Question: please help answer question please :) Assume that you are the managerial accountant at Hershey's whose reporting year-end is December 31. The chief financial officer

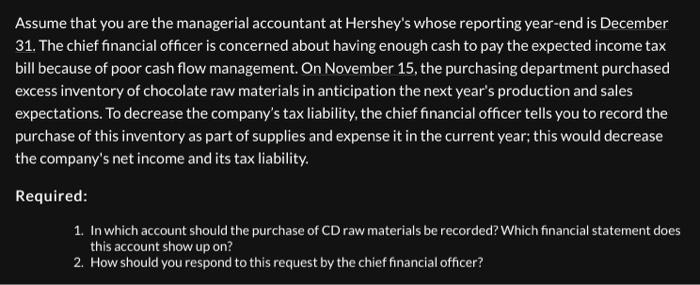

Assume that you are the managerial accountant at Hershey's whose reporting year-end is December 31. The chief financial officer is concerned about having enough cash to pay the expected income tax bill because of poor cash flow management. On November 15, the purchasing department purchased excess inventory of chocolate raw materials in anticipation the next year's production and sales expectations. To decrease the company's tax liability, the chief financial officer tells you to record the purchase of this inventory as part of supplies and expense it in the current year; this would decrease the company's net income and its tax liability. Required: 1. In which account should the purchase of CD raw materials be recorded? Which financial statement does this account show up on? 2. How should you respond to this request by the chief financial officer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts