Question: please help Answer Question 6 (1 point) A company needs to raise $120,000 for a new project and will obtain externally generated funds by selling

please help

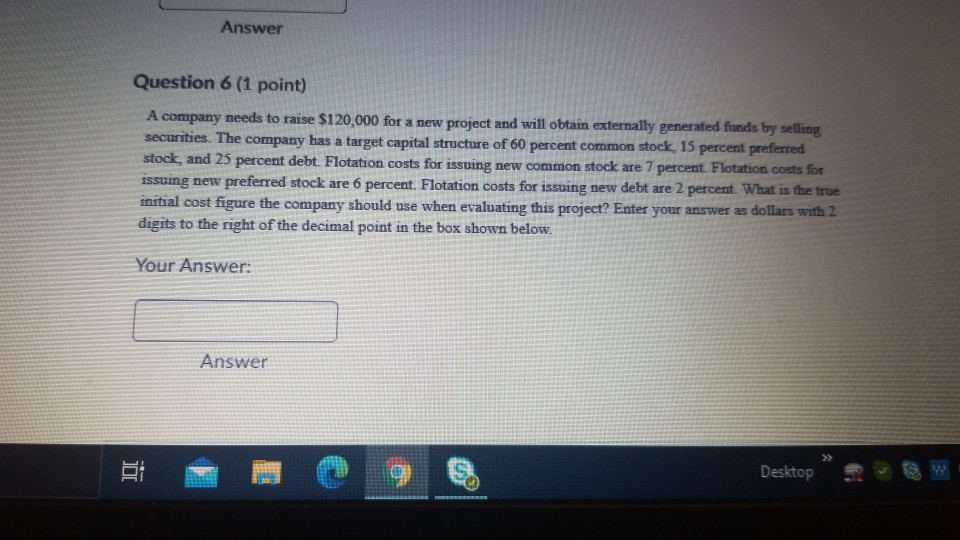

Answer Question 6 (1 point) A company needs to raise $120,000 for a new project and will obtain externally generated funds by selling securities. The company has a target capital structure of 60 percent common stock, 15 percent preferred stock, and 25 percent debt. Flotation costs for issuing new common stock are 7 percent. Flotation costs for issuing new preferred stock are 6 percent. Flotation costs for issuing new debt are 2 percent. What is the true initial cost figure the company should use when evaluating this project? Enter your answer as dollars with 2 digits to the right of the decimal point in the box shown below. Your Answer: Answer 8 Desktop

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts