Question: Please help answer and also explain, thanks! (ignore the answers in the picture) Which of the following is (are) subtracted from Earnings Before Interest &

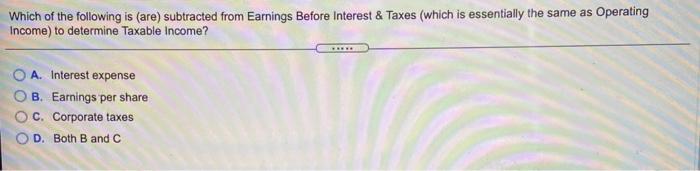

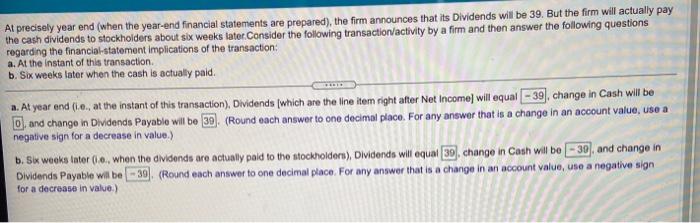

Which of the following is (are) subtracted from Earnings Before Interest & Taxes (which is essentially the same as Operating Income) to determine Taxable income? A. Interest expense B. Earnings per share C. Corporate taxes OD. Both B and C At precisely year end (when the year-end financial statements are prepared), the firm announces that its Dividends will be 39. But the firm will actually pay the cash dividends to stockholders about six weeks later. Consider the following transaction/activity by a firm and then answer the following questions regarding the financial-statement implications of the transaction: a. At the instant of this transaction b. Six weeks later when the cash is actually paid. a. At year end (.o., at the instant of this transaction), Dividends (which are the line item right after Net Income) will equal 39), change in Cash will be and change in Dividends Payable will be 30). (Round each answer to ono decimal place. For any answer that is a change in an account value, use a negative sign for a decrease in value.) b. Six weeks inter (0, when the dividends are actually paid to the stockholders), Dividends will equat 30) change in Cash will be 30 and change in Dividends Payable wil be-30). (Round each answer to one decimal place. For any answer that is a change in an account value, use a negative sign for a decrease in value)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts