Question: Please help ANSWER ALL QUESTIONS (100) QUESTION 1 (25) Mia Carriers has determined that a new specialised delivery truck needs to be purchased. The truck

Please help

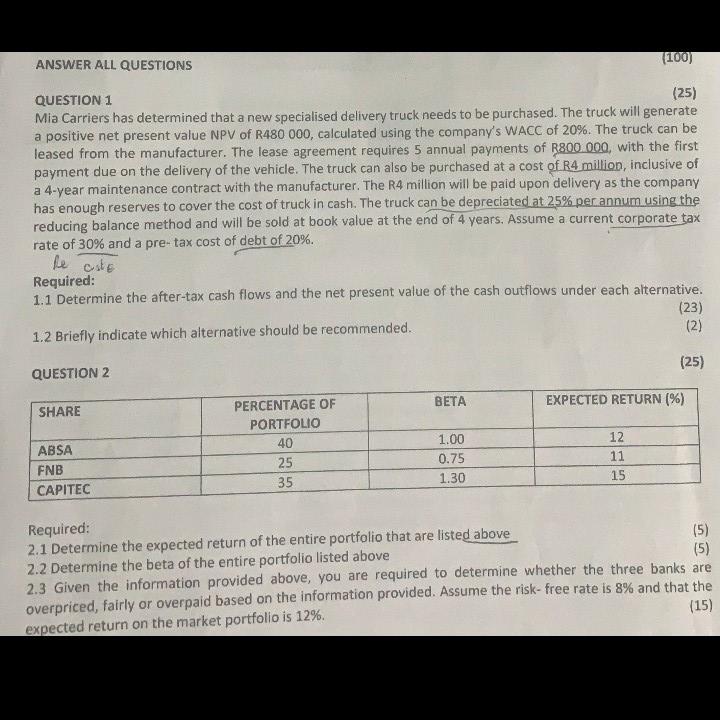

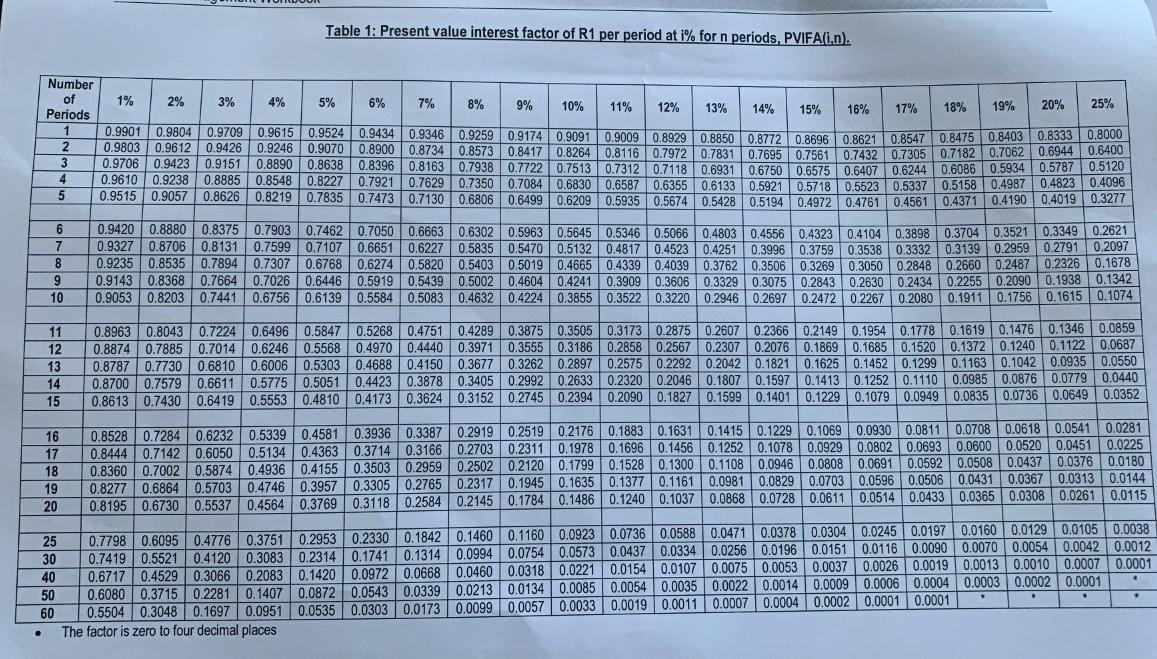

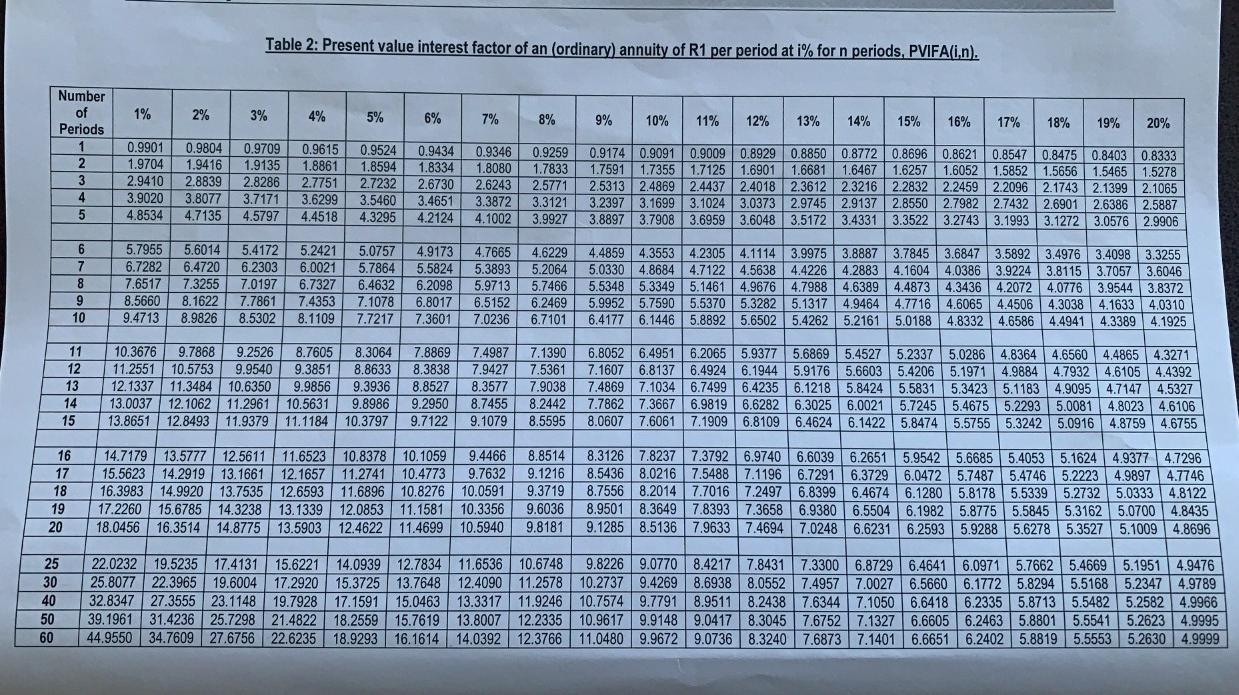

ANSWER ALL QUESTIONS (100) QUESTION 1 (25) Mia Carriers has determined that a new specialised delivery truck needs to be purchased. The truck will generate a positive net present value NPV of R480 000, calculated using the company's WACC of 20%. The truck can be leased from the manufacturer. The lease agreement requires 5 annual payments of R800.000, with the first payment due on the delivery of the vehicle. The truck can also be purchased at a cost of R4 million, inclusive of a 4-year maintenance contract with the manufacturer. The R4 million will be paid upon delivery as the company has enough reserves to cover the cost of truck in cash. The truck can be depreciated at 25% per annum using the reducing balance method and will be sold at book value at the end of 4 years. Assume a current corporate tax rate of 30% and a pre-tax cost of debt of 20%. he este Required: 1.1 Determine the after-tax cash flows and the net present value of the cash outflows under each alternative. (23) 1.2 Briefly indicate which alternative should be recommended. (2) (25) QUESTION 2 BETA EXPECTED RETURN (%) SHARE ABSA FNB CAPITEC PERCENTAGE OF PORTFOLIO 40 25 35 1.00 0.75 1.30 12 11 15 Required: 2.1 Determine the expected return of the entire portfolio that are listed above (5) 2.2 Determine the beta of the entire portfolio listed above (5) 2.3 Given the information provided above, you are required to determine whether the three banks are overpriced, fairly or overpaid based on the information provided. Assume the risk-free rate is 8% and that the expected return on the market portfolio is 12%. (15) Table 1: Present value interest factor of R1 per period at i% for n periods, PVIFA(in). Number of 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% Periods 13% 14% 15% 16% 17% 18% 19% 20% 25% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8696 0.86210.8547 0.8475 0.8403 0.8333 0.8000 2 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 0.7831 0.7695 0.7561 0.7432 0.7305 0.9706 0.9423 0.9151 0.8890 0.7182 0.7062 0.6944 0.6400 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.6750 0.6575 0.6407 0.6244 0.6086 0.5934 0.5787 0.5120 4 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.5921 0.57180.5523 0.5337 0.5158 0.4987 0.4823 0.4096 5 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 0.5428 0.5194 0.4972 0.4761 0.4561 0.4371 0.4190 0.4019 0.3277 6 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 0.5066 0.4803 0.4556 0.4323 0.4104 0.3898 0.3704 0.3521 0.3349 0.2621 7 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 0.4523 0.4251 0.3996 0.3759 0.3538 0.3332 0.3139 0.2959 0.2791 0.2097 8 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.3762 0.3506 0.3269 0.3050 0.2848 0.2660 0.2487 0.2326 0.1678 9 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 0.3606 0.3329 0.3075 0.2843 0.2630 0.2434 0.2255 0.2090 0.1938 0.1342 10 0.9053 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 0.2946 0.2697 0.2472 0.2267 0.2080 0.1911 0.1756 0.1615 0.1074 11 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.3173 0.2875 0.2607 0.2366 0.2149 0.1954 0.1778 0.1619 0.1476 0.1346 0.0859 12 0.8874 0.7885 0.7014 0.6246 0.5568 0.4970 0.4440 0.3971 0.3555 0.3186 0.2858 0.2567 0.2307 0.2076 0.1869 0.1685 0.1520 0.1372 0.1240 0.1122 0.0687 13 0.8787 0.7730 0.6810 0.6006 0.5303 0.4688 0.4150 0.3677 0.3262 0.2897 0.2575 0.2292 0.2042 0.1821 0.1625 0.1452 0.1299 0.1163 0.1042 0.0935 0.0550 14 0.8700 0.7579 0.6611 0.5775 0.50510.4423 0.3878 0.3405 0.29920.2633 0.2320 0.2046 0.1807 0.1597 0.1413 0.1252 0.1110 0.0985 0.0876 0.0779 0.0440 15 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 0.2090 0.1827 0.1599 0.1401 0.1229 0.1079 0.0949 0.0835 0.0736 0.0649 0.0352 16 17 18 19 20 0.8528 0.7284 0.6232 0.5339 0.4581 0.39360.3387 0.2919 0.2519 0.2176 0.1883 0.1631 0.1415 0.1229 0.1069 0.0930 0.0811 0.0708 0.0618 0.0541 0.0281 0.8444 0.7142 0.6050 0.5134 0.4363 0.3714 0.3166 0.2703 0.2311 0.1978 0.1696 0.1456 0.1252 0.1078 0.0929 0.0802 0.0693 0.0600 0.05200.0451 0.0225 0.8360 0.7002 0.5874 0.4936 0.4155 0.3503 0.2959 0.2502 0.21200.1799 0.1528 0.1300 0.1108 0.0946 0.0808 0.0691 0.0592 0.0508 0.0437 0.0376 0.0180 0.8277 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 0.23170.1945 0.1635 0.1377 0.1161 0.0981 0.0829 0.0703 0.0596 0.0506 0.0431 0.0367 0.0313 0.0144 0.8195 0.6730 0.5537 0.4564 0.3769 0.3118 0.2584 0.2145 0.1784 0.1486 0.1240 0.1037 0.0868 0.0728 0.0611 0.0514 0.0433 0.0365 0.0308 0.0261 0.0115 25 0.7798 0.6095 0.4776 0.3751 0.2953 0.2330 0.1842 0.1460 0.1160 0.0923 0.0736 0.0588 0.0471 0.0378 0.0304 0.0245 0.0197 0.0160 0.0129 0.0105 0.0038 30 0.7419 0.5521 0.4120 0.3083 0.2314 0.1741 0.1314 0.0994 0.0754 0.0573 0.0437 0.0334 0.0256 0.0196 0.0151 0.0116 0.0090 0.0070 0.0054 0.0042 0.0012 40 0.6717 0.4529 0.3066 0.2083 0.1420 0.0972 0.0668 0.0460 0.0318 0.0221 0.0154 0.0107 0.0075 0.0053 0.0037 0.0026 0.0019 0.0013 0.0010 0.0007 0.0001 50 0.6080 0.3715 0.2281 0.1407 0.0872 0.0543 0.0339 0.0213 0.0134 0.0085 0.0054 0.0035 0.0022 0.0014 0.0009 0.0006 0.0004 0.0003 0.0002 0.0001 60 0.5504 0.3048 0.1697 0.0951 0.0535 0.0303 0.0173 0.0099 0.0057 0.0033 0.0019 0.0011 0.0007 0.0004 0.0002 0.0001 0.0001 The factor is zero to four decimal places . Table 2: Present value interest factor of an (ordinary) annuity of R1 per period at i% for n periods, PVIFA(i,n). 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% Number of Periods 1 2 3 4 5 0.9901 1.9704 2.9410 3.9020 4.8534 0.9804 1.9416 2.8839 3.8077 4.7135 0.9709 1.9135 2.8286 3.7171 4.5797 0.9615 1.8861 2.7751 3.6299 4.4518 0.9524 1.8594 2.7232 3.5460 4.3295 0.9434 1.8334 2.6730 3.4651 4.2124 0.9346 1.8080 2.6243 3.3872 4.1002 0.9259 1.7833 2.5771 3.3121 3.9927 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8696 0.8621 0.8547 0.8475 0.8403 0.8333 1.7591 1.7355 1.7125 1.6901 1.6681 1.6467 1.6257 1.6052 1.5852 1.5656 1.5465 1.5278 2.5313 2.4869 2.44372.4018 2.36122.3216 2.2832 2.2459 2.2096 2.1743 2.1399 2.1065 3.2397 3.1699 3.1024 3.0373 2.9745 2.9137 2.8550 2.7982 2.7432 2.6901 2.6386 2.5887 3.8897 3.7908 3.6959 3.6048 3.5172 3.4331 3.3522 3.27433.1993 3.1272 3.0576 2.9906 6 7 8 9 10 5.7955 6.7282 7.6517 8.5660 9.4713 5.6014 6.4720 7.3255 8.1622 8.9826 5.4172 6.2303 7.0197 7.7861 8.5302 5.2421 6.0021 6.7327 7.4353 8.1109 5.0757 5.7864 6.4632 7.1078 7.7217 4.9173 5.5824 6.2098 6.8017 7.3601 4.7665 5.3893 5.9713 6.5152 7.0236 4.6229 5.2064 5.7466 6.2469 6.7101 4.4859 4.3553 4.2305 4.1114 3.9975 3.8887 3.7845 3.6847 3.5892 3.4976 3.4098 3.3255 5.03304.86844.71224.5638 4.42264.2883 4.1604 4.0386 3.92243.81153.7057 3.6046 5.5348 5.3349 5.1461 4.9676 4.7988 4.6389 4.4873 4.3436 4.2072 4.0776 3.9544 5.9952 5.7590 5.5370 5.3282 3.8372 5.13174.9464 4.6065 4.4506 4.3038 4.1633 4.0310 6.1446 5.8892 5.6502 5.4262 5.21615.0188 4.8332 4.6586 4.4941 4.3389 4.1925 4.7716 6.4177 7.4987 9.9540 7.9427 11 12 13 14 15 10.3676 9.7868 9.2526 8.7605 11.2551 10.5753 9.3851 12.1337 11.3484 10.6350 9.9856 13.0037 12.1062 11.2961 10.5631 13.8651 12.8493 11.9379 11.1184 8.3064 8.8633 9.3936 9.8986 10.3797 7.8869 8.3838 8.8527 9.2950 9.7122 8.3577 8.7455 9.1079 7.1390 7.5361 7.9038 8.2442 8.5595 6.8052 6.4951 6.2065 5.9377 5.6869 5.4527 5.2337 5.0286 4.8364 4.6560 4.4865 4.3271 7.1607 6.81376.4924 6.1944 5.9176 5.6603 5.4206 5.1971 4.9884 4.7932 4.6105 4.4392 7.48697.10346.7499 6.42356.1218 5.8424 5.5831 5.3423 5.1183 4.9095 4.7147 4.5327 7.78627.36676.9819 6.6282 6.3025 6.0021 5.7245 5.4675 5.2293 5.0081 4.8023 4.6106 8.0607 7.6061 7.1909 6.8109 6.46246.1422 5.8474 5.5755 5.32425.0916 4.8759 4.6755 16 17 18 19 20 14.7179 13.5777 12.5611 11.6523 10.8378 10.1059 9.4466 15.5623 14.291913.1661 12.1657 11.2741 10.4773 9.7632 16.3983 14.9920 13.7535 12.6593 11.6896 10.8276 10.0591 17.2260 15.6785 14.3238 13.1339 12.0853 11.1581 10.3356 18.0456 16.3514 14.8775 13.5903 12.4622 11.4699 10.5940 8.8514 9.1216 9.3719 9.6036 9.8181 8.3126 7.8237 7.3792 6.9740 6.6039 6.2651 5.9542 5.6685 5.4053 5.1624 4.9377 4.7296 8.5436 8.0216 7.5488 7.11966.7291 6.37296.0472 5.74875.4746 5.2223 4.9897 4.7746 8.7556 8.2014 7.7016 7.24976.8399 6.4674 6.1280 5.81785.5339 5.27325.0333 4.8122 8.9501 8.36497.83937.3658 6.9380 6.5504 6.1982 5.8775 5.5845 5.3162 5.0700 4.8435 9.1285 8.5136 7.96337.4694 7.0248 6.6231 6.25935.92885.6278 5.3527 5.10094.8696 25 30 40 50 60 22.0232 19.5235 17.4131 15.6221 14.093912.7834 11.6536 10.6748 9.8226 9.07708.4217 7.8431 7.3300 6.8729 6.4641 6.0971 5.7662 5.4669 5.1951 4.9476 25.8077 22.3965 19.6004 17.2920 15.3725 13.7648 12.4090 11.2578 10.2737 9.4269 8.6938 8.0552 7.4957 7.0027 6.5660 6.1772 5.8294 5.5168 5.2347 4.9789 32.8347 27.3555 23.1148 19.7928 17.1591 15.0463 13.3317 11.9246 10.7574 9.7791 8.9511 8.2438 7.6344 7.1050 6.6418 6.2335 5.8713 5.5482 5.2582 4.9966 39.1961 31.4236 25.7298 21.4822 18.2559 15.7619 13.8007 12.2335 10.9617 9.9148 9.0417 8.3045 7.6752 7.1327 6.6605 6.2463 5.8801 5.5541 5.2623 4.9995 44.9550 34.7609 27.6756 22.6235 18.9293 16.1614 14.0392 12.3766 11.0480 9.96729.0736 8.3240 7.6873 7.1401 6.6651 6.2402 5.8819 5.5553 5.2630 4.9999

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts