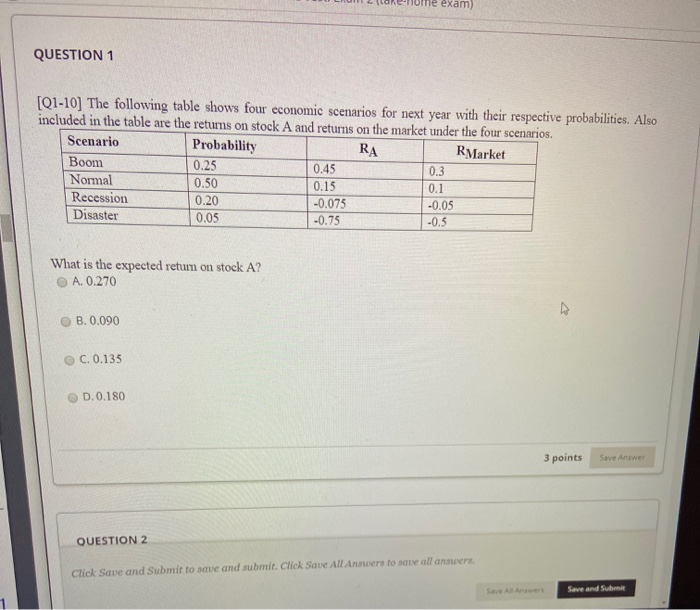

Question: please help and show work L (CURL T ela QUESTION 1 [Q1-10] The following table shows four economic scenarios for next year with their respective

![[Q1-10] The following table shows four economic scenarios for next year with](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffe8fc76ce2_35566ffe8fbad24b.jpg)

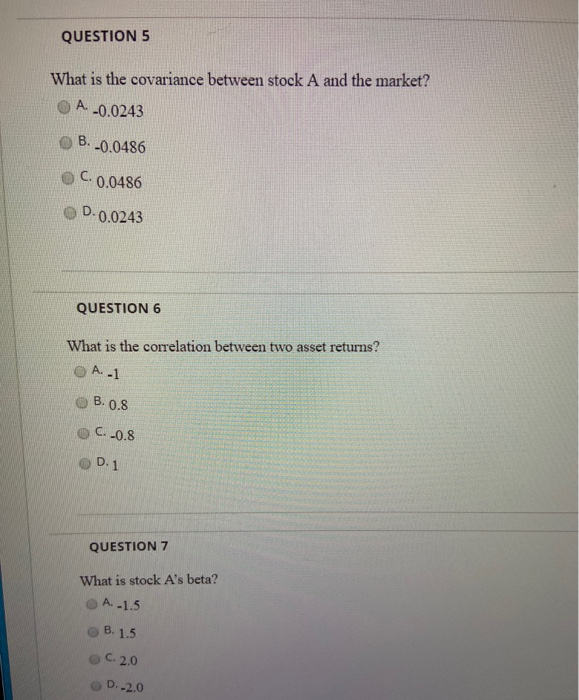

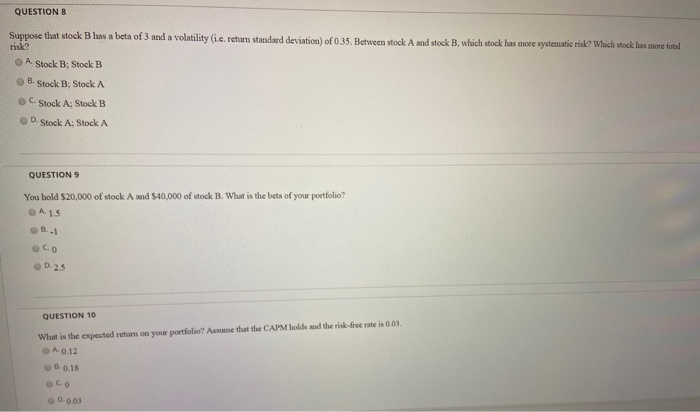

L (CURL T ela QUESTION 1 [Q1-10] The following table shows four economic scenarios for next year with their respective probabilities. Also included in the table are the retums on stock A and returns on the market under the four scenarios. Scenario Probability | RA | RMarket. Boom 0.45 0.3 Normal 0.50 0.15 10.1 Recession 0.20 -0.075 -0.05 Disaster 0.05 -0.75 -0.5 0.25 What is the expected retum on stock A? A. 0.270 B. 0.090 C. 0.135 D.0.180 3 points QUESTION 2 r to e alla Click Save and Submit to save and submit. Click Save All A Save and Submit QUESTION 2 What is the expected return on the market? A. 0.135 B. 0.270 C.0.090 D.0.180 QUESTION 3 3) What is the standard deviation of the retum on A? A.0.27 B. 0.11 C 0.13 D. 0.18 QUESTION 4 What is the standard deviation of the return on the market? A. 0.13 B. 0.27 C. 0.11 D.0.18 QUESTION 5 What is the covariance between stock A and the market? OA-0.0243 B. -0.0486 C. 0.0486 D.0.0243 QUESTION 6 What is the correlation between two asset returns? O A1 B. 0.8 C.-0.8 D.1 QUESTION 7 0 What is stock A's beta? A-1.5 B. 1.5 OC. 2.0 D.-2.0 0 0 QUESTION 8 Suppose that stock Bhas a beta of 3 and a volatility (i.c. return standard deviation) of 0.35. Between stock A and stock B, which stock has more systematic risk? Which stock has more total A Stock B: Stock B B. Stock B: Stock A Stock A: Stock B D. Stock A: Stock A QUESTION 9 You hold $20,000 of stock And $40,000 of stock B. What is the beta of your portfolio? A 15 oco D.25 QUESTION 10 What is the expected retum on your portfolio? Assume that the CAPM holde and the risk-free rate is 0.03. A 0.12 5015 CO 0.003

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts