $ 420,000 6,000 31,000 37,000 Delph had no overapplied or underapplied manufacturing overhead during the year. Assume Delph uses a plantwide overhead rate based on machine-hours. Required: 1-a. Compute the predetermined plantwide overhead rate. (Round your answer to 2 decimal places.) Predetermined overhead rate per MH 1-b. Compute the total manufacturing costs assigned to Job D-70 and Job C-200. (Round your intermediate calculations to 2 decimal places.) Total manufacturing cost Job D-70 Job C-200 1-c. If Delph establishes bid prices that are 120% of total manufacturing costs, what bid price would it have established for Job D-70 and Job C-200? (Round your intermediate calculations to 2 decimal places.) Bid price Job D-70 Job C-200 1-d. What is Delph's cost of goods sold for the year? (Round your intermediate calculations to 2 decimal places.) Cost of goods sold Assume Delph uses departmental overhead rates based on machine-hours. 2-a. Compute the predetermined departmental overhead rates. (Round your answer to 2 decimal places.) Molding Department Fabrication Department Predetermined overhead rates per MH per MH 2-b. Compute the total manufacturing costs assigned to Job D-70 and Job C-200. (Round your intermediate calculations to 2 decimal places.) Total manufacturing cost Job D-70 Job C-200 2-c. If Delph establishes bid prices that are 120% of total manufacturing costs, what bid price would it have established for Job D-70 and Job C-200? (Round your intermediate calculations to 2 decimal places.) Bid price Job D-70 Job C-200 2-d. What is Delph's cost of goods sold for the year? (Round your intermediate calculations to 2 decimal places.) Cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts