Question: Please help answer bullet point 3. trying to find price securities including securitization and the pricing of derivatives. Term Paper: Allais' Paradox In 1953, a

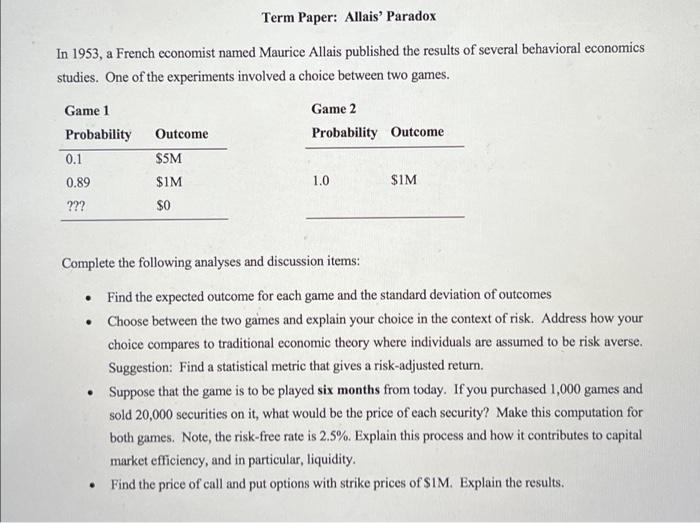

Term Paper: Allais' Paradox In 1953, a French economist named Maurice Allais published the results of several behavioral economics studies. One of the experiments involved a choice between two games. Game 1 Game 2 Probability Outcome Probability Outcome 0.1 $5M 0.89 $1M 1.0 $IM ??? SO Complete the following analyses and discussion items: Find the expected outcome for each game and the standard deviation of outcomes Choose between the two games and explain your choice in the context of risk. Address how your choice compares to traditional economic theory where individuals are assumed to be risk averse. Suggestion: Find a statistical metric that gives a risk-adjusted return. Suppose that the game is to be played six months from today. If you purchased 1,000 games and sold 20,000 securities on it, what would be the price of each security? Make this computation for both games. Note, the risk-free rate is 2.5%. Explain this process and how it contributes to capital market efficiency, and in particular, liquidity. Find the price of call and put options with strike prices of SIM. Explain the results. Term Paper: Allais' Paradox In 1953, a French economist named Maurice Allais published the results of several behavioral economics studies. One of the experiments involved a choice between two games. Game 1 Game 2 Probability Outcome Probability Outcome 0.1 $5M 0.89 $1M 1.0 $IM ??? SO Complete the following analyses and discussion items: Find the expected outcome for each game and the standard deviation of outcomes Choose between the two games and explain your choice in the context of risk. Address how your choice compares to traditional economic theory where individuals are assumed to be risk averse. Suggestion: Find a statistical metric that gives a risk-adjusted return. Suppose that the game is to be played six months from today. If you purchased 1,000 games and sold 20,000 securities on it, what would be the price of each security? Make this computation for both games. Note, the risk-free rate is 2.5%. Explain this process and how it contributes to capital market efficiency, and in particular, liquidity. Find the price of call and put options with strike prices of SIM. Explain the results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts