Question: Please help answer boxes with red X Alternative Inventory Methods Garrett Company has the following transactions during the months of April and May: The cost

Please help answer boxes with red X

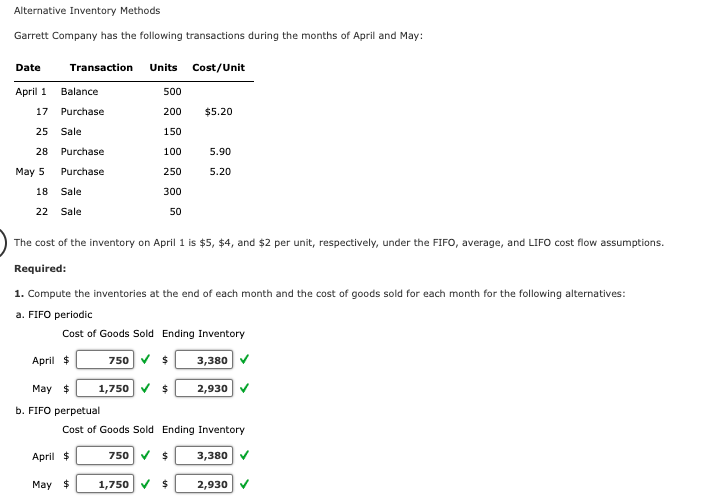

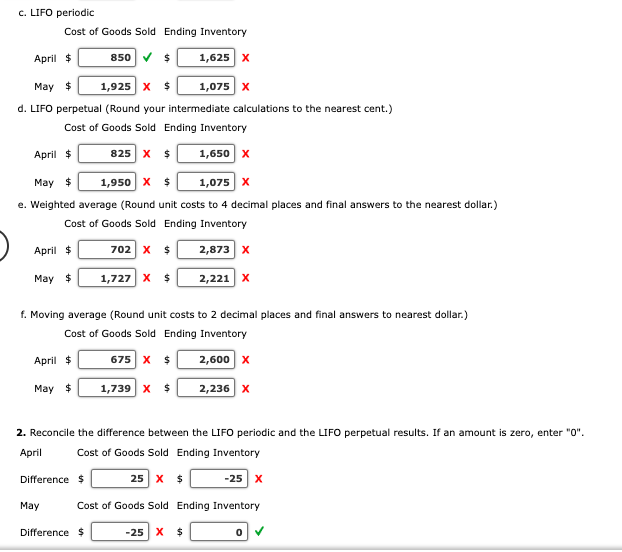

Alternative Inventory Methods Garrett Company has the following transactions during the months of April and May: The cost of the inventory on April 1 is $5,$4, and $2 per unit, respectively, under the FIFO, average, and LIFO cost flow assumptions. Required: 1. Compute the inventories at the end of each month and the cost of goods sold for each month for the following alternatives: a. FIFO periodic d. LIFO perpetual (Round your intermediate calculations to the nearest cent.) Cost of Goods Sold Ending Inventory April$May$X$$X e. Weighted average (Round unit costs to 4 decimal places and final answers to the nearest dollar.) Cost of Goods Sold Ending Inventory April$May$$$X f. Moving average (Round unit costs to 2 decimal places and final answers to nearest dollar.) Cost of Goods Sold Ending Inventory April$May$$$ 2. Reconcile the difference between the LIFO periodic and the LIFO perpetual results. If an amount is zero, enter "0". April Cost of Goods Sold Ending Inventory Difference $ $ May Cost of Goods Sold Ending Inventory Difference \$ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts