Question: please help. another expert gave me this answer and it was wrong. here is my work and the answer i got. i dont see how

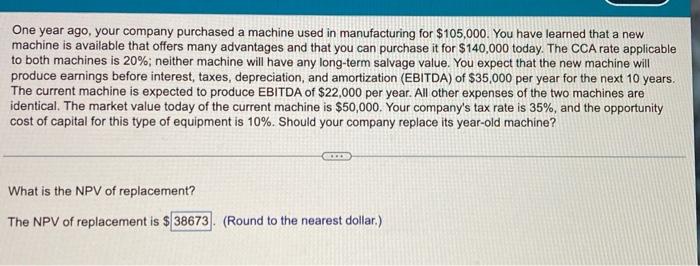

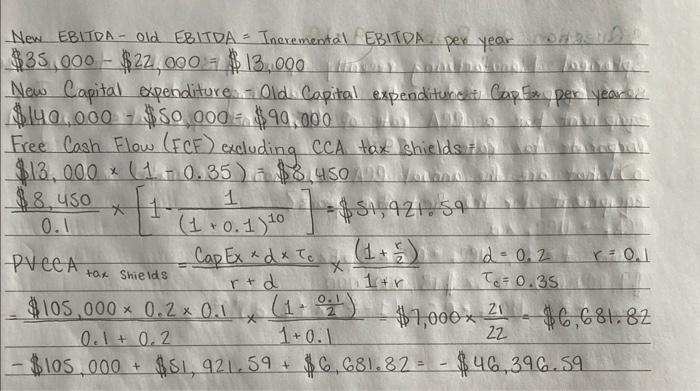

One year ago, your company purchased a machine used in manufacturing for $105,000. You have learned that a new machine is available that offers many advantages and that you can purchase it for $140,000 today. The CCA rate applicable to both machines is 20\%; neither machine will have any long-term salvage value. You expect that the new machine will produce earnings before interest, taxes, depreciation, and amortization (EBITDA) of $35,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $22,000 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 35%, and the opportunity cost of capital for this type of equipment is 10%. Should your company replace its year-old machine? What is the NPV of replacement? The NPV of replacement is $ (Round to the nearest dollar.) New EBITDA - old EBITDA = Tneremental EBITDA, per year $35,000$22,000=$13,000 New Capital expenditure, Old Capital expenditurest Cap 5 . per yeanc. $140,000$50,000=$99,000 Free Cash Flow (FCF) excluding CCA tax shields = $13,000(10.35)=$8,4500.1$8,450[1(1+0.1)101]=$51,921.59PVCCAAaxShields=r+dCapExdc1+r(1+2r)d=0.2c=0.35r=0.1=0.1+0.2$105,0000.20.11+0.1(1+20.1)=$7,0002221=$6,681.82$105,000+$51,921.59+$6,681.82=$46,396.59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts