Question: please help Answer questions 21-22 based on the following information: PMC Bank is considering a loan of S1.5M, with duration of 5 years, loan rate

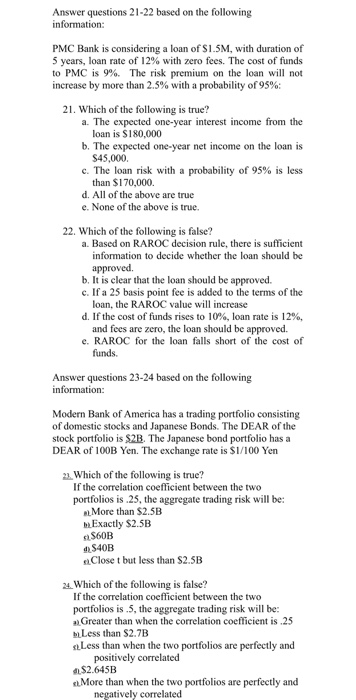

Answer questions 21-22 based on the following information: PMC Bank is considering a loan of S1.5M, with duration of 5 years, loan rate of 12% with zero fees. The cost of funds to PMC is 9%. The risk premium on the loan will not increase by more than 2.5% with a probability of 95%: 21. Which of the following is true? a. The expected one-year interest income from the loan is $180,000 b. The expected one-year net income on the loan is S45,000. c. The loan risk with a probability of 95% is less than $170,000. d. All of the above are true e. None of the above is true. 22. Which of the following is false? a. Based on RAROC decision rule, there is sufficient information to decide whether the loan should be approved. b. It is clear that the loan should be approved. c. If a 25 basis point fee is added to the terms of the loan, the RAROC value will increase d. If the cost of funds rises to 10%, loan rate is 12%, and fees are zero, the loan should be approved. e. RAROC for the loan falls short of the cost of funds. Answer questions 23-24 based on the following information: Modern Bank of America has a trading portfolio consisting of domestic stocks and Japanese Bonds. The DEAR of the stock portfolio is S2B. The Japanese bond portfolio has a DEAR of 100B Yen. The exchange rate is $1/100 Yen 21 Which of the following is true? If the correlation coefficient between the two portfolios is.25, the aggregate trading risk will be: More than $2.5B Exactly $2.5B S60B S40B Closet but less than $2.5B 24. Which of the following is false? If the correlation coefficient between the two portfolios is 5, the aggregate trading risk will be: aGreater than when the correlation coefficient is 25 Less than $2.7B stLess than when the two portfolios are perfectly and positively correlated $2.645B More than when the two portfolios are perfectly and negatively correlated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts