Question: Please help answer and explain 3-5 Section 5 On October 1, your calendar year company signs a $20,000 contract to have its offices painted and

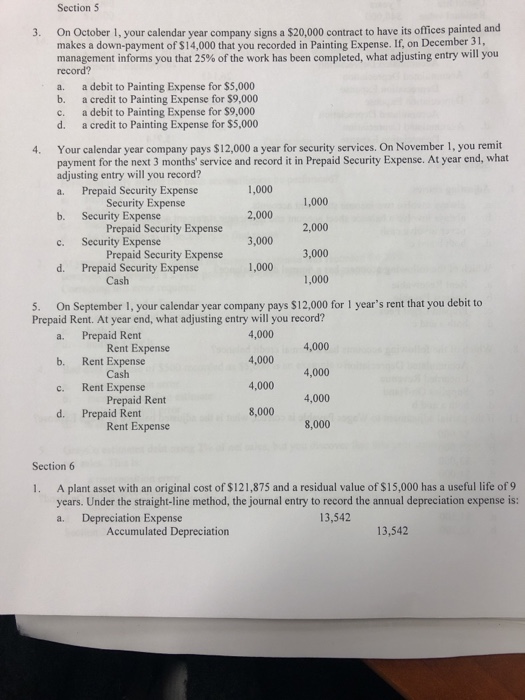

Section 5 On October 1, your calendar year company signs a $20,000 contract to have its offices painted and makes a down-payment of s14,000 that you recorded in Painting Expense. If, on December 31, record? management informs you that 25% of the work has been completed,what adjusting entry will you a. a debit to Painting Expense for $5,000 b. a credit to Painting Expense for $9,000 c. a debit to Painting Expense for $9,000 d. a credit to Painting Expense for $5,000 3. 4. Your calendar year company pays $12,000 a year for security services. On November 1, you remit payment for the next 3 months' service and record it in Prepaid Security Expense. At year end, what adjusting entry will you record? a. Prepaid Security Expense b. Security Expense c. Security d. Prepaid Security Expense Security Expense Prepaid Security Expense Prepaid Security Expense Cash 1,000 2,000 3,000 2,000 ty Expenscurity Expense 1,000 1,000 3,00 1,000 Prepaid Rent. At year end, what adjusting entry will you record? 4,000 On September 1, your calendar year company pays $12,000 for 1 year's rent that you debit to a. Prepaid Rent b. Rent Expense c. Rent Expense d. Prepaid Rent 5. 4,000 Rent Expense Cash Prepaid Rent Rent Expense 4,000 4,000 4,000 8,000 4000 8,000 Section 6 A plant asset with an original cost of $121,875 and a residual value of $15,000 has a useful life of 9 years. Under the straight-line method, the journal entry to record the annual depreciation expense is: a. Depreciation Expense 1. 13,542 Accumulated Depreciation 13,542

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts