Question: Please help answer all questions, thank you! 1. 2. 3. ROE will increase or decrease? 4. Assume the following relationships for the Caulder Corp.: Sales/Total

Please help answer all questions, thank you!

1.

2.

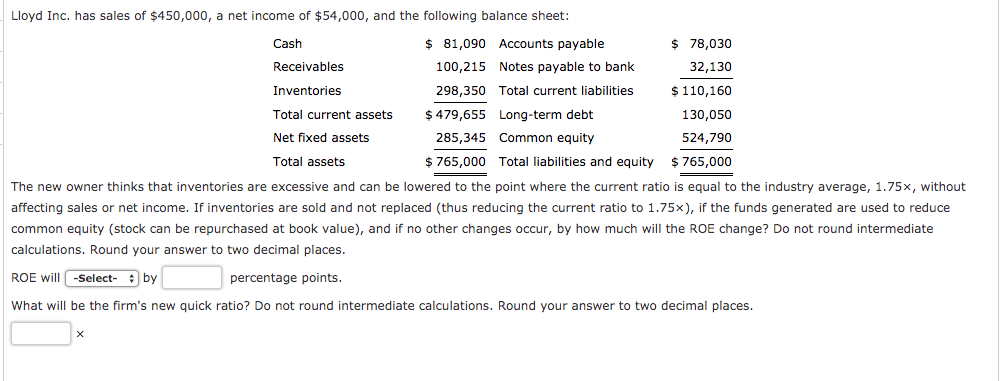

3. ROE will increase or decrease?

4.

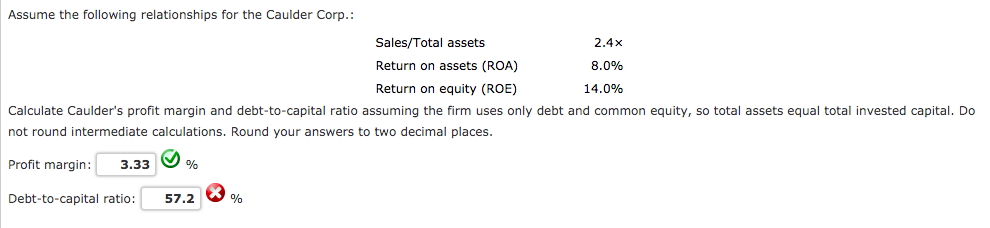

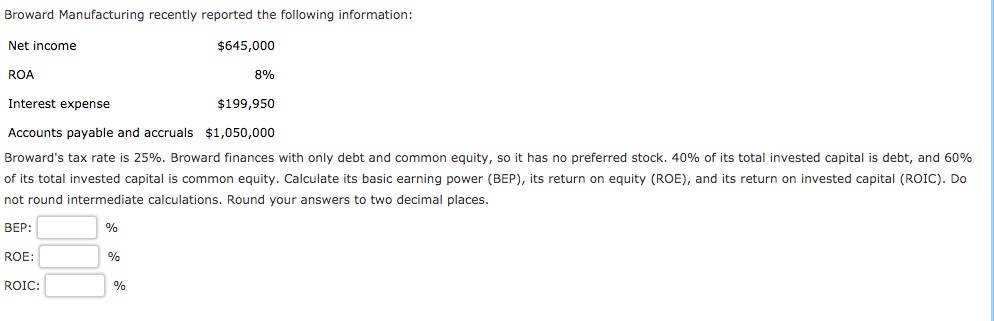

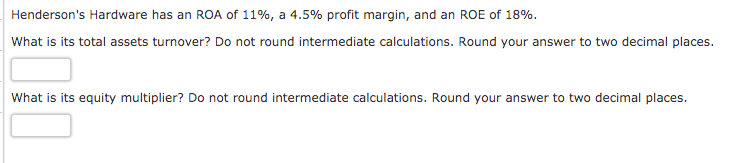

Assume the following relationships for the Caulder Corp.: Sales/Total assets 2.4x Return on assets (ROA) 8.0% Return on equity (ROE) 14.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: 3.33 Debt-to-capital ratio: 57.2 Broward Manufacturing recently reported the following information: Net income $645,000 ROA 8% Interest expense $199,950 Accounts payable and accruals $1,050,000 Broward's tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC). Do not round intermediate calculations. Round your answers to two decimal places. BEP: % ROE: ROIC: Lloyd Inc. has sales of $450,000, a net income of $54,000, and the following balance sheet: $ 78,030 $ 81,090 Accounts payable Cash Receivables 100,215 Notes payable to bank 32,130 $ 110,160 Inventories 298,350 Total current liabilities $ 479,655 Long-term debt Total current assets 130,050 Net fixed assets 285,345 Common equity 524,790 $ 765,000 Total liabilities and equity $ 765,000 Total assets The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 1.75x, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 1.75x), if the funds generated are used to reduce common equity (stock can be repurchased at book value), and if no other changes occur, by how much will the ROE change? Do not round intermediate calculations. Round your answer to two decimal places. ROE will -Select- : by percentage points. What will be the firm's new quick ratio? Do not round intermediate calculations. Round your answer to two decimal places. Henderson's Hardware has an ROA of 11%, a 4.5% profit margin, and an ROE of 18%. What is its total assets turnover? Do not round intermediate calculations. Round your answer to two decimal places. What is its equity multiplier? Do not round intermediate calculations. Round your answer to two decimal places. Assume the following relationships for the Caulder Corp.: Sales/Total assets 2.4x Return on assets (ROA) 8.0% Return on equity (ROE) 14.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: 3.33 Debt-to-capital ratio: 57.2 Broward Manufacturing recently reported the following information: Net income $645,000 ROA 8% Interest expense $199,950 Accounts payable and accruals $1,050,000 Broward's tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC). Do not round intermediate calculations. Round your answers to two decimal places. BEP: % ROE: ROIC: Lloyd Inc. has sales of $450,000, a net income of $54,000, and the following balance sheet: $ 78,030 $ 81,090 Accounts payable Cash Receivables 100,215 Notes payable to bank 32,130 $ 110,160 Inventories 298,350 Total current liabilities $ 479,655 Long-term debt Total current assets 130,050 Net fixed assets 285,345 Common equity 524,790 $ 765,000 Total liabilities and equity $ 765,000 Total assets The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 1.75x, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 1.75x), if the funds generated are used to reduce common equity (stock can be repurchased at book value), and if no other changes occur, by how much will the ROE change? Do not round intermediate calculations. Round your answer to two decimal places. ROE will -Select- : by percentage points. What will be the firm's new quick ratio? Do not round intermediate calculations. Round your answer to two decimal places. Henderson's Hardware has an ROA of 11%, a 4.5% profit margin, and an ROE of 18%. What is its total assets turnover? Do not round intermediate calculations. Round your answer to two decimal places. What is its equity multiplier? Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Sure lets go through the calculations for each question step by step Question 1 Caulder Corp Profit Margin and DebttoCapital Ratio 1 Profit Margin Cal... View full answer

Get step-by-step solutions from verified subject matter experts