Question: Please help and show any work, thank you! Problem #5-Accounts Receive able case At December 31 of the current year, Robert s Company had a

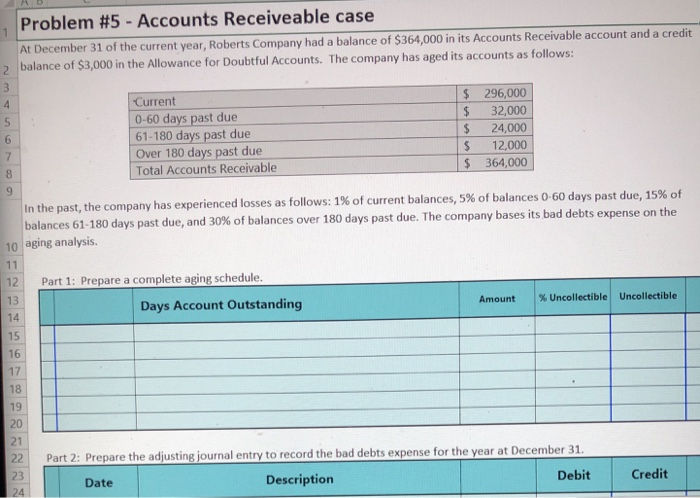

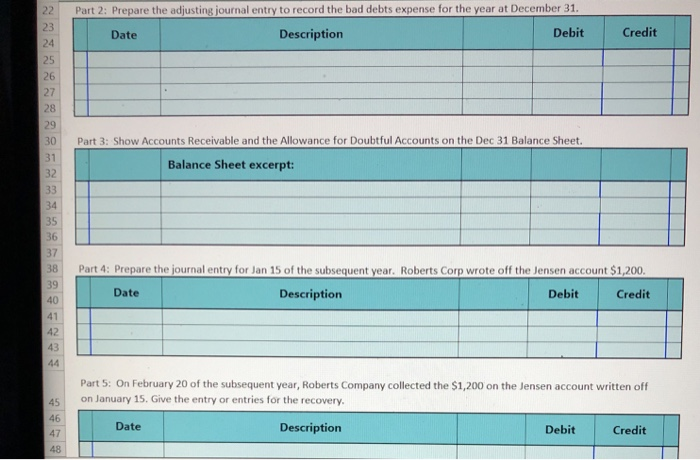

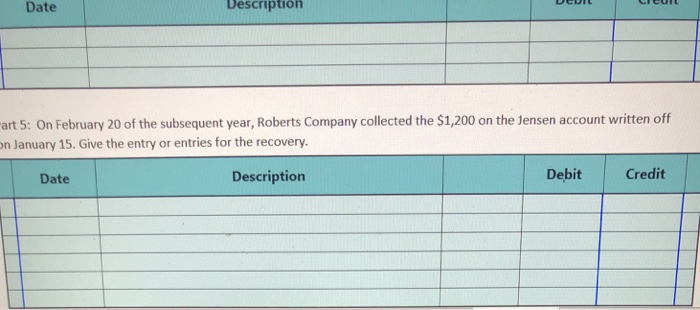

Problem #5-Accounts Receive able case At December 31 of the current year, Robert s Company had a balance of $364,000 in its Accounts Receivable account and a credit 2 balance of $3,000 in the Allowance for Doubtful Accounts. The company has aged its accounts as follows: Current 0-60 days past due 61-180 days past due Over 180 days past due Total Accounts Receivable 296,000 $ 32,000 24,000 S 12,000 364,000 6 8 9 In the past, the company has experienced losses as follows: 1% of current balances, 5% of balances 0.60 da ys past due, 15% of and 30% of balances over 180 days past due. The company bases its bad debts expense on the 61-180 days past due, 10 aging analysis. 12 Part 1: Prepare a complete aging schedule 13 14 15 16 17 18 19 20 21 Days Account Outstanding Amount | % Uncollectible uncollectible Part 2: Prepare the adjusting journal entry to record the bad debts expense for the year at December 31 23 24 Date Description DebitCredit 22 Part 2: Prepare the adjusting iournal entry to record the bad debts expense for the year at December 31 Date Description Debit Credit 24 25 26 8 29 30 Part 3: Show Accounts Receivable and the Allowance for Doubtful Accounts on the Dec 31 Balance Sheet 31 32 Balance Sheet excerpt: 34 36 38 Part 4: Prepare the journal entry for Jan 15 of the subsequent year. Roberts Corp wrote off the Jensen account $1,200 39 40 41 42 43 Debit Credit Date Descriptiorn Part 5: On February 20 of the subsequent year, Roberts Company collected the $1,200 on the Jensen account written off 45 on January 15. Give the entry or entries for the recovery 46 47 48 Date Description Debit Credit Date Description art 5: On February 20 of the subsequent year, Roberts Company collected the $1,200 on the Jensen account written off on January 15. Give the entry or entries for the recovery. Date Description Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts