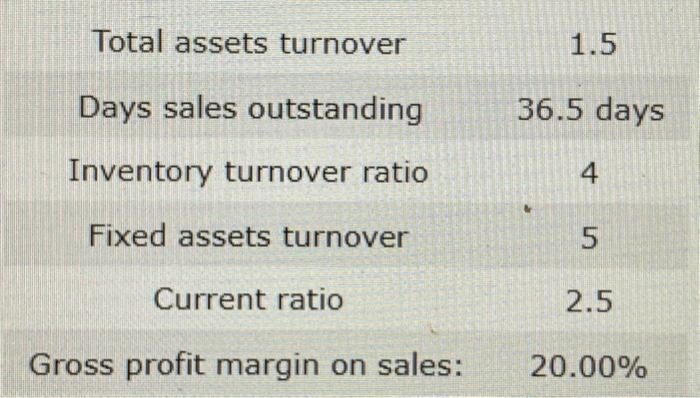

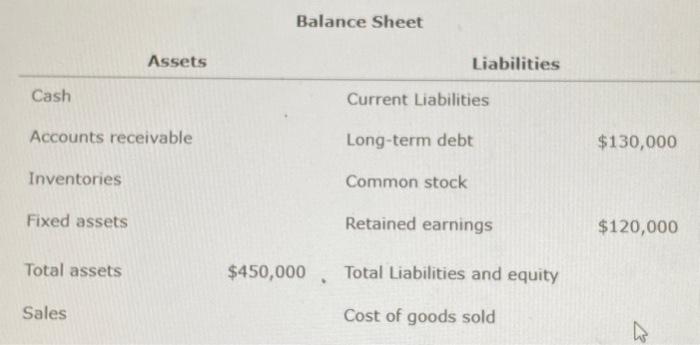

Question: please help and show work as I need to understand and am confused after watching Balance Sheet Assets Liabilities begin{tabular}{ll} hline Cash & Current Liabilities

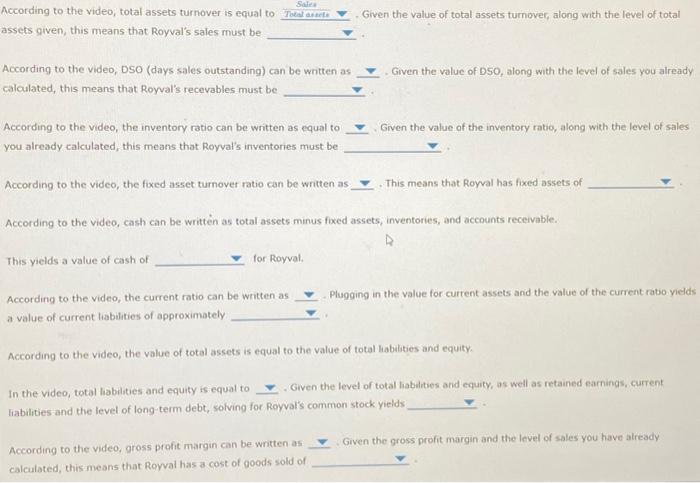

Balance Sheet Assets Liabilities \begin{tabular}{ll} \hline Cash & Current Liabilities \\ Accounts receivable & Long-term debt \\ Inventories & Common stock \\ Fixed assets & Retained earnings \\ Total assets & $40,000 \\ Sales & Total Liabilities and equity \\ \hline \end{tabular} G According to the video, total assets turnover is equal to assets given, this means that Royval's sales must be - Given the value of total assets turnover, along with the level of total According to the video, DSO (days sales outstanding) can be written as Given the value of DSO, along with the level of sales you already calculated, this means that Royral's recevables must be According to the video, the inventory ratio can be written as equal to Given the value of the inventory ratio, along with the level of sales you already calculated, this means that Royval's inventories must be According to the video, the fixed asset turnover ratio can be written as This means that Royral has foxed assets of According to the video, cash can be writtn as total assets minus foxed assets, inventories, and accounts receivable. This yields a value of cash of for Royval. According to the video, the current ratio can be written as Plugging in the value for curtent assets and the value of the current ratio yields a value of current liabilities of approximately According to the video, the value of total assets is equal to the value of total liabilities and equity. In the video, total labilities and equity is equal to Given the level of total liabinties and equity, os well as retained earnings, current liabilities and the level of long-term debt, solving for Royval's common stock yields According to the video, gross profit margin can be written as Given the gross profit margin and the level of sales you have already calculated, this means that Royval has a cost of goods sold of Balance Sheet Assets Liabilities \begin{tabular}{ll} \hline Cash & Current Liabilities \\ Accounts receivable & Long-term debt \\ Inventories & Common stock \\ Fixed assets & Retained earnings \\ Total assets & $40,000 \\ Sales & Total Liabilities and equity \\ \hline \end{tabular} G According to the video, total assets turnover is equal to assets given, this means that Royval's sales must be - Given the value of total assets turnover, along with the level of total According to the video, DSO (days sales outstanding) can be written as Given the value of DSO, along with the level of sales you already calculated, this means that Royral's recevables must be According to the video, the inventory ratio can be written as equal to Given the value of the inventory ratio, along with the level of sales you already calculated, this means that Royval's inventories must be According to the video, the fixed asset turnover ratio can be written as This means that Royral has foxed assets of According to the video, cash can be writtn as total assets minus foxed assets, inventories, and accounts receivable. This yields a value of cash of for Royval. According to the video, the current ratio can be written as Plugging in the value for curtent assets and the value of the current ratio yields a value of current liabilities of approximately According to the video, the value of total assets is equal to the value of total liabilities and equity. In the video, total labilities and equity is equal to Given the level of total liabinties and equity, os well as retained earnings, current liabilities and the level of long-term debt, solving for Royval's common stock yields According to the video, gross profit margin can be written as Given the gross profit margin and the level of sales you have already calculated, this means that Royval has a cost of goods sold of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts