Question: Please help answer B and C Securities A, B, and C have the following cash flows: (Ignore taxes) a. Calculate their durations if the interest

Please help answer B and C

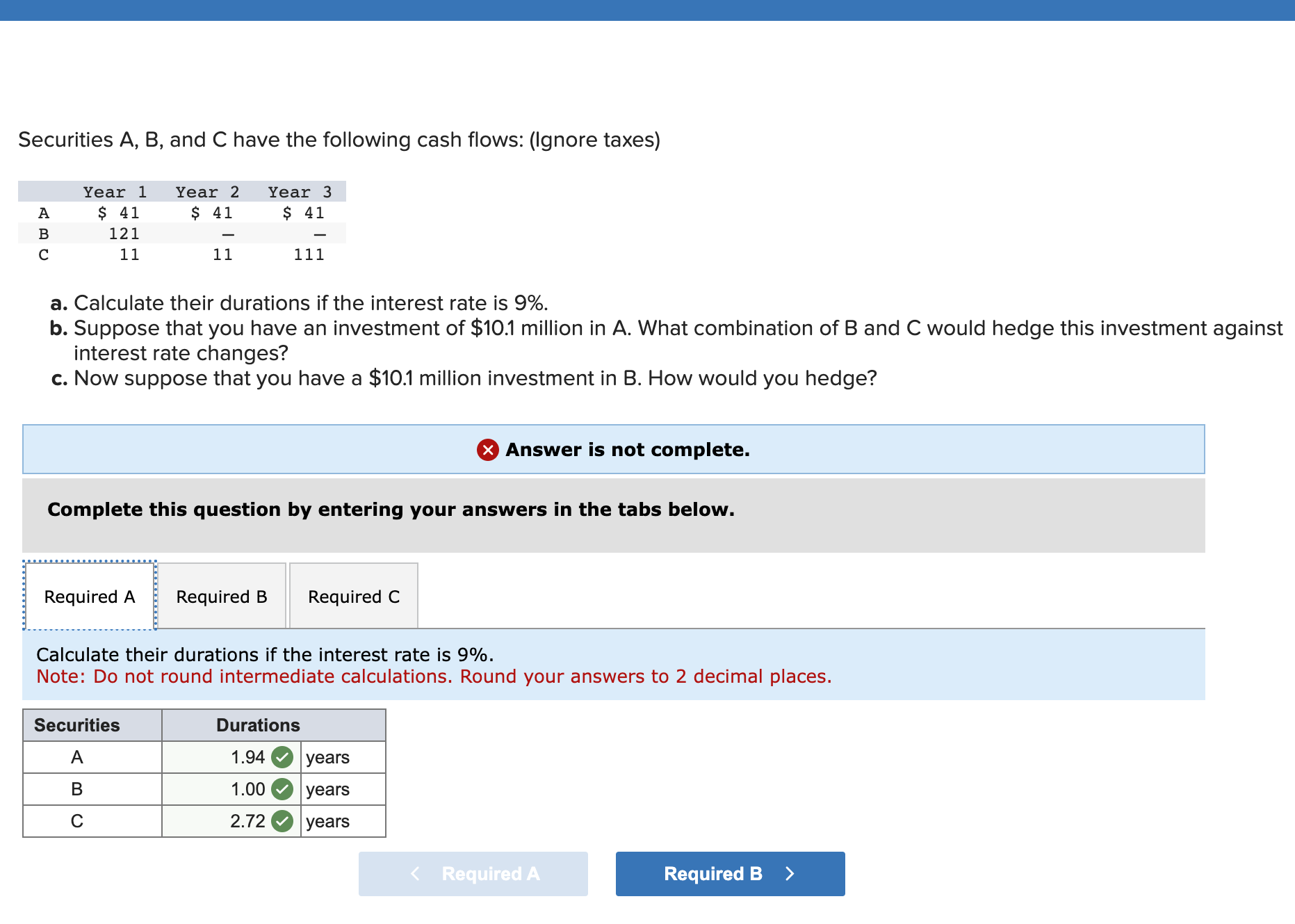

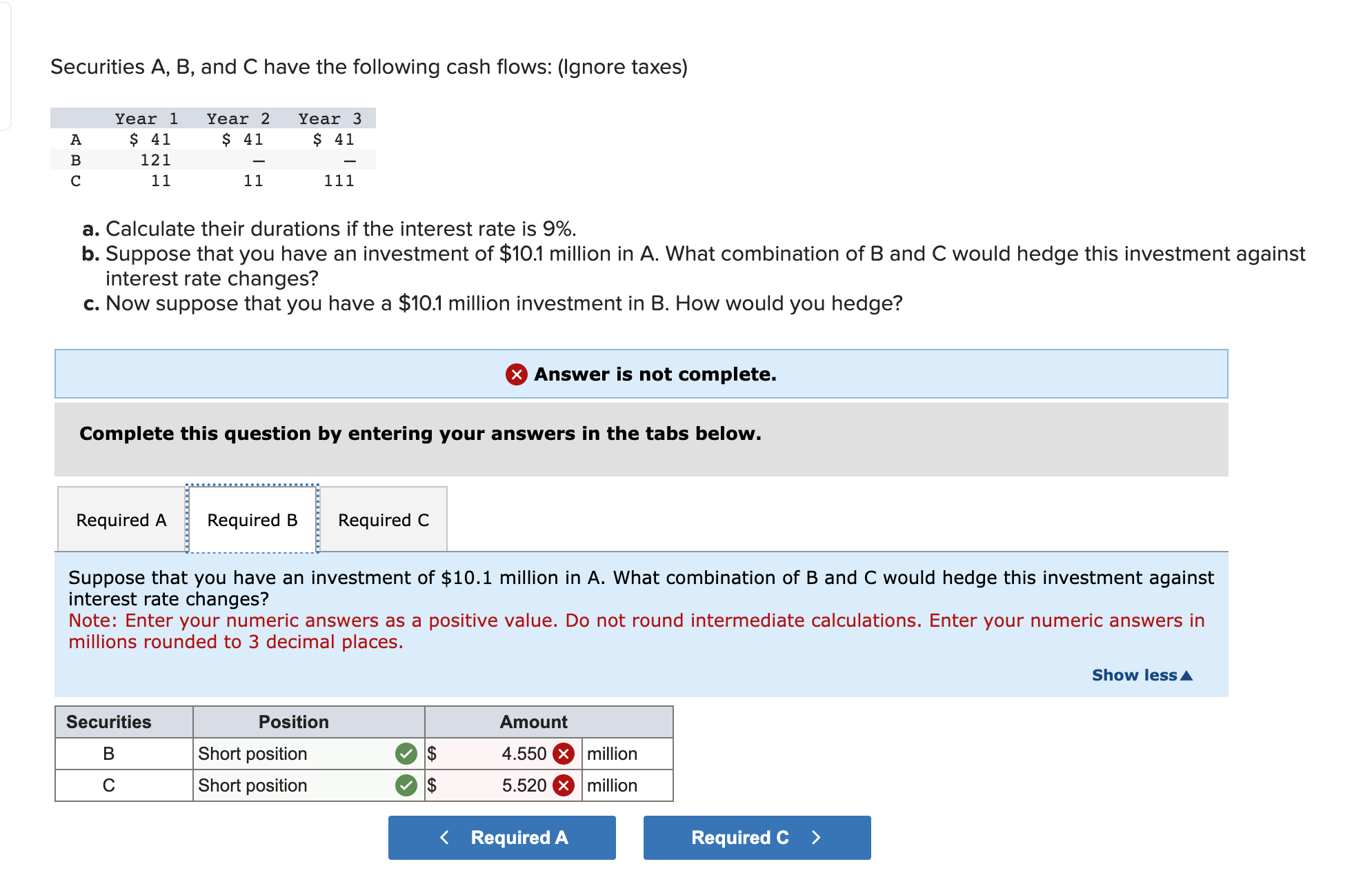

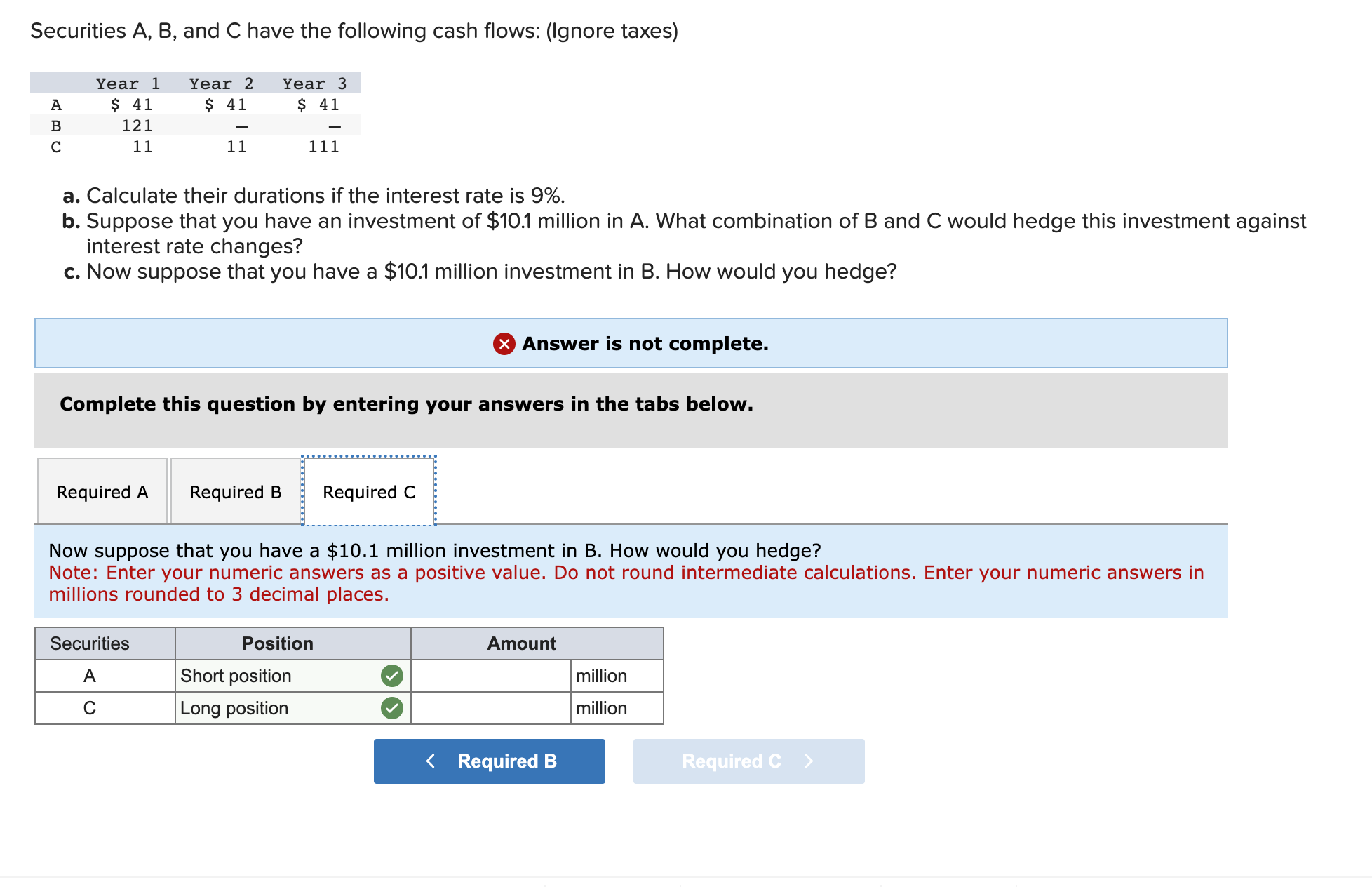

Securities A, B, and C have the following cash flows: (Ignore taxes) a. Calculate their durations if the interest rate is 9%. b. Suppose that you have an investment of $10.1 million in A. What combination of B and C would hedge this investment agains interest rate changes? c. Now suppose that you have a $10.1 million investment in B. How would you hedge? Answer is not complete. Complete this question by entering your answers in the tabs below. Calculate their durations if the interest rate is 9%. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Securities A, B, and C have the following cash flows: (Ignore taxes) a. Calculate their duration if the interest rate is 9%. b. Suppose that you have an investment of $10.1 million in A. What combination of B and C would hedge this investment as interest rate changes? c. Now suppose that you have a \$10.1 million investment in B. How would you hedge? Answer is not complete. Complete this question by entering your answers in the tabs below. Suppose that you have an investment of $10.1 million in A. What combination of B and C would hedge this investment against interest rate changes? Note: Enter your numeric answers as a positive value. Do not round intermediate calculations. Enter your numeric answers in millions rounded to 3 decimal places. Securities A, B, and C have the following cash flows: (Ignore taxes) a. Calculate their durations if the interest rate is 9%. b. Suppose that you have an investment of $10.1 million in A. What combination of B and C would hedge this investment agair interest rate changes? c. Now suppose that you have a $10.1 million investment in B. How would you hedge? Answer is not complete. Complete this question by entering your answers in the tabs below. Now suppose that you have a $10.1 million investment in B. How would you hedge? Note: Enter your numeric answers as a positive value. Do not round intermediate calculations. Enter your numeric answers in millions rounded to 3 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts