Question: PLEASE HELP AND SHOW STEPS JAM, Inc. is currently trying to optmize its payables policy. The firm's vendors all offer terms of 3/10 net 50,

PLEASE HELP AND SHOW STEPS

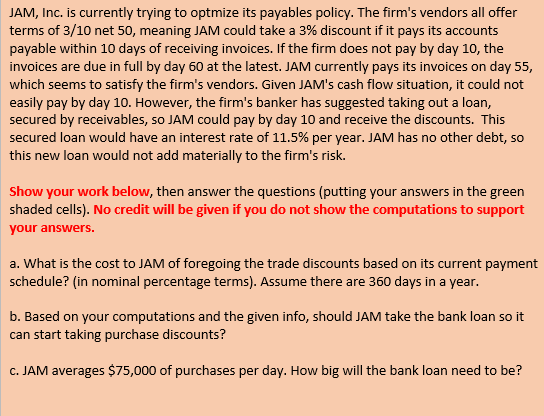

JAM, Inc. is currently trying to optmize its payables policy. The firm's vendors all offer terms of 3/10 net 50, meaning JAM could take a 3% discount if it pays its accounts payable within 10 days of receiving invoices. If the firm does not pay by day 10, the invoices are due in full by day 60 at the latest. JAM currently pays its invoices on day 55, which seems to satisfy the firm's vendors. Given JAM's cash flow situation, it could not easily pay by day 10. However, the firm's banker has suggested taking out a loan, secured by receivables, so JAM could pay by day 10 and receive the discounts. This secured loan would have an interest rate of 11.5% per year. JAM has no other debt, so this new loan would not add materially to the firm's risk. Show your work below, then answer the questions (putting your answers in the green shaded cells). No credit will be given if you do not show the computations to support your answers. a. What is the cost to JAM of foregoing the trade discounts based on its current payment schedule? (in nominal percentage terms). Assume there are 360 days in a year. b. Based on your computations and the given info, should JAM take the bank loan so it can start taking purchase discounts? C. JAM averages $75,000 of purchases per day. How big will the bank loan need to be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts