Question: please help and show me step by step Required information [The following information applies to the questions displayed below.] At the beginning of the current

![following information applies to the questions displayed below.] At the beginning of](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66aa1c0fa61b6_33566aa1c0f2d057.jpg)

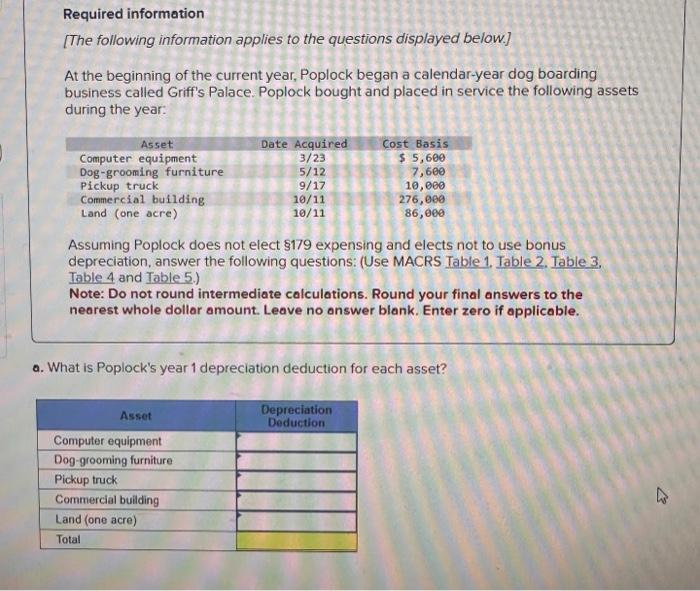

Required information [The following information applies to the questions displayed below.] At the beginning of the current year, Poplock began a calendar-year dog boarding business called Griff's Palace. Poplock bought and placed in service the following assets during the year: Assuming Poplock does not elect $179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2. Table 3 , Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable. a. What is Poplock's year 1 depreciation deduction for each asset? Required information [The following information applies to the questions displayed below.] At the beginning of the current year, Poplock began a calendar-year dog boarding business called Griff's Palace. Poplock bought and placed in service the following assets during the year: Assuming Poplock does not elect \$179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2. Table 3 , Table 4 and Table 5 .) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollor amount. Leave no answer blank. Enter zero if applicable. b. What is Poplock's year 2 depreciation deduction for each asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts