Question: Please help Answer! Lazer Technologies Inc. (LTI) has produced a total of 20 high-power laser systems that could be used to destroy any approaching enemy

Please help Answer!

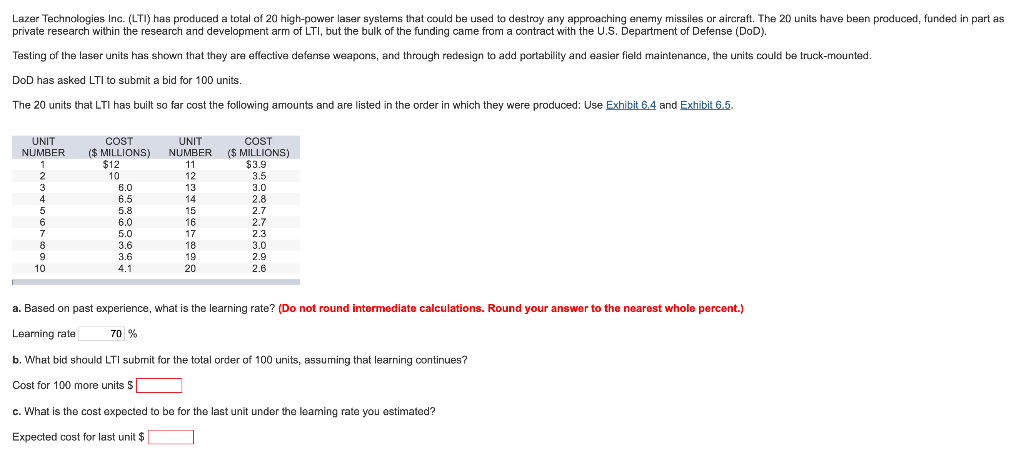

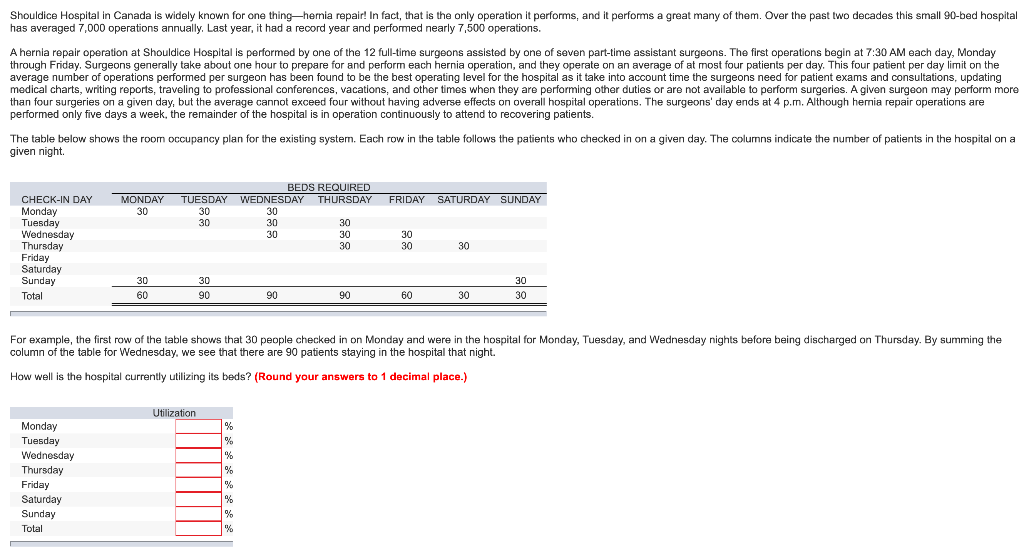

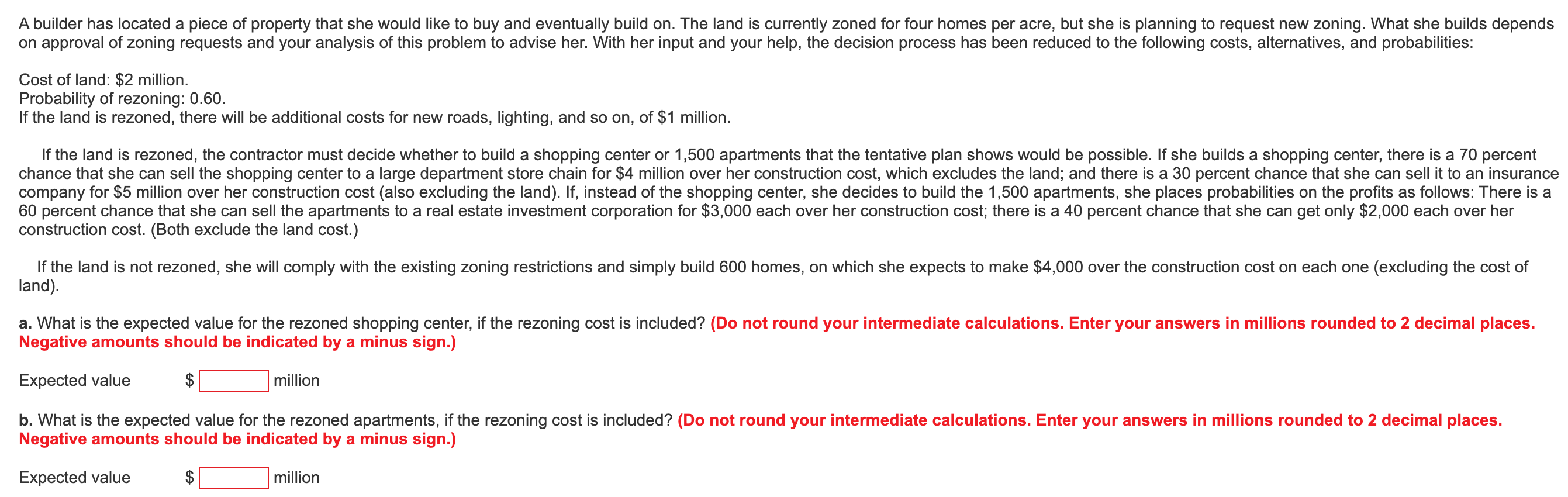

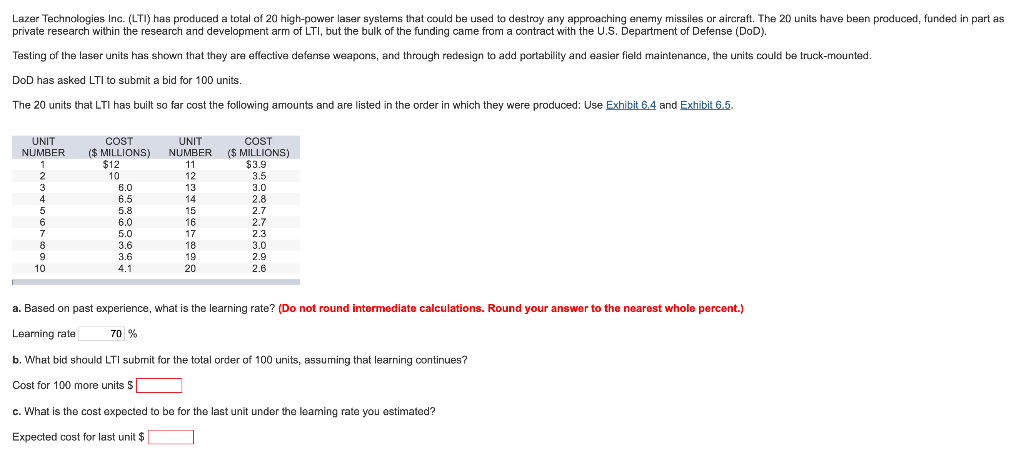

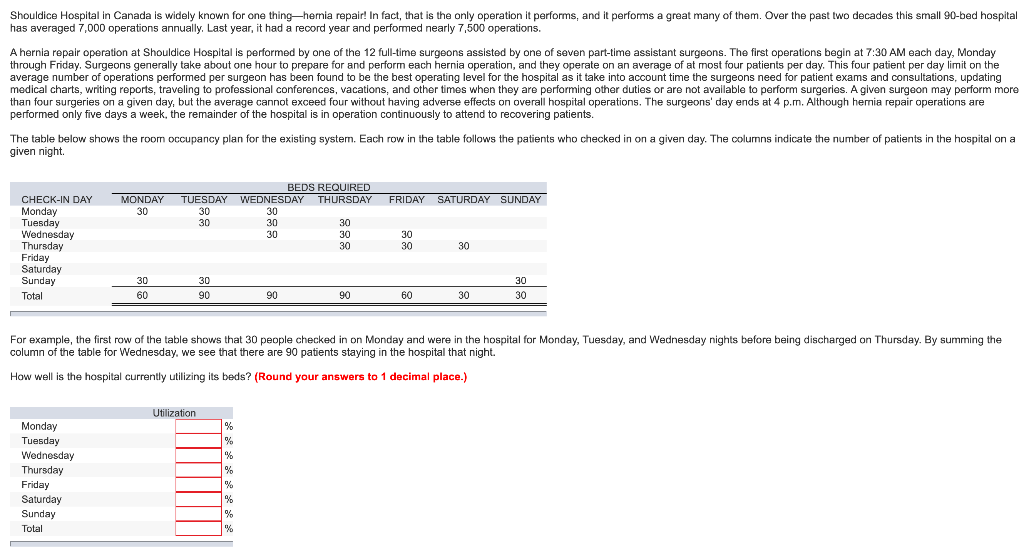

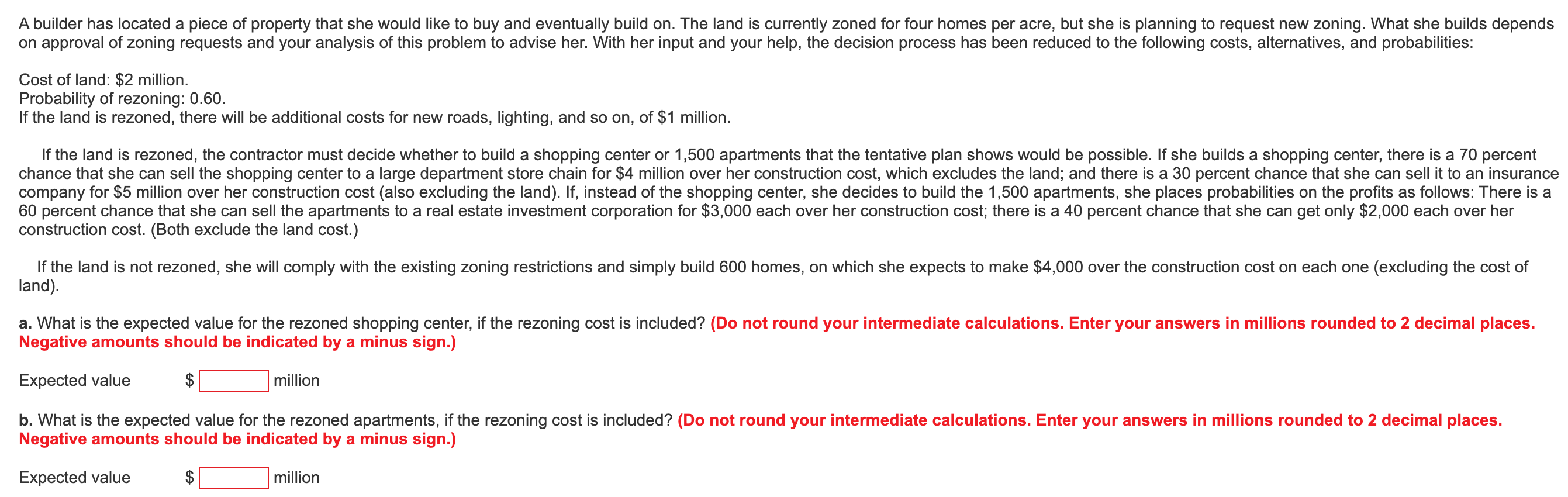

Lazer Technologies Inc. (LTI) has produced a total of 20 high-power laser systems that could be used to destroy any approaching enemy missiles or aircraft. The 20 units have been produced, funded in part as private research within the research and development arm of LTI, but the bulk of the funding came from a contract with the U.S. Department of Defense (DoD). Testing of the laser units has shown that they are effective defense weapons, and through redesign to add portability and easier field maintenance, the units could be truck-mounted. DoD has asked LTI to submit a bid for 100 units. The 20 units that LTI has built so far cost the following amounts and are listed in the order in which they were produced: Use Exhibit 6.4 and Exhibit 6.5. UNIT NUMBER 1 2 3 4 5 6 7 8 9 10 COST ($ MILLIONS) $12 10 6.0 6.5 5.8 6.0 5.0 3.6 3.6 4.1 UNIT NUMBER 11 12 13 14 15 16 17 18 19 20 COST ($ MILLIONS) $3.9 3.5 3.0 2.8 2.7 2.7 2.3 3.0 2.9 2.6 a. Based on past experience, what is the learning rate? (Do not round intermediate calculations. Round your answer to the nearest whole percent.) Learning rate 70 % b. What bid should LTI submit for the total order of 100 units, assuming that learning continues? Cost for 100 more units $ c. What is the cost expected to be for the last unit under the leaming rate you estimated? Expected cost for last unit $ Shouldice Hospital in Canada is widely known for one thinghernia repair! In fact, that is the only operation it performs, and it performs a great many of them. Over the past two decades this small 90-bed hospital has averaged 7,000 operations annually. Last year, it had a record year and performed nearly 7,500 operations. A hernia repair operation at Shouldice Hospital is performed by one of the 12 full-time surgeons assisted by one of seven part-time assistant surgeons. The first operations begin at 7:30 AM each day, Monday through Friday. Surgeons generally take about one hour to prepare for and perform each hernia operation, and they operate on an average of at most four patients per day. This four patient per day limit on the average number of operations performed per surgeon has been found to be the best operating level for the hospital as it take into account time the surgeons need for patient exams and consultations, updating medical charts, writing reports, traveling to professional conferences, vacations, and other times when they are performing other duties or are not available to perform surgeries. A given surgeon may perform more than four surgeries on a given day, but the average cannot exceed four without having adverse effects on overall hospital operations. The surgeons' day ends at 4 p.m. Although hernia repair operations are performed only five days a week, the remainder of the hospital is in operation continuously to attend to recovering patients. The table below shows the room occupancy plan for the existing systern. Each row in the table follows the patients who checked in on a given day. The colurns indicate the number of patients in the hospital on a given night FRIDAY MONDAY 30 SATURDAY SUNDAY TUESDAY 30 30 CHECK-IN DAY Monday Tuesday Wednesday Thursday Friday Saturday Sunday Total BEDS REQUIRED WEDNESDAY THURSDAY 30 30 30 30 30 30 30 30 30 30 60 30 90 30 30 90 90 60 30 For example, the first row of the table shows that 30 people checked in on Monday and were in the hospital for Monday, Tuesday, and Wednesday nights before being discharged on Thursday. By summing the column of the table for Wednesday, we see that there are 90 patients staying in the hospital that night. How well is the hospital currently utilizing its beds? (Round your answers to 1 decimal place.) Utilization Monday Tuesday Wednesday Thursday Friday Saturday Sunday Total % % % % % % % % A builder has located a piece of property that she would like to buy and eventually build on. The land is currently zoned for four homes per acre, but she is planning to request new zoning. What she builds depends on approval of zoning requests and your analysis of this problem to advise her. With her input and your help, the decision process has been reduced to the following costs, alternatives, and probabilities: Cost of land: $2 million. Probability of rezoning: 0.60. If the land is rezoned, there will be additional costs for new roads, lighting, and so on, of $1 million. If the land is rezoned, the contractor must decide whether to build a shopping center or 1,500 apartments that the tentative plan shows would be possible. If she builds a shopping center, there is a 70 percent chance that she can sell the shopping center to a large department store chain for $4 million over her construction cost, which excludes the land; and there is a 30 percent chance that she can sell it to an insurance company for $5 million over her construction cost (also excluding the land). If, instead of the shopping center, she decides to build the 1,500 apartments, she places probabilities on the profits as follows: There is a 60 percent chance that she can sell the apartments to a real estate investment corporation for $3,000 each over her construction cost; there is a 40 percent chance that she can get only $2,000 each over her construction cost. (Both exclude the land cost.) If the land is not rezoned, she will comply with the existing zoning restrictions and simply build 600 homes, on which she expects to make $4,000 over the construction cost on each one (excluding the cost of land). a. What is the expected value for the rezoned shopping center, if the rezoning cost is included? (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign.) Expected value $ million b. What is the expected value for the rezoned apartments, if the rezoning cost is included? (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign.) Expected value $ million