Question: please help and show work thank you 1. 2. 3. 4. 5. Blaser Corporation had $1,097,000 in invested assets, sales of $1,241,000, operating income amounting

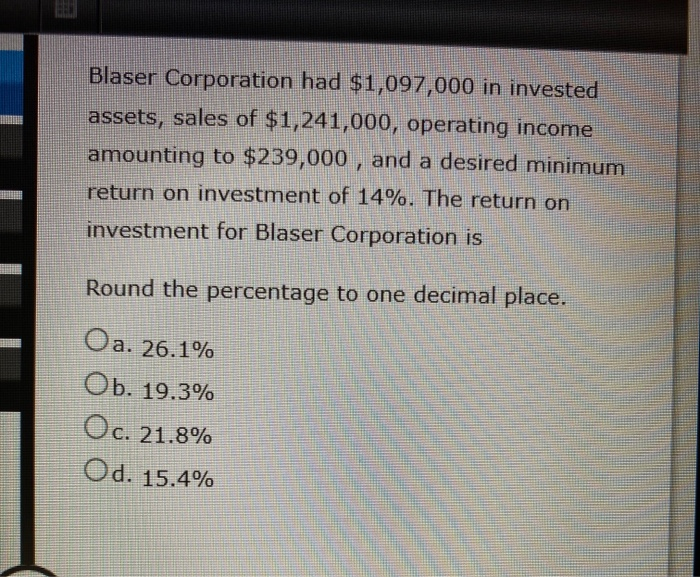

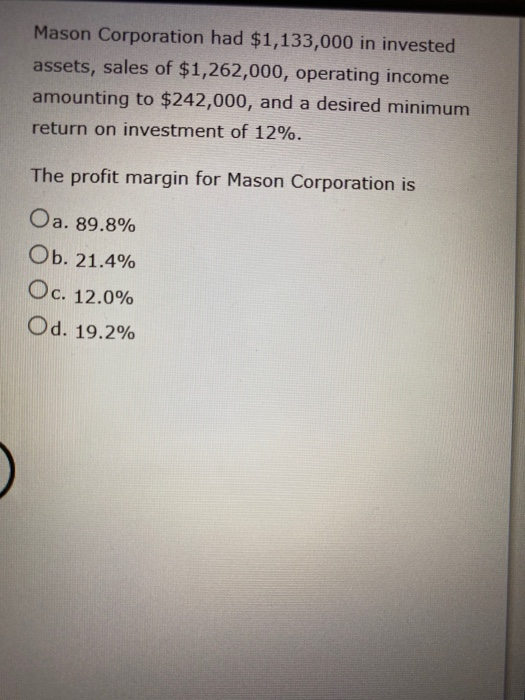

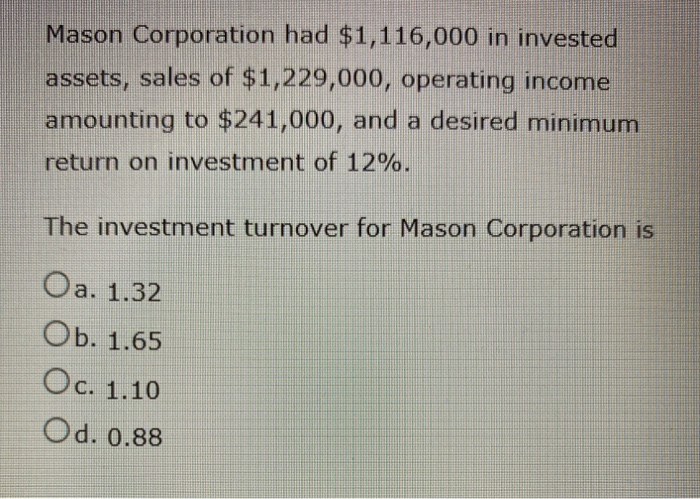

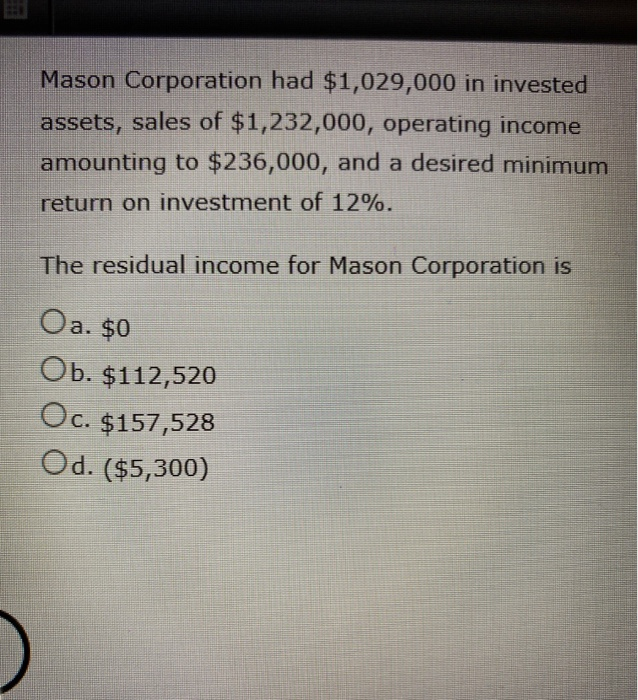

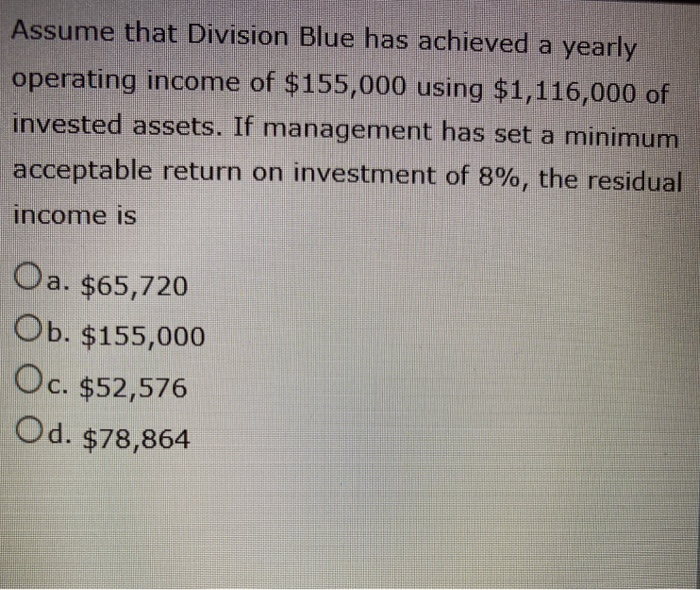

Blaser Corporation had $1,097,000 in invested assets, sales of $1,241,000, operating income amounting to $239,000, and a desired minimum return on investment of 14%. The return on investment for Blaser Corporation is Round the percentage to one decimal place. Oa. 26.1% Ob. 19.3% Oc. C. 21.8% Od. 15.4% Mason Corporation had $1,133,000 in invested assets, sales of $1,262,000, operating income amounting to $242,000, and a desired minimum return on investment of 12%. The profit margin for Mason Corporation is O a. 89.8% Ob. 21.4% Oc. 12.0% Od. 19.2% Mason Corporation had $1,116,000 in invested assets, sales of $1,229,000, operating income amounting to $241,000, and a desired minimum return on investment of 12%. The investment turnover for Mason Corporation is Oa. 1.32 Ob. 1.65 Oc. 1.10 Od. 0.88 Mason Corporation had $1,029,000 in invested assets, sales of $1,232,000, operating income amounting to $236,000, and a desired minimum return on investment of 12%. The residual income for Mason Corporation is Oa. $0 Ob. $112,520 Oc. $157,528 Od. ($5,300) Assume that Division Blue has achieved a yearly operating income of $155,000 using $1,116,000 of invested assets. If management has set a minimum acceptable return on investment of 8%, the residual income is Oa. a. $65,720 Ob. $155,000 Oc. $52,576 Od. $78,864

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts