Question: please help and show steps and explain. thanks E7-4 (Algo) Computing and Recording Cost and Depreciation of Assets in a Basket Purchase (StraightLine Depreciation) L07-2,

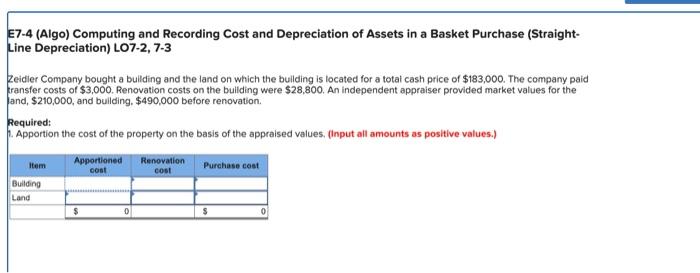

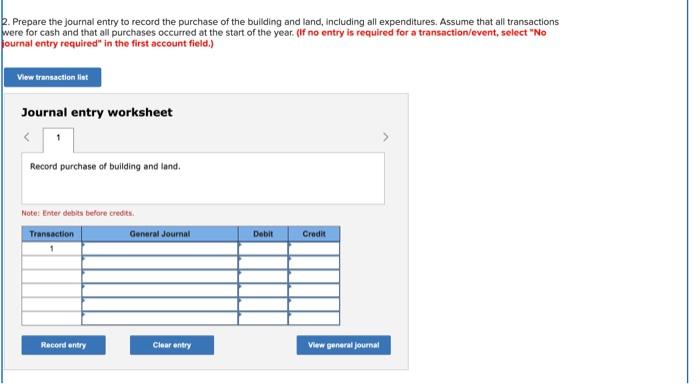

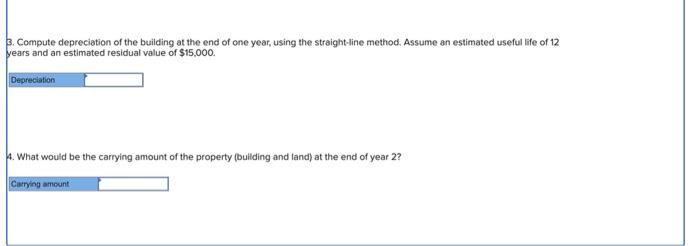

E7-4 (Algo) Computing and Recording Cost and Depreciation of Assets in a Basket Purchase (StraightLine Depreciation) L07-2, 7-3 Zeidier Company bought a bullding and the land on which the bullding is located for a totai cash price of $183,000. The company paid transfer costs of $3,000. Renovation costs on the buliding were $28,800. An independent appraiser provided market values for the land, $210,000, and building. $490,000 before renovation. Required: Apportion the cost of the property on the basis of the appraised values. (Input all amounts as positive values.) Prepare the journal entry to record the purchase of the building and land, including all expenditures. Assume that all transactions ere for cash and that all purchases occurred at the start of the year. (If no entry is required for a transaction/event, select "No curnal entry required" in the first account field.) Journal entry worksheet Record purchase of building and land. Note: Enter debits before credits. 3. Compute depreciation of the building at the end of one year, using the straight-line method. Assume an estimated useful life of 12 years and an estimated residual value of $15,000. 4. What would be the carrying amount of the property (buliding and land) at the end of year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts