Question: Please help answer as soon as possible. Question a ) A six - month call option on 100 shares of ABC company is selling for

Please help answer as soon as possible.

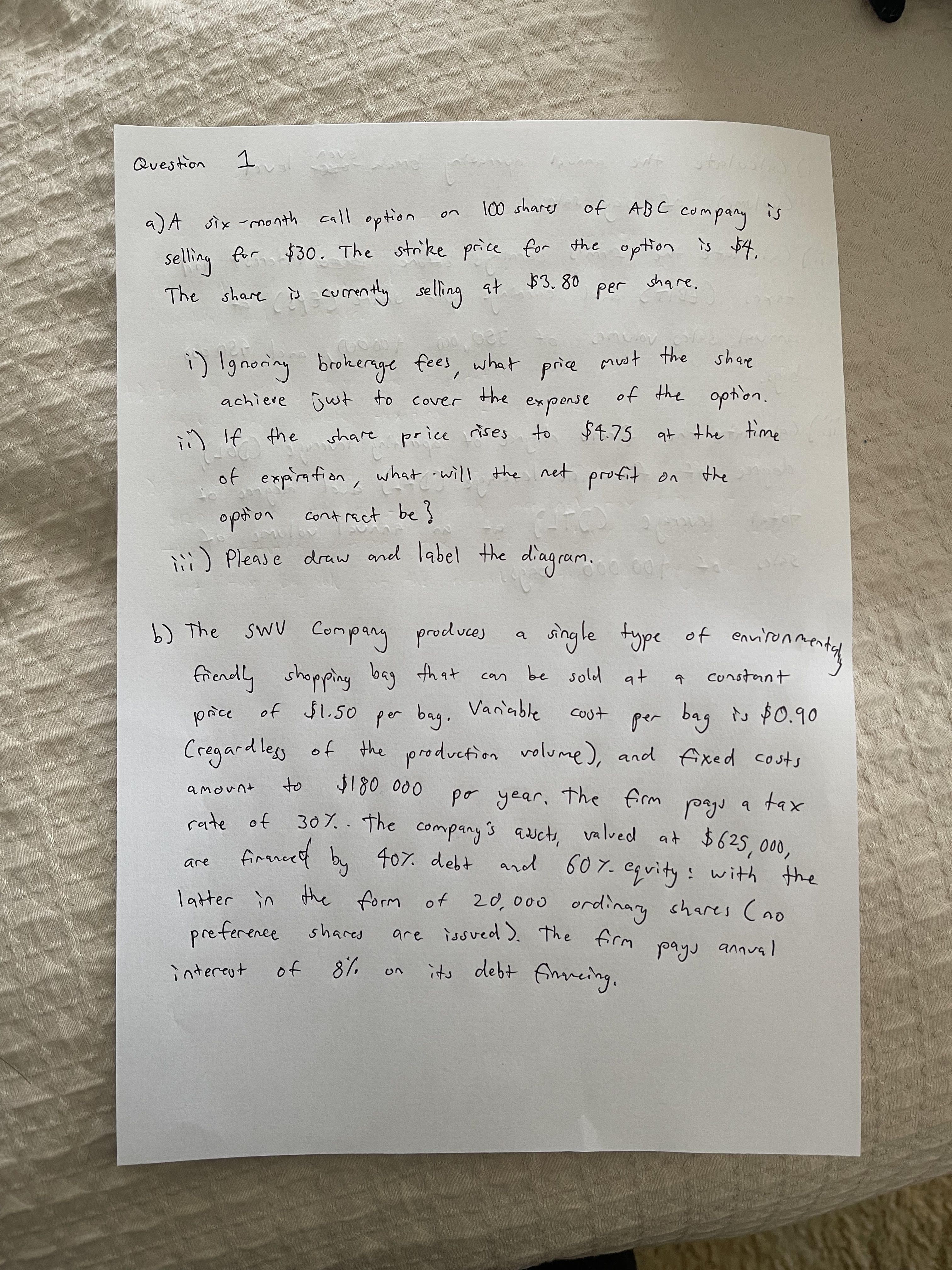

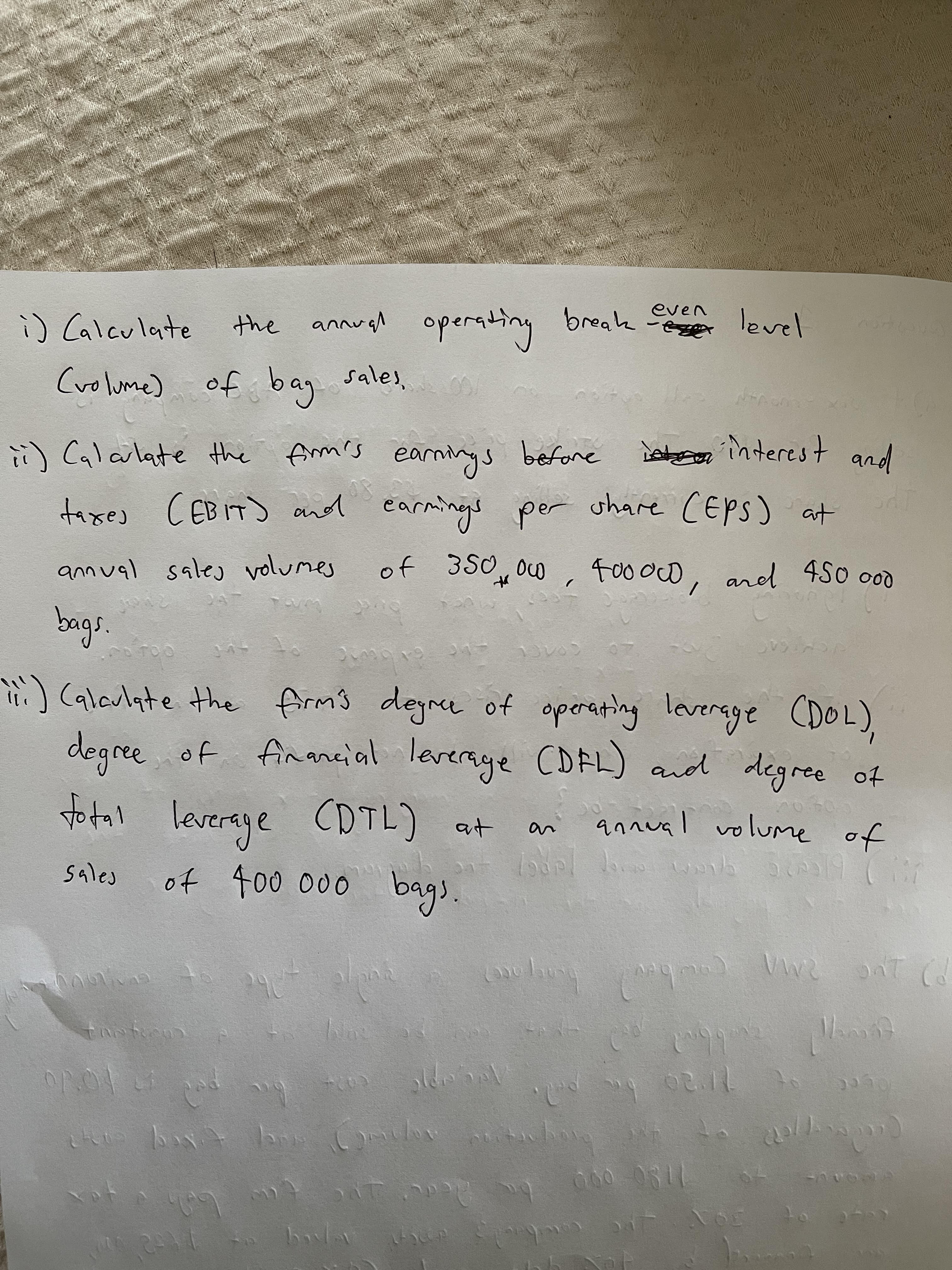

Question a ) A six - month call option on 100 shares of ABC company is selling for $30 . The strike price for the option is $4. The share is currently selling at $53.80 per share. i ) Ignoring brokerage fees , what price must the share achieve just to cover the expense of the option. ill If the share price rises to $4.75 at the time of expiration, what will the net profit on the option contract be ? ii ) Please draw and label the diagram. b) The SWV Company produces a single type of environmental Friendly shopping bag that can be sold at a constant price of $1.50 per bag. Variable cost per bag is $0. 90 (regardless of the production volume), and fixed costs amount to $180 000 po year. the firm pays a tax rate of 30%.. The company's assets, valued at $625, 000, are financed by 40%. debt and 607. equity: with the latter in the form of 20,000 ordinary shares ( no preference shares are issued). The firm pays annual interest of 8% on its debt financing.i) Calculate the annual operating break -level (volume ) of bag sales . ii ) Calculate the firm's earnings before interest and taxes (EBIT) and earnings per share (EPS ) at annual sales volumes of 350,0w, Food, and 450 000 bags li. ) Calculate the firm's degree of operating leverage (DOL), degree of financial leverage (DRL ) and degree of votal leverage (DTL) at an annual volume of sales of 400 000 bags

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts