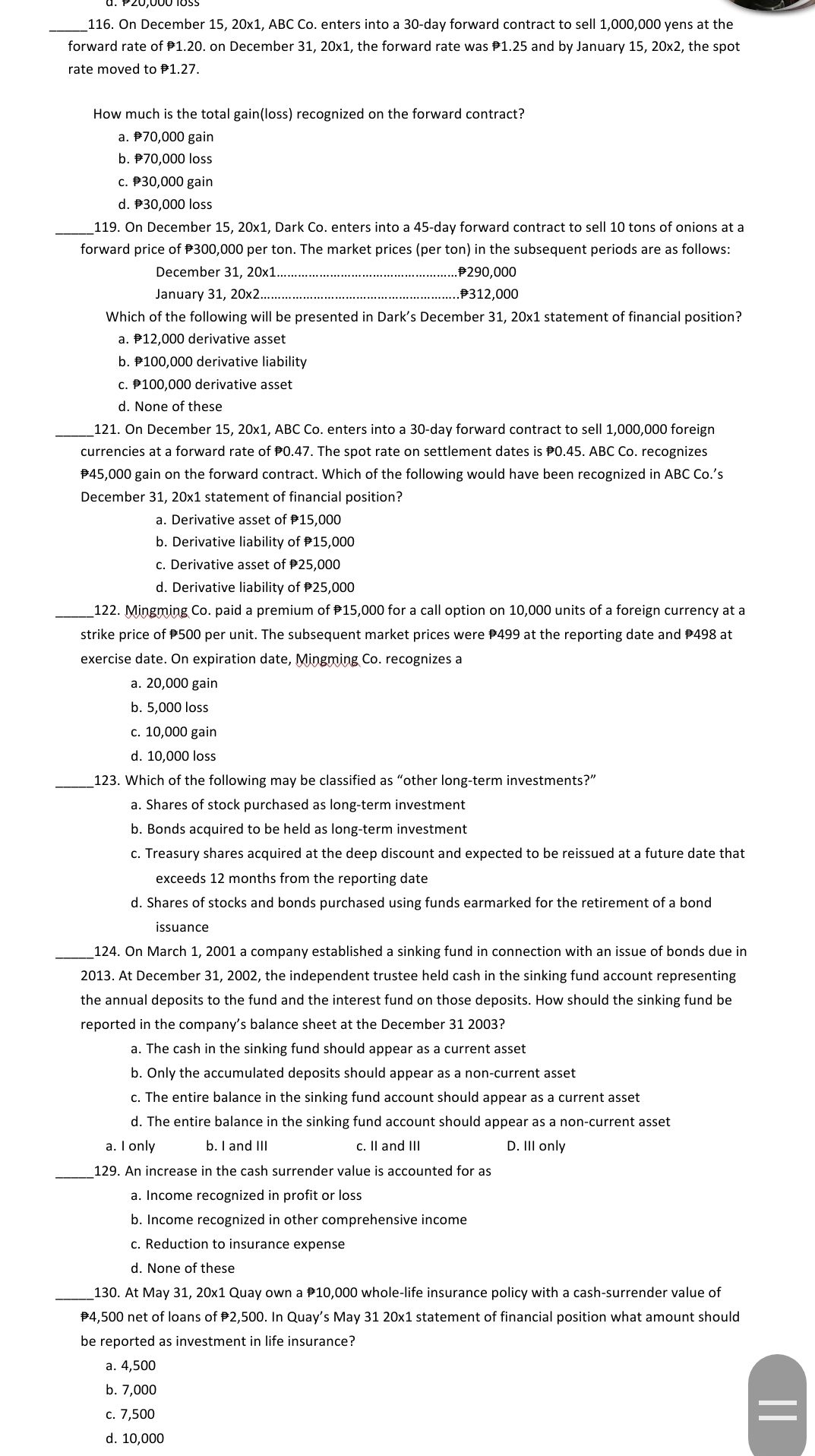

Question: Please help answer only LI. PLUIUUU IUhh ' 116. On December 15, 20x1, ABC Co. enters into a 30-day forward contract to sell 1,000,000 yens

Please help answer only

LI. PLUIUUU IUhh ' 116. On December 15, 20x1, ABC Co. enters into a 30-day forward contract to sell 1,000,000 yens at the forward rate of 91.20. on December 31, 20x1, the forward rate was 91.25 and by January 15, 20x2, the spot rate moved to 91.27. How much is the total gainlloss} recognized on the forward contract? a. 970,000 gain b. 970,000 loss c. 930,000 gain d. 930,000 loss 119. On December 15, 20x 1, Dark Co. enters into a 45-day forward contract to sell 10 tons of onions at a forward price of 9300,000 per ton. The market prices {per ton) in the subsequent periods are as follows: December 31, 20x1. .9290,000 January 31, 20x2 ................9312,000 which of the following will be presented in Dark's December 31, 20x1 statement offinancial position? a. 912,000 derivative asset b. 9100,000 derivative liability c. 9100,000 derivative asset d. None of these _121. On December 15, 20x 1, ABC Co. enters into a 30-day fonivard contract to sell 1,000,000 foreign currencies at a forward rate of 90.47. The spot rate on settlement dates is 90.45. ABC Co. recognizes 945,000 gain on the forward contract. which of the following would have been recognized in ABC Co.'s December 31, 20x1 statement of financial position? a. Derivative asset of915,000 b. Derivative liability of 915,000 c. Derivative asset of 925,000 d. Derivative liability of 925,000 122. W00. paid a premium of 915,000 for a call option on 10,000 units of a foreign currency at a strike price of 9500 per unit. The subsequent market prices were 9499 at the reporting date and 9498 at exercise date. 0n expiration date, 5419mm recognizes a a. 20,000 gain b. 5,000 loss c. 10,000 gain d. 10,000 loss _123. Which of the following may be classified as \"other long-term investments?\" a. Shares of stock purchased as long-term investment b. Bonds acquired to be held as long-term investment c. Treasury shares acquired at the deep discount and expected to be reissued at a future date that exceeds 12 months from the reporting date d. Shares of stocks and bonds purchased using funds earmarked for the retirement of a bond issuance _124. On March 1, 2001 a company established a sinking fund in connection with an issue of bonds due in 2013. At December 31, 2002, the independent trustee held cash in the sinking fund account representing the annual deposits to the fund and the interest fund on those deposits. How should the sinking fund be reported in the company's balance sheet at the December 31 2003? a. The cash in the sinking fund should appear as a current asset b. Only the accumulated deposits should appear as a non-current asset c. The entire balance in the sinking fund account should appear as a current asset d. The entire balance in the sinking fund account should appear as a non-current asset a. I only b. I and III c. II and III D. III only _129. An increase in the cash surrender value is accounted for as a. Income recognized in prot or loss b. Income recognized in other comprehensive income c. Reduction to insurance expense d. None ofthese _130. At May 31, 20x1 Quay own a 910,000 whole-life insurance policy with a cash-surrender value of 94,500 net of loans of 92,500. In Quay's May 31 20x1 statement of financial position what amount should be reported as investment in life insurance? a. 4,500 b. 7,000 c. 2,500 d. 10,000