Question: Please help answer parts b,c,d. Thank you! Reporting Financial Statement Effects of Bond Transactions On January 1, 2019, Shields, Inc., issued $800,000 of 9%, 20-year

Please help answer parts b,c,d. Thank you!

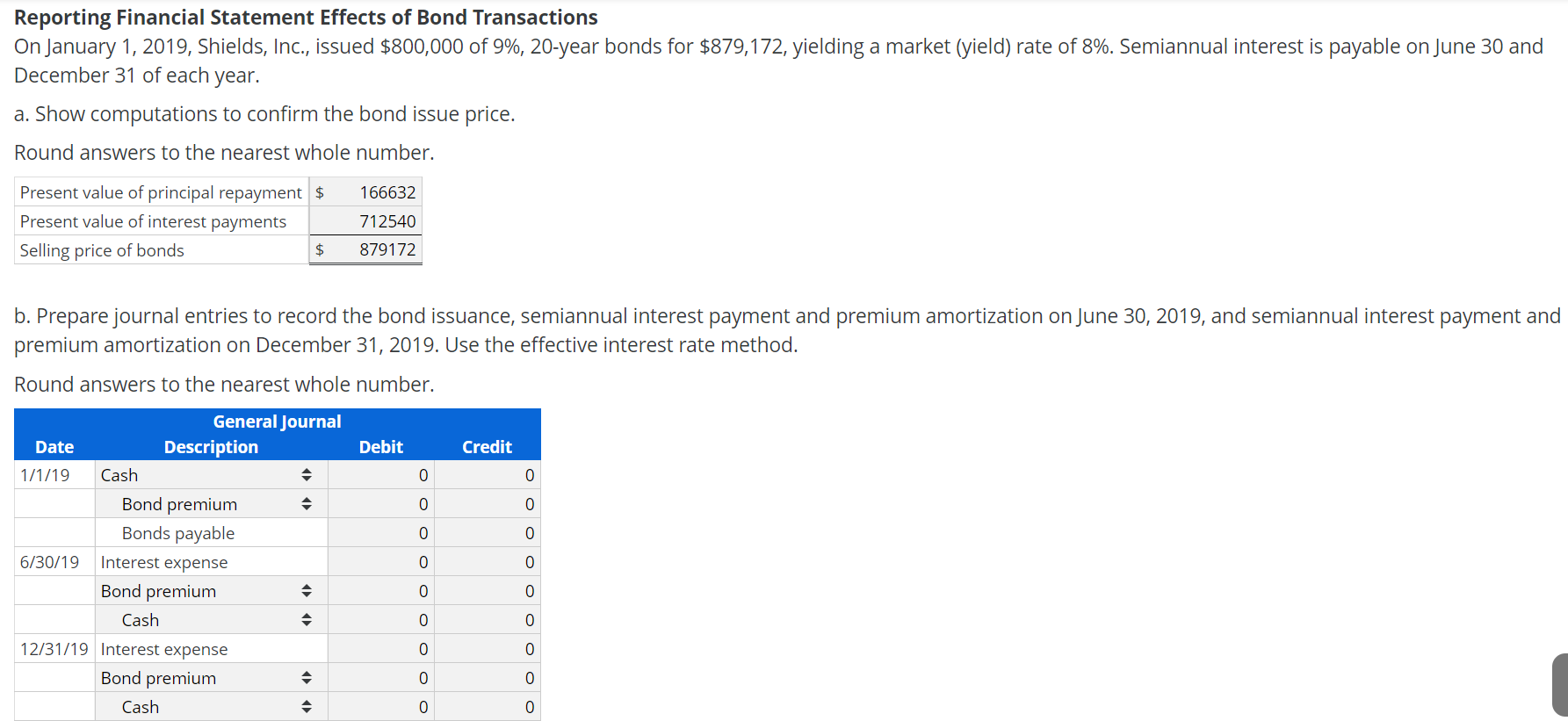

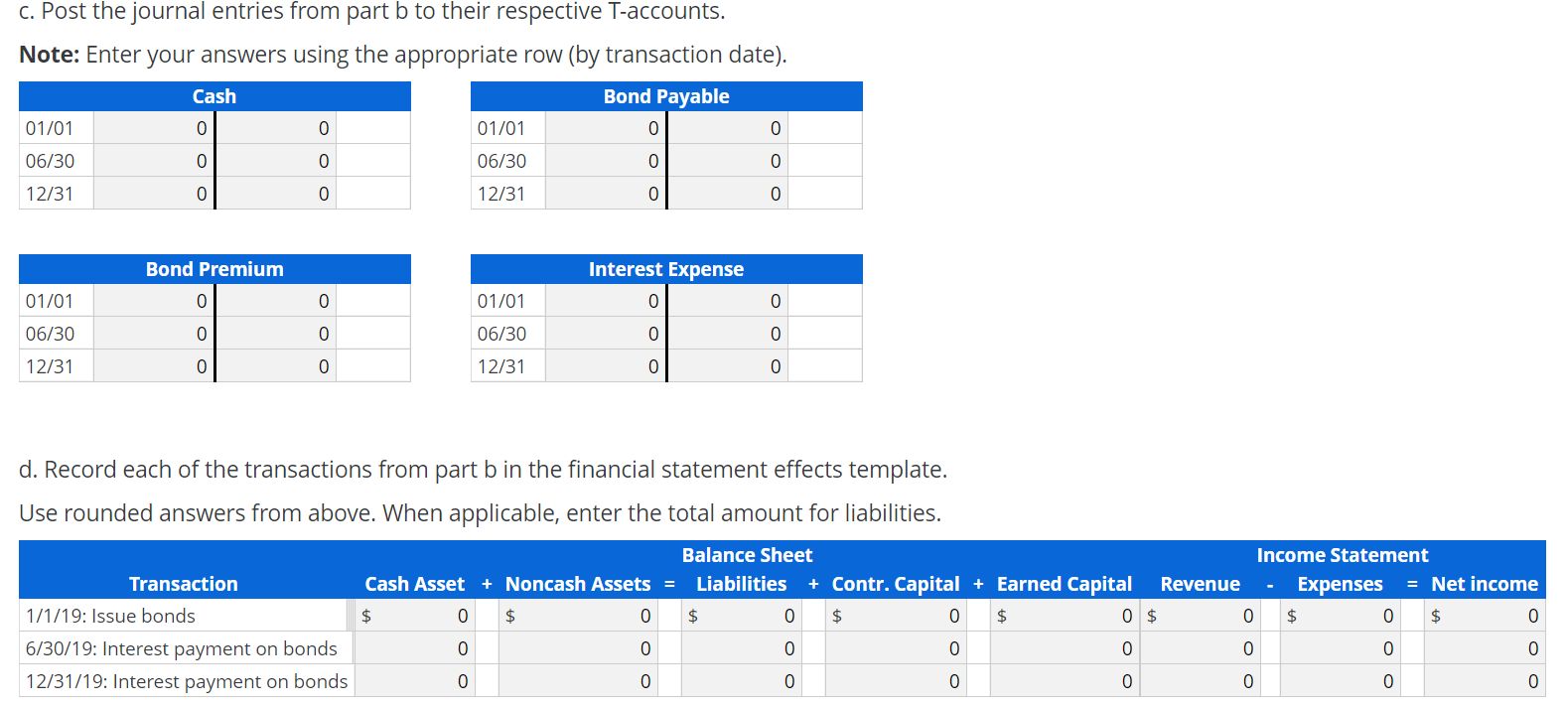

Reporting Financial Statement Effects of Bond Transactions On January 1, 2019, Shields, Inc., issued $800,000 of 9%, 20-year bonds for $879,172, yielding a market (yield) rate of 8%. Semiannual interest is payable on June 30 and December 31 of each year. a. Show computations to confirm the bond issue price. Round answers to the nearest whole number. 166632 Present value of principal repayment $ Present value of interest payments Selling price of bonds $ 712540 879172 b. Prepare journal entries to record the bond issuance, semiannual interest payment and premium amortization on June 30, 2019, and semiannual interest payment and premium amortization on December 31, 2019. Use the effective interest rate method. Round answers to the nearest whole number. Debit Credit 0 General Journal Date Description 1/1/19 Cash Bond premium Bonds payable 6/30/19 Interest expense Bond premium Cash A 12/31/19 Interest expense Bond premium . Cash O O O O O O O O O O O O O O O O O C. Post the journal entries from part b to their respective T-accounts. Note: Enter your answers using the appropriate row (by transaction date). Cash Bond Payable 01/01 0 01/01 0 06/30 0 ooo 06/30 o O O O O 12/31 0 12/31 Bond Premium Interest Expense 01/01 0 0 01/01 06/30 0 0 06/30 12/31 ooo Ooo 12/31 0 0 d. Record each of the transactions from part b in the financial statement effects template. Use rounded answers from above. When applicable, enter the total amount for liabilities. Balance Sheet Transaction Cash Asset + Noncash Assets = Liabilities + Contr. Capital + Earned Capital Revenue 1/1/19: Issue bonds $ 0 $ $ 0 $ 6/30/19: Interest payment on bonds 0 12/31/19: Interest payment on bonds 0 0 Income Statement Expenses = Net income $ $ o oo O O O O O O ooo O O O o oo O O O 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts