Question: PLEASE HELP ANSWER, I WILL GIVE THUMBS UP, THANKS. 1. Followings are parts of a yield curve today. There is a bond which pays $10

PLEASE HELP ANSWER, I WILL GIVE THUMBS UP, THANKS.

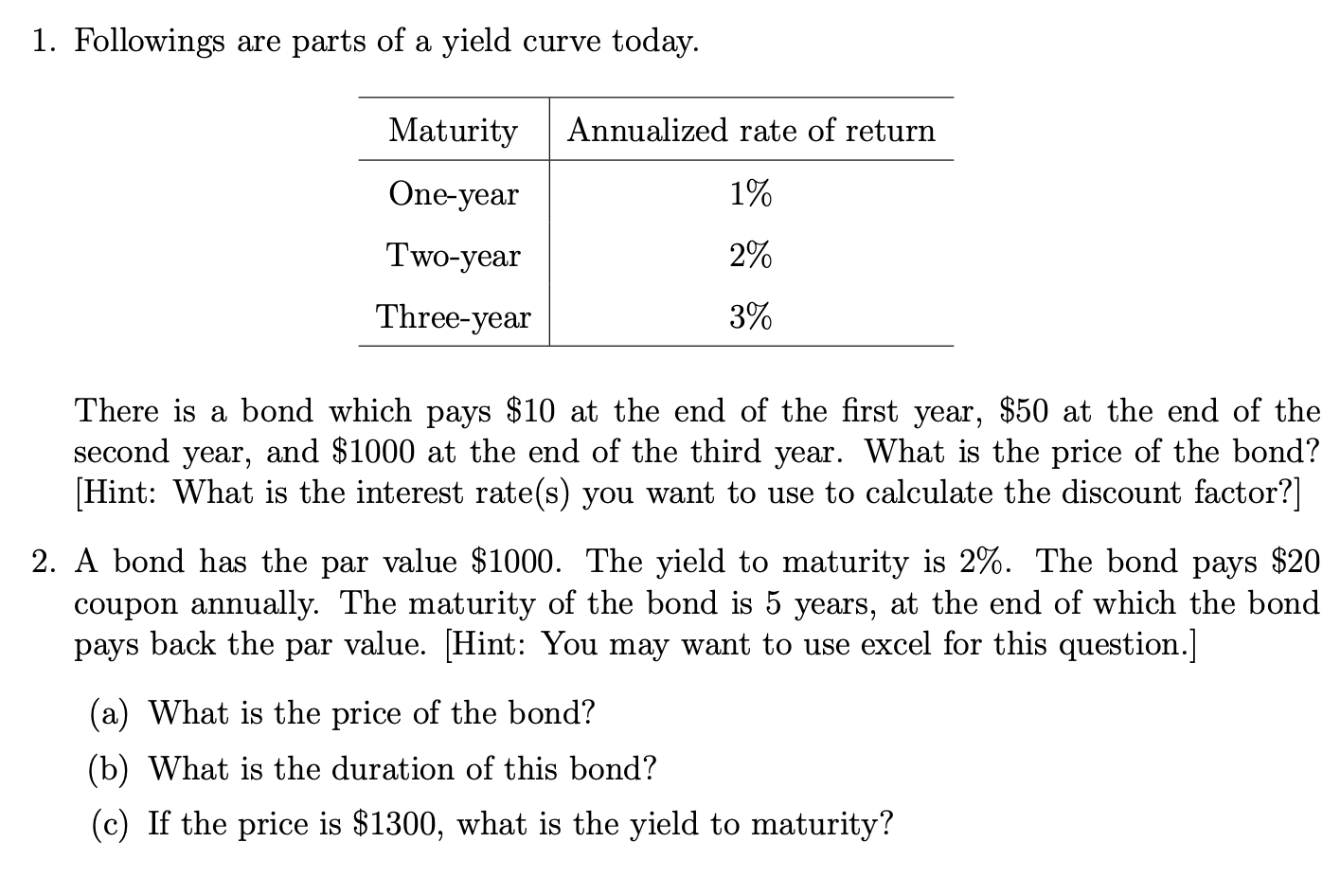

1. Followings are parts of a yield curve today. There is a bond which pays $10 at the end of the first year, $50 at the end of the second year, and $1000 at the end of the third year. What is the price of the bond? [Hint: What is the interest rate(s) you want to use to calculate the discount factor?] 2. A bond has the par value $1000. The yield to maturity is 2%. The bond pays $20 coupon annually. The maturity of the bond is 5 years, at the end of which the bond pays back the par value. [Hint: You may want to use excel for this question.] (a) What is the price of the bond? (b) What is the duration of this bond? (c) If the price is $1300, what is the yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts