Question: please help answer (10 pts) Had Jones taken full advantage of the trade discounts in 2006? How about in 2004 and 2005? Exhibit 1 Operating

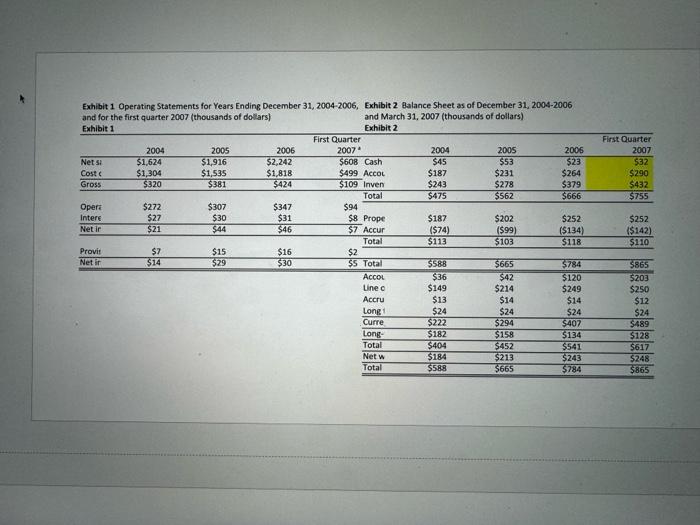

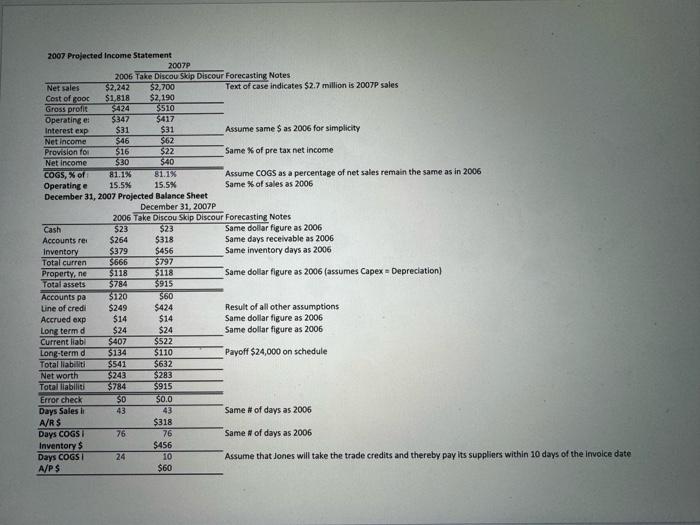

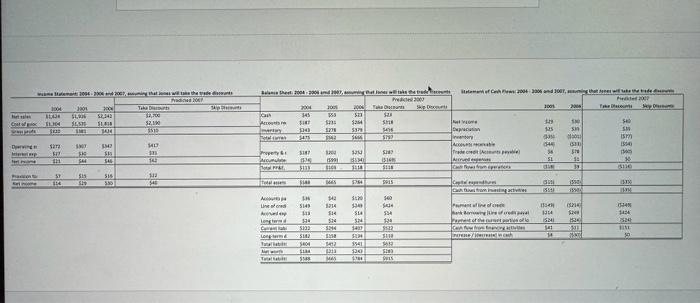

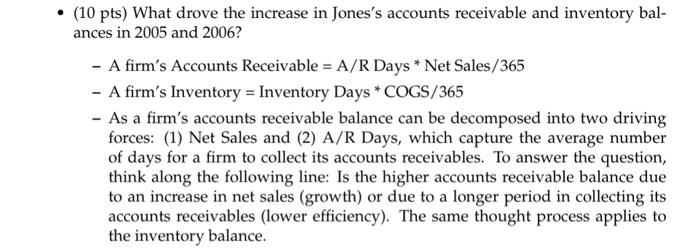

(10 pts) Had Jones taken full advantage of the trade discounts in 2006? How about in 2004 and 2005? Exhibit 1 Operating Statements for Years Ending December 31, 2004-2006, Exhibit 2 Balance Sheet as of December 31, 20042006 and for the first quarter 2007 (thousands of dollars) and March 31, 2007 (thousands of dollars) Eutikite: Evkihit? 2007 Projected Income Statement - (10 pts) What drove the increase in Jones's accounts receivable and inventory balances in 2005 and 2006? - A firm's Accounts Receivable = A/R Days * Net Sales /365 - A firm's Inventory = Inventory Days * COGS/365 - As a firm's accounts receivable balance can be decomposed into two driving forces: (1) Net Sales and (2) A/R Days, which capture the average number of days for a firm to collect its accounts receivables. To answer the question, think along the following line: Is the higher accounts receivable balance due to an increase in net sales (growth) or due to a longer period in collecting its accounts receivables (lower efficiency). The same thought process applies to the inventory balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts