Question: Please Help and show works 4. (9 points) Consider a European put option on British pounds with an exercise price of $1.6/. You pay a

Please Help and show works

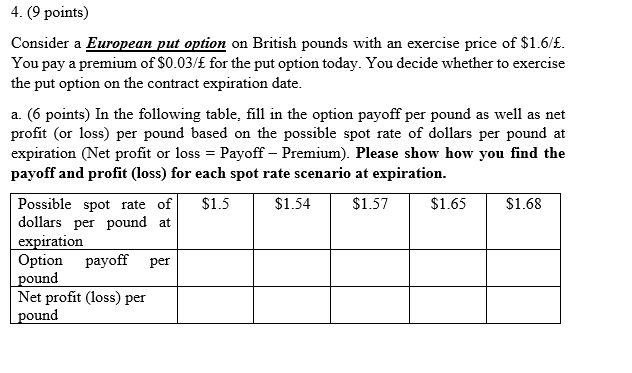

4. (9 points) Consider a European put option on British pounds with an exercise price of $1.6/. You pay a premium of $0.03/ for the put option today. You decide whether to exercise the put option on the contract expiration date. a. 6 points) In the following table, fill in the option payoff per pound as well as net profit (or loss) per pound based on the possible spot rate of dollars per pound at expiration (Net profit or loss = Payoff - Premium). Please show how you find the payoff and profit (loss) for each spot rate scenario at expiration. Possible spot rate of $1.5 $1.54 $1.57 $1.65 $1.68 dollars per pound at expiration Option payoff per pound Net profit (loss) per pound

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts