Question: PLEASE help answer the following 6! please only attempt if you can help me answer all 6! THANK YOU! will rate Delta Company has a

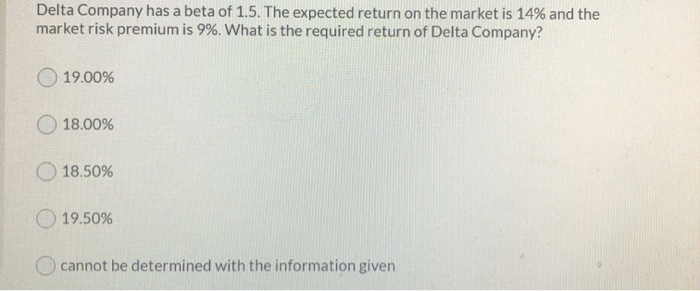

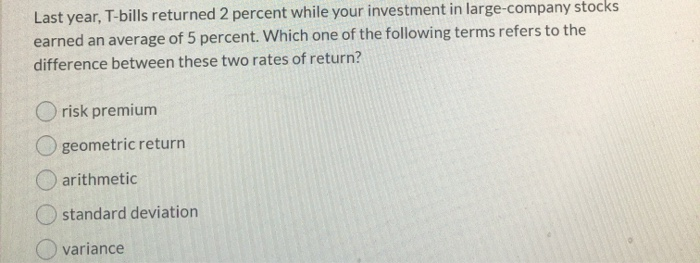

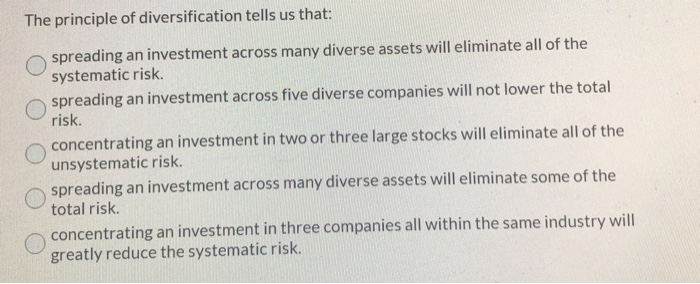

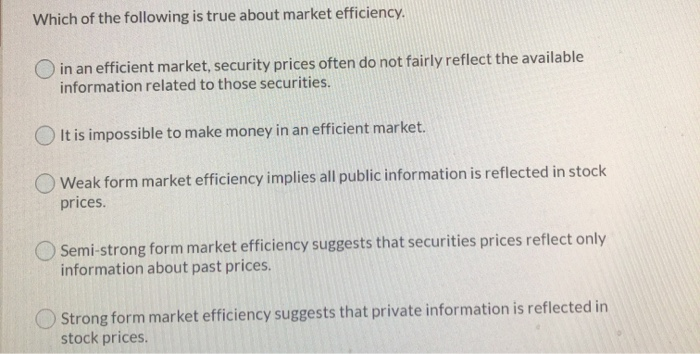

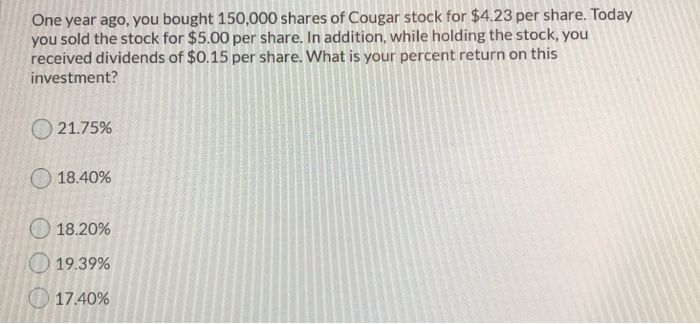

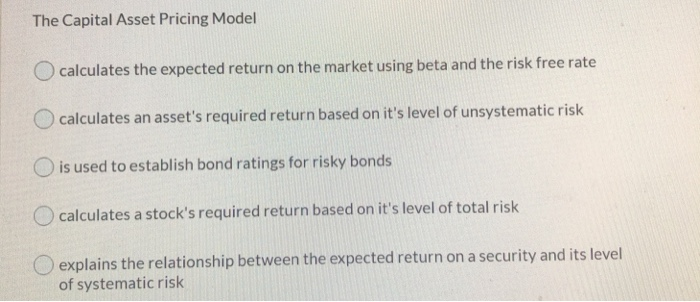

Delta Company has a beta of 1.5. The expected return on the market is 14% and the market risk premium is 9%. What is the required return of Delta Company? 19.00% 18.00% 18.50% 19.50% cannot be determined with the information given Last year, T-bills returned 2 percent while your investment in large company stocks earned an average of 5 percent. Which one of the following terms refers to the difference between these two rates of return? Orisk premium O geometric return arithmetic standard deviation Ovariance The principle of diversification tells us that: spreading an investment across many diverse assets will eliminate all of the systematic risk. spreading an investment across five diverse companies will not lower the total risk. concentrating an investment in two or three large stocks will eliminate all of the unsystematic risk. spreading an investment across many diverse assets will eliminate some of the total risk. concentrating an investment in three companies all within the same industry will greatly reduce the systematic risk. Which of the following is true about market efficiency, in an efficient market, security prices often do not fairly reflect the available information related to those securities. It is impossible to make money in an efficient market. Weak form market efficiency implies all public information is reflected in stock prices. Semi-strong form market efficiency suggests that securities prices reflect only information about past prices, Strong form market efficiency suggests that private information is reflected in stock prices One year ago, you bought 150,000 shares of Cougar stock for $4.23 per share. Today you sold the stock for $5.00 per share. In addition, while holding the stock, you received dividends of $0.15 per share. What is your percent return on this investment? 21.75% 18.40% 18.20% O 19.39% 17.40% The Capital Asset Pricing Model calculates the expected return on the market using beta and the risk free rate calculates an asset's required return based on it's level of unsystematic risk O is used to establish bond ratings for risky bonds calculates a stock's required return based on it's level of total risk explains the relationship between the expected return on a security and its level of systematic risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts