Question: please help and show how to get answer Use the following table for the problem: H and W are married and file a joint return

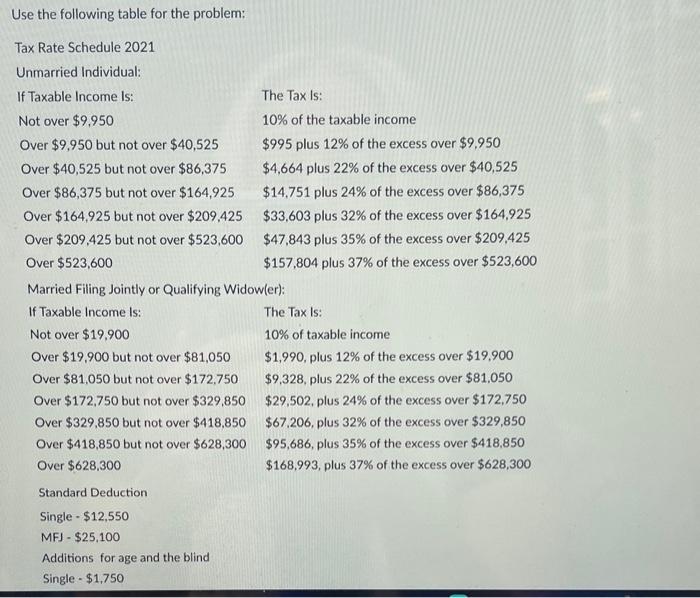

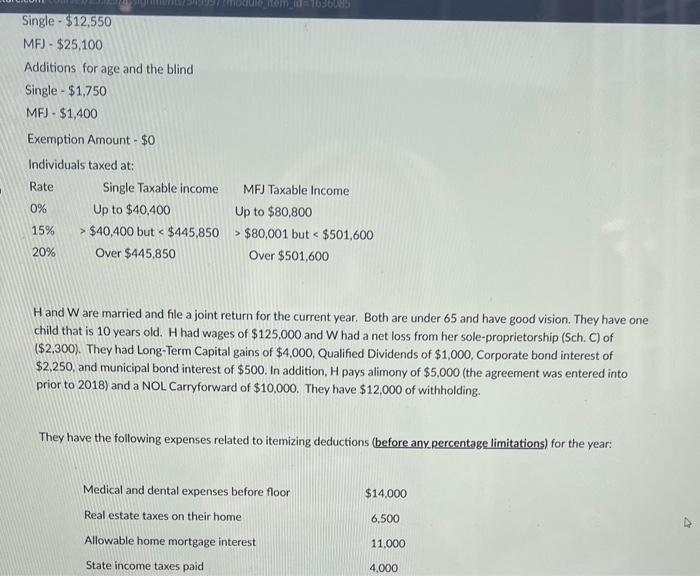

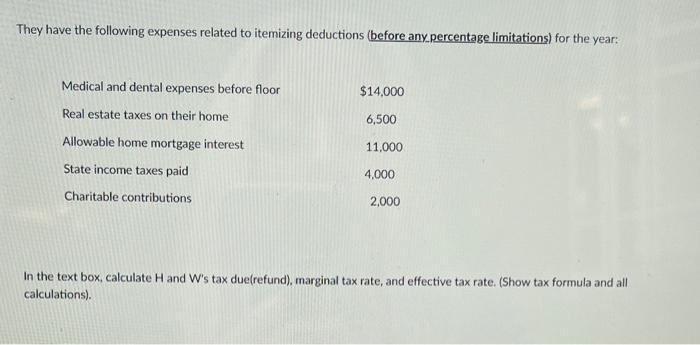

Use the following table for the problem: H and W are married and file a joint return for the current year. Both are under 65 and have good vision. They have one child that is 10 years old. H had wages of $125,000 and W had a net loss from her sole-proprietorship (Sch. C) of ($2,300). They had Long-Term Capital gains of $4,000, Qualifed Dividends of $1,000, Corporate bond interest of $2,250, and municipal bond interest of $500. In addition, H pays alimony of $5,000 (the agreement was entered into prior to 2018) and a NOL Carryforward of $10,000. They have $12,000 of withholding. They have the following expenses related to itemizing deductions (before any percentage limitations) for the year: They have the following expenses related to itemizing deductions (before any,percentage limitations) for the year: In the text box, calculate H and W's tax due(refund), marginal tax rate, and effective tax rate. (Show tax formula and all calculations)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts