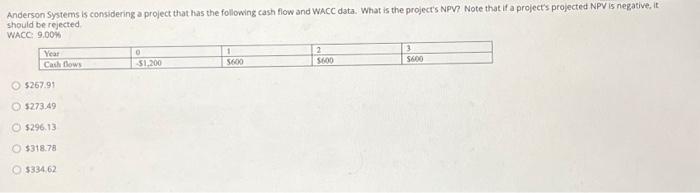

Question: please help Anderson Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if

Anderson Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's projected NPV is negative, it hould be rejected WACC ,9,00% $267.91$273.49$296.13$318.78$334.62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts