Question: Please help answer a and b and explain Toby transfers to Jim a life insurance policy with a face value of $25,000 and a cash

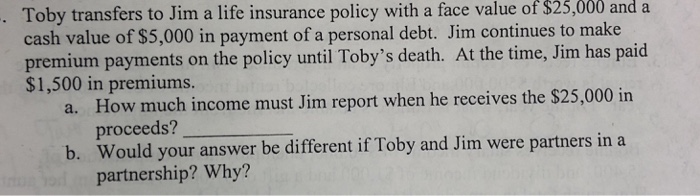

Toby transfers to Jim a life insurance policy with a face value of $25,000 and a cash value of $5,000 in payment of a personal debt. Jim continues to make m payments on the policy until Toby's death. At the time, Jim has paid $1,500 in premiums. How much income must Jim report when he receives the $25,000 in proceeds? a. be different if Toby and Jim were partners in a partnership? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts