Question: please help answer a-c and income statement, (Working with financial statements) Based on the balance sheet, for T. P. Jarmon Company for the year ended

please help answer a-c

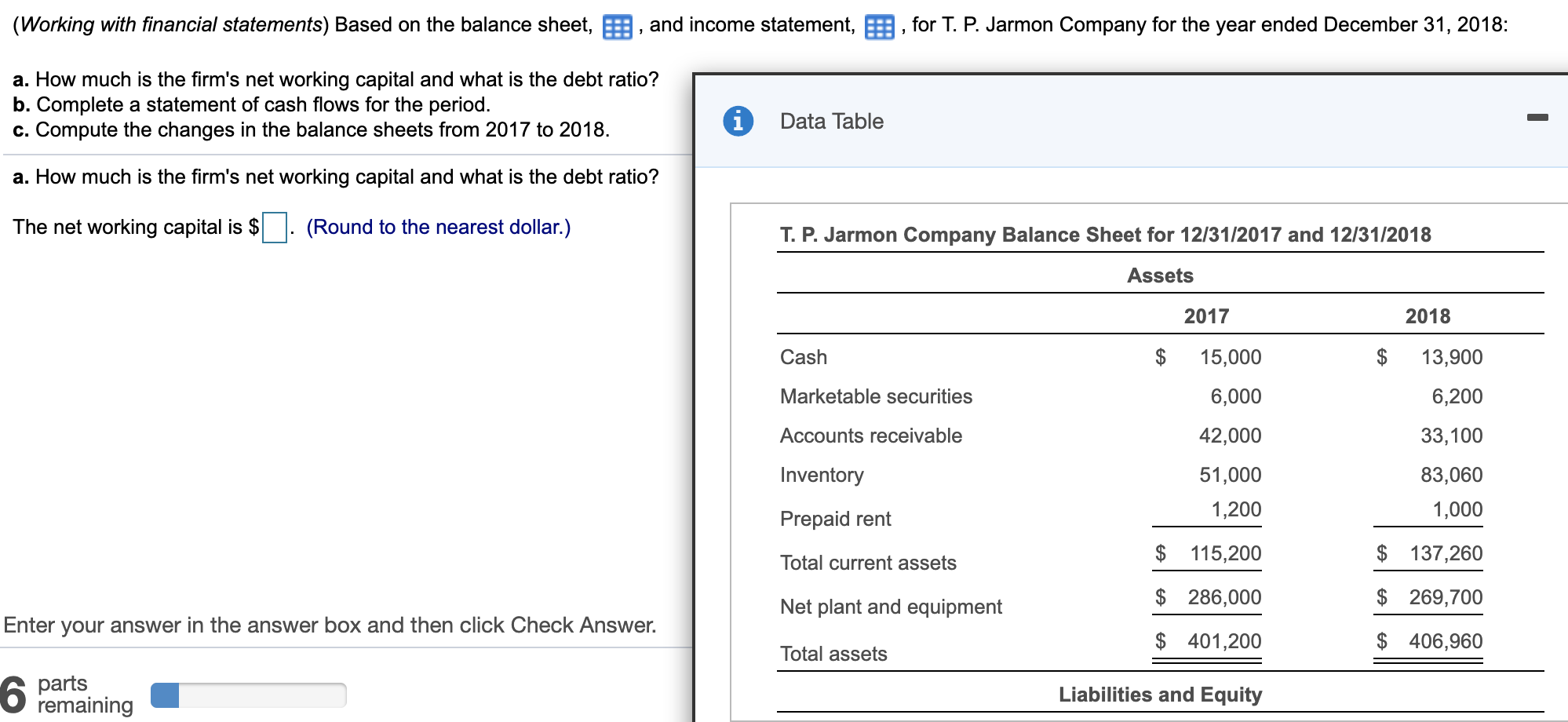

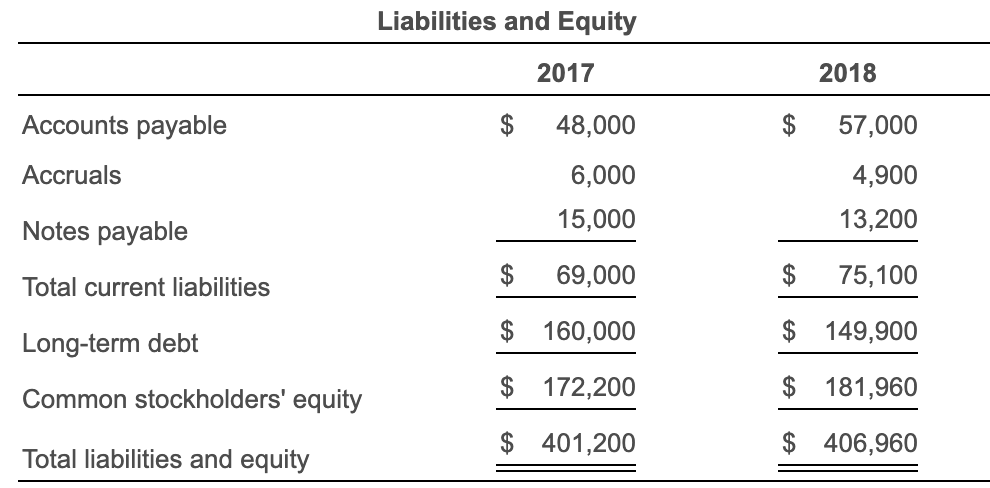

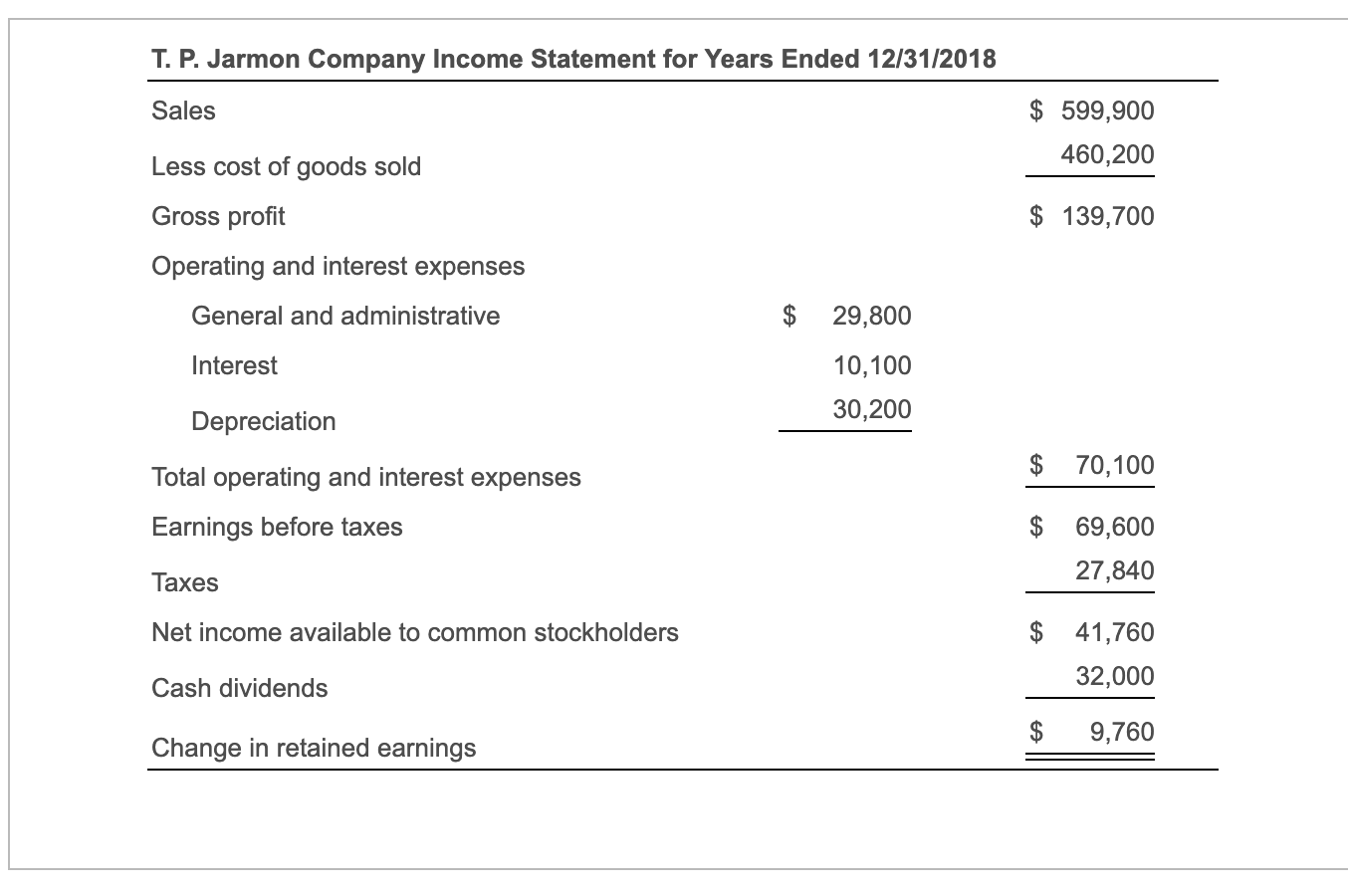

and income statement, (Working with financial statements) Based on the balance sheet, for T. P. Jarmon Company for the year ended December 31, 2018:1 a. How much is the firm's net working capital and what is the debt ratio? b. Complete a statement of cash flows for the period c. Compute the changes in the balance sheets from 2017 to 2018 i Data Table a. How much is the firm's net working capital and what is the debt ratio? The net working capital is $ (Round to the nearest dollar.) T. P. Jarmon Company Balance Sheet for 12/31/2017 and 12/31/2018 Assets 2018 2017 $ 15,000 Cash 13,900 Marketable securities 6,000 6,200 Accounts receivable 42,000 33,100 Inventory 51,000 83,060 1,200 1,000 Prepaid rent $ 115,200 137,260 Total current assets $ 286,000 $ 269,700 Net plant and equipment Enter your answer in the answer box and then click Check Answer. $ 406,960 $ 401,200 Total assets parts remaining Liabilities and Equity Liabilities and Equity 2017 2018 Accounts payable 57,000 48,000 Accruals 6,000 4,900 15,000 13,200 Notes payable $ 69,000 75,100 Total current liabilities $ 160,000 $ 149,900 Long-term debt $ 181,960 $ 172,200 Common stockholders' equity $ 406,960 401,200 Total liabilities and equity T. P. Jarmon Company Income Statement for Years Ended 12/31/2018 599,900 Sales 460,200 Less cost of goods sold 139,700 Gross profit Operating and interest expenses 29,800 General and administrative Interest 10,100 30,200 Depreciation 70,100 Total operating and interest expenses $ 69,600 Earnings before taxes 27,840 Taxes 41,760 Net income available to common stockholders 32,000 Cash dividends $ 9,760 Change in retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts